SushiSwap Slippage Calculator

Arbitrum Nova Trading Calculator

Estimate trade slippage and costs on SushiSwap's Arbitrum Nova network. Based on October 2023 data showing daily volumes below $5,000 with extremely thin liquidity.

Trade Estimate

Arbitrum Nova NetworkWhat This Means

Based on October 2023 data from the article, SushiSwap on Arbitrum Nova has daily trading volume under $5,000 with extremely limited liquidity. This calculator shows realistic slippage you would experience on this network.

The low fees ($0.003 per transaction) don't matter if you can't execute your trade without significant price movement. This tool helps you understand why trading on low-volume networks can be problematic.

When you hear "SushiSwap," you might think of a powerful decentralized exchange with deep liquidity, low fees, and a thriving community. But SushiSwap on Arbitrum Nova? That’s a different story. This version isn’t the main SushiSwap you’ve heard about on Ethereum or Polygon. It’s a small, niche offshoot running on a layer-2 network that barely gets used. If you’re considering trading here, you need to know what you’re really signing up for.

What Is SushiSwap on Arbitrum Nova?

SushiSwap on Arbitrum Nova is a version of the SushiSwap decentralized exchange (DEX) built specifically for the Arbitrum Nova blockchain. It’s not a separate company or product-it’s just SushiSwap’s automated market maker (AMM) code deployed on a different network. Arbitrum Nova was created by Offchain Labs to offer ultra-low transaction fees and faster speeds than Ethereum mainnet. It’s meant for high-volume, low-value transactions like micro-payments or casual DeFi trading.

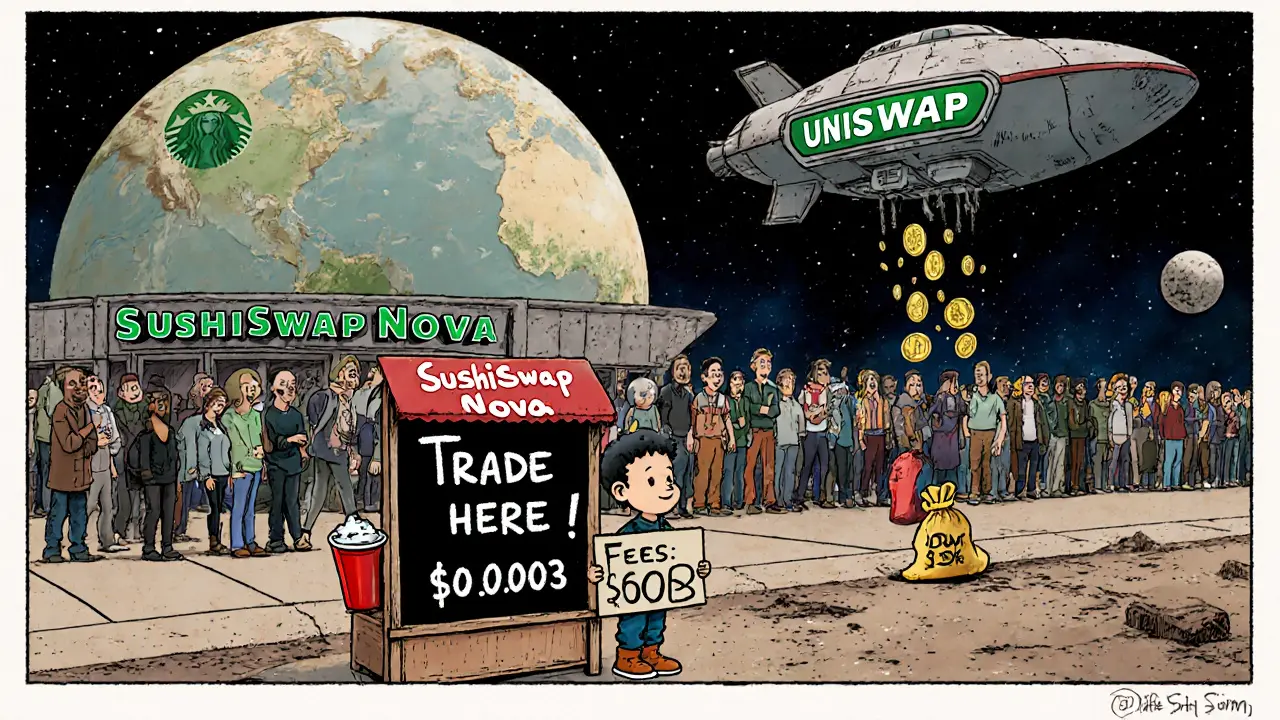

But here’s the catch: while SushiSwap on Ethereum handles billions in daily volume, the Arbitrum Nova version struggles to hit $5,000 on a good day. According to CoinGecko’s October 2023 data, it holds 88% of the entire Arbitrum Nova DEX market-but that market is tiny. The whole network’s daily trading volume is around $49,400. That’s less than a single trade on Uniswap.

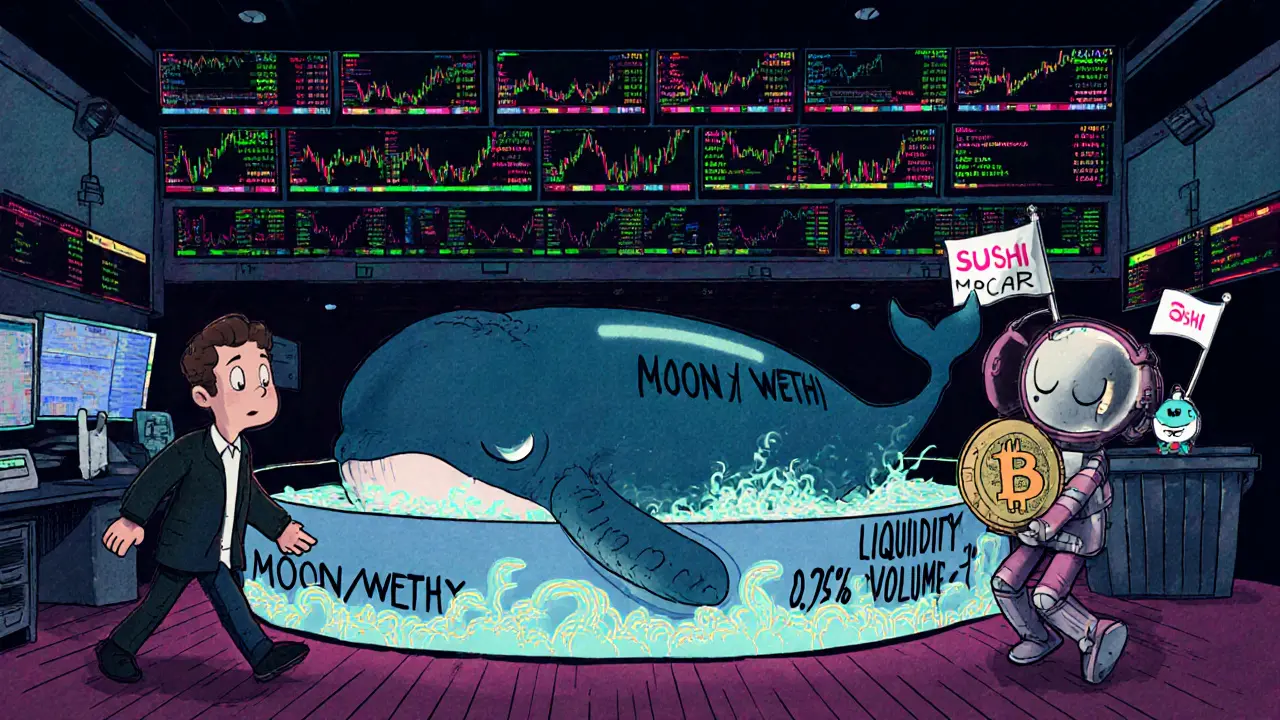

Trading Pairs and Liquidity: Limited to the Point of Uselessness

As of October 2023, SushiSwap on Arbitrum Nova supports only six cryptocurrencies and six trading pairs. The most active pair is MOON/WETH, with volume around $22,000 in one report-but other sources list it at under $70. The confusion isn’t a glitch; it’s a symptom of how little activity there is. Different data trackers pull from different endpoints, and none of them show consistent numbers because there’s barely any trading happening.

USDC/WETH is another pair listed, but its volume is even lower. If you want to trade anything other than WETH, USDC, or a few obscure tokens like MOON, you’re out of luck. There’s no SOL, no BTC, no DOGE. No stablecoins beyond USDC. No major altcoins. Just a handful of tokens that barely move.

Liquidity is thin. Really thin. If you try to swap $500 worth of a token, you’ll likely see your price move 5-10% just from your own trade. That’s slippage you can’t afford. Professional traders avoid exchanges like this because they can’t execute orders without massive losses. Even small retail traders get burned.

Fees Are Low-But That’s the Only Advantage

The one real benefit of SushiSwap on Arbitrum Nova is cost. Swaps cost about $0.003 per transaction. That’s less than a penny. Compare that to Ethereum mainnet, where a single swap can cost $1.50 to $5.00, and it sounds amazing. On Arbitrum Nova, you can make dozens of small trades for the price of one on Ethereum.

But here’s the problem: low fees don’t matter if there’s no one to trade with. If you’re trying to exit a position, and no one’s buying, your cheap fee won’t help you get out. And if you’re trying to add liquidity, you’re locking up your money in a pool with almost no volume. You won’t earn meaningful fees, and you won’t get rewarded enough to make it worth the risk.

SushiSwap’s standard fee structure is 0.3% per trade. Of that, 0.25% goes to liquidity providers and 0.05% goes to xSUSHI stakers. But on Arbitrum Nova, the rewards are meaningless because there’s so little trading. You’re not earning passive income-you’re just holding tokens in a dead pool.

Who Uses This Exchange? Almost No One

There are no user reviews on FxVerify. No ratings. No comments. Zero. That’s not because people are happy-it’s because almost no one has used it. The Alexa rank for the site is #26,723, which puts it far behind even obscure centralized exchanges. Compare that to Binance, which ranks around #100 globally.

There are no institutional players here. No OTC desks. No market makers. No hedge funds. Delphi Digital’s October 2023 report says DEXs with less than $10,000 in daily volume face existential threats-and SushiSwap on Arbitrum Nova falls far short of that. Without professional liquidity, it’s just a ghost town.

Security and Technical Setup: Not Beginner-Friendly

To use SushiSwap on Arbitrum Nova, you need to manually add the network to your wallet. That means entering the right RPC URL (https://nova.arbitrum.io/rpc), Chain ID (42170), and token symbol (ETH). If you mess up one detail, your transaction fails-or worse, your funds get stuck.

It’s not hard for someone who’s done it before, but if you’re new to crypto, this is a wall. Centralized exchanges like Coinbase or Kraken let you click a button and start trading. Here, you need to understand blockchain networks, RPCs, and gas tokens. That’s a barrier that keeps most people out.

Also, Arbitrum Nova uses optimistic rollups, which means withdrawals take up to seven days to finalize. If you need to move your funds quickly, you’re stuck waiting. That’s fine for long-term holders, but terrible for anyone trying to react to market moves.

Why Does This Even Exist?

SushiSwap’s team isn’t ignoring Arbitrum Nova. They’re just not prioritizing it. Their focus is on Ethereum, Polygon, Avalanche, and BNB Chain-all networks with millions in daily volume. Arbitrum Nova is a side project, an experiment. It’s like opening a coffee shop in a town of 20 people and expecting it to compete with Starbucks.

The real goal of Arbitrum Nova was to attract low-value, high-frequency transactions-think gaming tokens, micro-payments, or DeFi experiments. But most of those projects didn’t come. Instead, they stuck to Ethereum or Polygon where users already were.

And now, with ARB (Arbitrum’s native token) down 34% in a month and the broader crypto market cooling, there’s even less incentive to build here. The momentum is gone.

Should You Use SushiSwap on Arbitrum Nova?

Here’s the short answer: Only if you’re doing a very specific, low-risk experiment.

If you’re a developer testing a new token, or a hobbyist curious about how AMMs work on layer-2s, go ahead. Put in $10, trade a few tokens, see how it feels. You won’t lose much, and you’ll learn something.

If you’re trying to trade real money, invest, or earn yield? Walk away. The liquidity is too thin. The volume is too low. The rewards are negligible. You’re not getting access to a DEX-you’re getting access to a graveyard of unused pools.

There are better alternatives. SushiSwap on Polygon has 100x more volume. Uniswap on Ethereum has 1,000x more. Even newer DEXs on networks like Base or zkSync have more activity and better token selection.

SushiSwap on Arbitrum Nova isn’t broken. It just doesn’t have a reason to exist.

Final Thoughts: A DEX That’s Too Small to Matter

SushiSwap on Arbitrum Nova is a textbook example of a project that solved the wrong problem. It gave users low fees and fast transactions-but no one needed those features here. The market didn’t want a cheaper version of SushiSwap. It wanted a better version of SushiSwap-with more tokens, more users, and more liquidity.

Right now, this exchange exists in a vacuum. No one’s trading. No one’s earning. No one’s building. It’s a technical curiosity, not a functional platform.

If you’re looking for a decentralized exchange, there are dozens of better options. Don’t waste your time on this one unless you’re doing it for fun-and even then, keep your capital small.

Is SushiSwap on Arbitrum Nova safe to use?

Yes, technically. The smart contracts are based on well-audited SushiSwap code and deployed on Arbitrum Nova, which uses Ethereum’s security model. But safety isn’t just about code-it’s about liquidity. If you deposit funds, you can withdraw them. But if you can’t trade them because no one’s buying, your money is stuck in a dead pool. The risk isn’t hacking-it’s irrelevance.

Can I earn rewards by providing liquidity on SushiSwap (Arbitrum Nova)?

You can, but the rewards are nearly zero. The platform uses the standard SushiSwap fee structure: 0.25% of each trade goes to liquidity providers. But with daily volume under $5,000, you’d earn pennies per week-even if you provided the entire liquidity pool. The cost of gas and time far outweighs any return. This isn’t yield farming-it’s a donation to a nearly empty pool.

Why does CoinGecko show different volume numbers than CoinCodex?

Because they’re measuring different things. CoinGecko tracks the base SushiSwap (Arbitrum Nova) contract, while CoinCodex reports on SushiSwap V3 (Arbitrum Nova)-a separate deployment. Also, some trackers pull data from different liquidity pools or use different time windows. In a low-volume environment like this, small differences in data collection create huge discrepancies. Neither number is wrong-they’re just not comparable.

What tokens are available on SushiSwap (Arbitrum Nova)?

As of October 2023, only six tokens are listed: WETH, USDC, MOON, 0X722... (a custom token), SUSHI, and one other unnamed token. Most are low-cap or experimental tokens with no real utility. You won’t find major coins like BTC, SOL, or ADA. The selection is so limited that even casual traders have nothing meaningful to trade.

Can I connect SushiSwap (Arbitrum Nova) to MetaMask?

Yes, but you have to add the network manually. Go to MetaMask, click "Add Network," then enter: Network Name: Arbitrum Nova, New RPC URL: https://nova.arbitrum.io/rpc, Chain ID: 42170, Currency Symbol: ETH, Block Explorer URL: https://nova.arbiscan.io. If you skip any step, you won’t be able to connect or send transactions. It’s not plug-and-play like centralized exchanges.

Is SushiSwap on Arbitrum Nova worth it for beginners?

No. Beginners should start with centralized exchanges like Coinbase or Kraken, where trading is simple, liquidity is deep, and support is available. SushiSwap on Arbitrum Nova requires technical knowledge, carries high slippage risk, and offers no real benefits over more established platforms. It’s not a learning tool-it’s a dead end.