COINZIX ATM: What It Is, Why It Matters, and What You Need to Know

When you hear COINZIX ATM, a cryptocurrency cash kiosk that allows users to buy or sell digital assets using physical cash. Also known as a crypto ATM, it’s designed to bridge the gap between traditional money and blockchain assets. But here’s the thing—COINZIX ATM isn’t a well-known brand like BitTeller or General Bytes. There’s no public record of its operations, no verified network of machines, and no official website. That’s not normal for a legitimate crypto ATM provider. If you’re seeing ads or social posts about COINZIX ATM, you’re probably looking at a scam or a misspelled name—maybe confusing it with Coinme, Coinsource, or even Coin Kiosk.

Real crypto ATMs let you swap cash for Bitcoin or Ethereum in under five minutes. They’re found in convenience stores, gas stations, and shopping centers. But they require KYC verification, clear fee disclosures, and reliable customer support. COINZIX ATM has none of that. Instead, it shows up in shady forum threads and TikTok ads promising "instant cashouts" with no ID. That’s a red flag. Legit crypto ATMs charge 5% to 12% fees—fair, but transparent. COINZIX ATM? No fee info. No location map. No company address. That’s not innovation—it’s evasion.

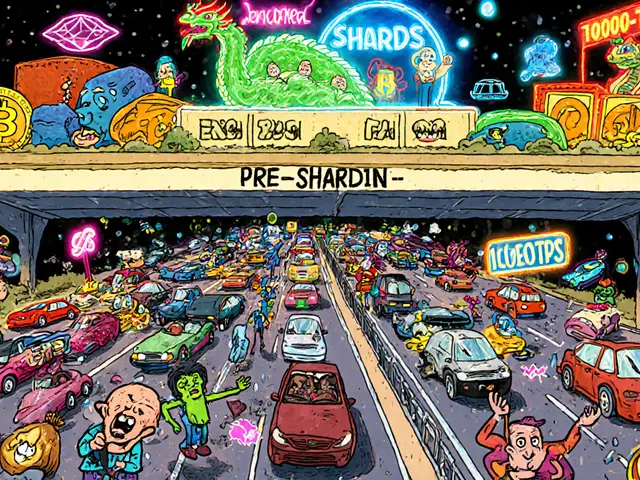

And it’s not just about COINZIX ATM. The bigger issue is how easily fake crypto services pop up. You’ve got BTX Pro, a platform exposed as a complete scam, and Armoney, a name that’s likely a typo for Harmony or a fake exchange. These aren’t outliers—they’re the norm. People get tricked because they want easy access to crypto without understanding the risks. A real crypto ATM doesn’t need you to send a private key. It doesn’t ask for your bank login. It doesn’t promise 10x returns on cash deposits. If it does, walk away.

What you’ll find below are real reviews of crypto exchanges, airdrops, and platforms that actually exist. Some are legit. Some are traps. All of them have been checked against public data, trading volumes, and user reports. You won’t find fluff here. Just facts: who’s running what, what went wrong, and where you should be putting your money—or keeping it out of.