DAO Viability Calculator

Assess Your Project

Answer these questions to see if your project is a good fit for a DAO structure. Based on the article "Benefits and Limitations of DAOs in 2025".

40-69% = Moderate fit (consider hybrid approach)

Below 40% = Not suitable as a DAO

What DAOs Really Do in 2025

Decentralized Autonomous Organizations, or DAOs, are digital groups that run on blockchain code instead of bosses. No CEO. No HR department. No board meetings. Instead, rules are written into smart contracts, and decisions are made by people who hold governance tokens. By 2025, over 13,000 active DAOs manage around $40 billion in assets. Some run DeFi protocols like Uniswap. Others fund open-source developers through Gitcoin. A few even tried to buy a rare copy of the U.S. Constitution - and failed. But they’re not just experiments anymore. DAOs are now real organizations handling real money, real work, and real problems.

Transparency: Your Money, Publicly Visible

One of the biggest wins for DAOs is transparency. Every dollar in a DAO’s treasury is on the blockchain. Anyone can check where the money goes - who got paid, how much, and why. Compare that to traditional companies, where financial reports come out once a year and are often full of jargon. In DAOs, you can see exactly how a $50,000 grant was spent on documentation, or how $2 million was moved to a cold wallet for safety. Juicebox, a popular DAO funding tool, shows real-time spending to everyone. No secrets. No hidden fees. That level of openness builds trust faster than any corporate mission statement ever could.

Global Participation: No Passport Needed

DAOs don’t care where you live. A 19-year-old in Nigeria can earn $120,000 a year helping manage Gitcoin’s grant system. Someone in Brazil can vote on Ethereum upgrades. A student in Indonesia can write code for a DAO and get paid in crypto. Traditional companies struggle to hire globally because of visas, payroll taxes, and legal structures. DAOs skip all that. Contributors from 187 countries are active in DAOs today. That’s more than most Fortune 500 companies can reach. This global talent pool means faster innovation, diverse perspectives, and lower costs. You don’t need to be in Silicon Valley to be part of the future.

Automation: Rules That Can’t Be Broken

DAOs use smart contracts to automate payments, access, and rules. If you complete a task and meet the criteria, the code pays you automatically. No manager to delay it. No accountant to lose your invoice. MakerDAO, for example, automatically adjusts interest rates on its lending platform based on community votes. Chainlink’s oracle network upgrades happen with 98% success because the code enforces them. This eliminates human error and delays. It also removes the need for middlemen - lawyers, auditors, and administrators - cutting overhead costs dramatically. Setup costs for a DAO are now around $50,000, compared to $250,000 for a traditional legal entity. That’s a massive drop.

The Voter Apathy Problem

But here’s the catch: most people don’t vote. In over 80% of DAOs, fewer than 18% of token holders participate in governance. That means a tiny group makes decisions for everyone. Uniswap’s Q2 2025 report showed that 78% of its governance tokens were held by the top 15-20% of addresses. That’s not democracy. That’s plutocracy. You can have a thousand members, but if five wallets control the majority of votes, you’re back to centralized control - just with crypto wallets instead of boardrooms. Many contributors spend months drafting proposals, only to see 4.7% of people vote. It’s frustrating. And it’s why some DAOs are experimenting with reputation-based voting instead of token-based voting.

Slow Decisions, Missed Opportunities

DAOs are slow. Really slow. While a traditional company can approve a new feature in 2-3 days, most DAOs take 14 to 21 days just to vote and execute a proposal. MakerDAO is an exception - it moves fast, sometimes in under 72 hours. But most? They get stuck in endless Discord debates. In 2023, Nouns DAO lost $1.2 million because the community took too long to respond to a security threat. By the time they voted, the hackers had already drained the funds. In fast-moving markets like DeFi, delays like that cost millions. DAOs are great for steady, long-term decisions - like funding open-source projects - but terrible in a crisis.

Legal Gray Zones

Here’s the biggest risk: no one knows who’s legally responsible. In the U.S., only 12 states have laws that recognize DAOs as legal entities. The rest? They’re legal ghosts. If a DAO gets hacked and loses money, who gets sued? The developers? The token holders? The person who wrote the smart contract? The SEC warns that participants could face unexpected liability. In 2025, 73% of DAOs operate without any clear legal structure. That’s a ticking time bomb. Some DAOs try to solve this by forming Wyoming LLCs - 1,200+ have already done it. Others use the new European Blockchain Partnership framework. But for the vast majority, they’re flying blind. Regulators are watching. And when they move, it won’t be gentle.

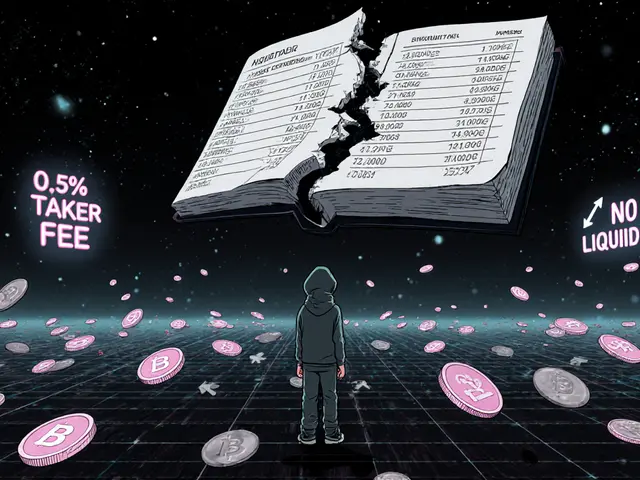

Security Risks Are Still Real

Smart contracts aren’t magic. They’re code. And code has bugs. In 2025 alone, DAOs lost over $90 million to exploits. The DAO’s original $60 million hack in 2016 wasn’t a fluke - it was a warning. Today, 42% of DAOs use formal verification to check their code, and 68% use Gnosis Safe for multi-signature treasury access. But that still leaves a lot of unsecured contracts. OpenZeppelin and Quantstamp do audits, but not every DAO can afford them. And even audited contracts can fail. The ConstitutionDAO raised $47 million in seven days - but couldn’t coordinate a purchase. The money was returned, but the lesson stuck: technology doesn’t fix bad organization.

AI Is Starting to Help - But Not Enough

Some DAOs are turning to AI to fix their problems. Forty-seven percent now use AI assistants that summarize proposals, predict voting trends, and flag risky votes. These tools help reduce information overload. They don’t replace human judgment, but they make participation easier. Still, AI can’t solve voter apathy or legal uncertainty. It can’t make people care more. And it can’t give DAOs legal personhood. It’s a band-aid, not a cure.

Who’s Using DAOs - And Who’s Not

Most DAOs are in DeFi (62%), NFT communities (18%), or social impact (12%). Only 8% are investment clubs. Big companies are watching: 37% of Fortune 500 firms are experimenting with DAOs - but mostly in innovation labs, not core operations. Why? Because they can’t risk legal exposure or slow decision-making in their main business. DAOs work best when speed isn’t critical and transparency matters most. They’re perfect for funding open-source tools, coordinating global contributors, or managing community-owned assets. They’re terrible for running a hospital, a bank, or a logistics company.

What’s Next for DAOs?

The future isn’t pure on-chain democracy. It’s hybrid. Vitalik Buterin says token voting is broken. He’s pushing for reputation-based systems - where your influence grows based on your contributions, not your wallet size. BlackRock just announced a $500 million DAO investment fund. That’s a signal: institutional money is coming. But they’ll want legal protection. That means more DAOs will tie on-chain governance to off-chain legal entities like Wyoming LLCs. Expect more standardization. More regulation. More consolidation. By 2030, DAOs will likely govern 15% of Web3 projects - but fewer than 5% of traditional businesses. The ones that survive will be the ones that stop pretending they’re perfect. They’ll admit they’re messy, slow, and still figuring it out. And that’s okay.

Should You Join a DAO?

If you want to work with global teams, get paid transparently, and help shape digital projects - yes. But don’t expect quick decisions. Don’t assume your vote matters. Don’t think you’re immune to legal risk. Start small. Join a DAO with good documentation (Aragon scores 4.7/5, MolochDAO scores 2.8/5). Learn how Snapshot and Discourse work. Understand gas fees. Don’t throw your tokens into a vote without reading the proposal. And never invest more than you can afford to lose. DAOs are powerful. But they’re not a magic bullet. They’re a new kind of organization - flawed, experimental, and full of potential.

Are DAOs legal in the U.S.?

Only 12 U.S. states, including Wyoming, have passed laws recognizing DAOs as legal entities. In the rest of the country, DAOs exist in a legal gray area. Participants could be held personally liable if something goes wrong. Many DAOs now form Wyoming LLCs to gain legal protection, but this adds complexity and cost.

Can anyone join a DAO?

Yes - if you have a crypto wallet and the right tokens. Most DAOs are permissionless, meaning you don’t need an invitation. But participation often requires holding governance tokens, which you can buy, earn, or receive as a grant. Some DAOs use Soulbound Tokens to verify identity or contribution history, making access more selective.

Why do most DAOs have low voter turnout?

Voter turnout is low because voting requires time, knowledge, and trust. Many people don’t understand proposals, find the interfaces confusing, or feel their vote won’t matter. Also, token distribution is highly concentrated - a small group holds most voting power. This makes participation feel pointless for the majority.

How much does it cost to start a DAO?

The average cost to launch a DAO in 2025 is around $50,000. This includes $15,000 for smart contract development, $12,000 for legal setup (like a Wyoming LLC), $23,000 for community tools and marketing, and additional costs for audits and security. Cheaper options exist, but they come with higher risk.

What’s the difference between a DAO and a traditional company?

A traditional company has a hierarchy: CEO, managers, employees. Decisions are made top-down. A DAO has no hierarchy. Rules are coded into smart contracts, and decisions are made by token holders voting. Everything is public. No one owns a DAO - everyone who participates helps run it. But DAOs are slower, less legally protected, and harder to manage at scale.

Are DAOs secure?

Some are, many aren’t. DAOs have lost over $90 million to hacks in 2025 alone. Security depends on code quality, audits, and treasury protection. Top DAOs use multi-sig wallets (like Gnosis Safe), formal verification, and third-party audits. But not all can afford them. If you’re joining a DAO, check if it’s been audited and how its funds are protected.

Can DAOs make money?

Yes - but not always for everyone. DAOs can generate income through protocol fees (like Uniswap), treasury investments, or grants. Contributors can earn crypto by writing code, designing graphics, or moderating communities. Some earn $100,000+ annually. But profits are uneven. Token holders benefit most. Contributors get paid for work, not ownership. And if the DAO fails, you could lose your investment.

What happens if a DAO gets hacked?

If a DAO is hacked, recovery depends on its structure. Some can vote to freeze funds or reverse transactions. Others can’t. Since DAOs are decentralized, there’s no central authority to call for help. Recovery often takes weeks, and losses are common. In 2023, Nouns DAO lost $1.2 million before a vote could be held. The only defense is prevention: audits, multi-sig wallets, and slow, deliberate governance.

Becky Shea Cafouros

Honestly? I just scroll past DAO posts now. Too much jargon, too little payoff. I’ve seen the same debates since 2021. If it’s not broken, why fix it with blockchain?