Blockchain Sharding: What It Is and Why It Matters for Crypto Scaling

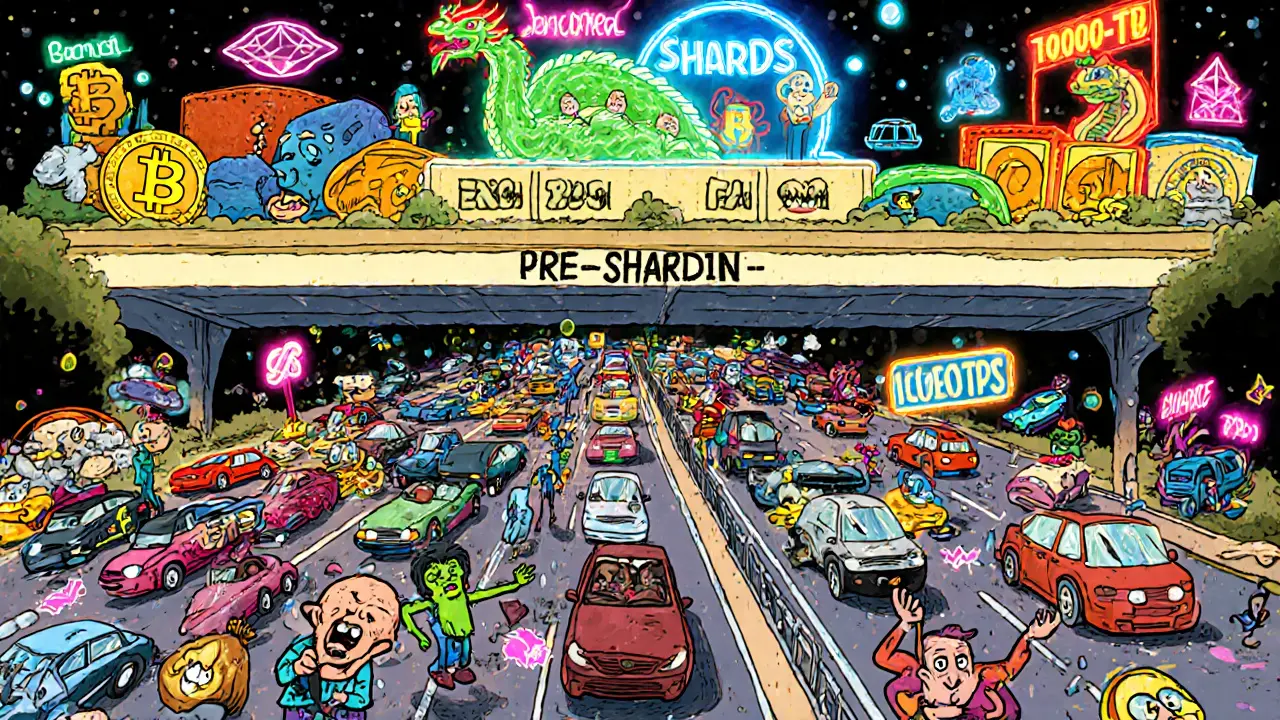

When you hear blockchain sharding, a technique that splits a blockchain into smaller, manageable parts called shards to improve speed and reduce congestion. It’s not magic—it’s engineering. Think of it like adding more checkout lanes at a crowded store. Without sharding, every transaction has to wait in one long line. With it, the line splits into five, ten, or even a hundred smaller ones, each processing payments at the same time. This isn’t just theory. Ethereum is rolling it out right now, and projects like Zilliqa and Near Protocol have been using it for years. The goal? Make blockchains fast enough for everyday use—like paying for coffee or trading NFTs—without crashing under the load.

Sharding doesn’t work alone. It needs blockchain scaling, the broader effort to make blockchains handle more users and transactions without slowing down to be effective. You can’t just split the chain and call it done. You need secure communication between shards, ways to verify data across them, and systems to prevent fraud. That’s where Ethereum sharding, Ethereum’s planned upgrade to divide its network into 64 parallel chains, each handling its own transactions and smart contracts comes in. It’s not just about speed—it’s about survival. If Ethereum doesn’t scale, users will leave for faster, cheaper chains. That’s why developers are pouring billions into making sharding work right.

But sharding isn’t a silver bullet. It changes how nodes operate, how wallets connect, and even how you interact with DeFi apps. Some platforms, like sharding in crypto, the general application of sharding across multiple blockchain networks to solve performance issues, have simplified it for users—others still make it feel like a technical hurdle. The good news? You don’t need to understand the code to benefit. Whether you’re trading tokens on a DEX, staking ETH, or playing a blockchain game, sharding quietly makes it faster, cheaper, and more reliable behind the scenes.

What you’ll find below isn’t a textbook. It’s a real-world look at how sharding and its cousins—like layer-2 solutions, new consensus models, and chain optimizations—are shaping today’s crypto landscape. Some posts expose scams hiding behind buzzwords. Others break down how real chains like Near or Arbitrum are using sharding to outperform Ethereum. You’ll see what works, what doesn’t, and what’s just hype. No fluff. No jargon. Just what you need to know to make smarter moves in a fast-moving space.