CBDC Adoption Scorecard Calculator

Evaluate Digital Currency Success

Based on real-world data from the article, this calculator shows how well countries are actually succeeding with their digital currency initiatives. Don't trust launch dates—focus on practical adoption metrics.

Critical for rural areas and emergencies (like Bahamas Sand Dollar)

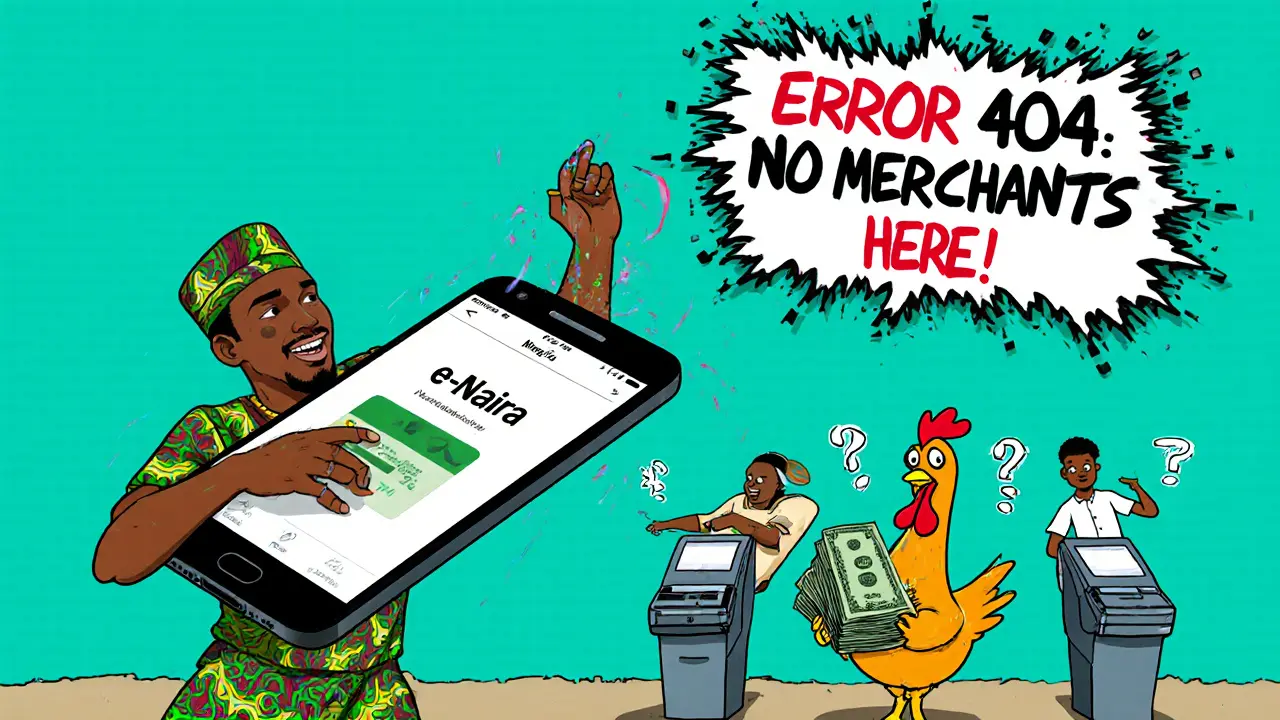

Nigeria's e-Naira has 43% adoption but only 15% merchant acceptance

El Salvador's Chivo wallet has 38% user adoption

Nigeria's e-Naira app crashes frequently; Bahamas scores 4.5/5

Bahamas' 94% user satisfaction included elderly training

Adoption Score:

Key Insights

When people talk about countries ditching cash, they’re not talking about a sudden end to dollars, euros, or pesos. No nation has fully replaced physical money with digital currency-not yet. But something quieter, bigger, and more practical is happening: 137 countries are actively building or testing digital versions of their own money. This isn’t science fiction. It’s happening right now, in real time, in places from the Bahamas to Nigeria to China.

What’s Actually Being Rolled Out?

The most common model isn’t Bitcoin. It’s the Central Bank Digital Currency, or CBDC. These are digital coins issued by governments, backed by central banks, and designed to act like cash-but in your phone. The Bahamas led the way in 2020 with the Sand Dollar. It works offline. You don’t need internet. Just tap your phone to another phone, even on a remote island with no signal. By 2025, 98.7% of Bahamians had access to it. That’s not a trial. That’s adoption. Nigeria followed with the e-Naira in 2021. Sounds promising, right? But here’s the catch: only 43% of Nigerians use it, even though 82% own smartphones. Why? Because merchants don’t accept it. The app crashes. The government didn’t build the ecosystem-just the currency. Users report frustration. It’s like giving everyone a new credit card but no terminals to swipe it. China’s digital yuan is the biggest in scale. Over $250 billion has been transacted since its pilot began. It’s live in 26 regions. But it’s not nationwide. And it’s not replacing cash. It’s supplementing it. The People’s Bank of China built a system that works on basic phones and even offline hardware wallets. That’s not an accident. It’s a deliberate design to reach people without smartphones or bank accounts. Then there’s El Salvador. The only country to make Bitcoin legal tender. But here’s what the data shows: 87% of daily transactions are still in US dollars. Only 38% of citizens regularly use the Chivo wallet. Prices jump around because Bitcoin’s network is slow. One user on Reddit said, “I order a coffee, and by the time I pay, it’s 10 cents more.” Bitcoin isn’t replacing the dollar. It’s a gamble on the side.How Do These Systems Actually Work?

Not all digital currencies are built the same. The Sand Dollar runs on a private blockchain. That means only approved players can validate transactions. It’s fast-1.2 seconds per payment. And it’s designed for places where the internet is spotty. NFC chips let you pay by tapping phones, like Apple Pay, but without needing Wi-Fi. Nigeria’s e-Naira uses a two-tier system. The central bank issues it, but commercial banks handle distribution. That sounds smart. But it also means banks control access. If your bank doesn’t promote the app, you won’t use it. Their system can handle 10,000 transactions per second. That’s more than Visa. But if users can’t get past the login screen, speed doesn’t matter. Jamaica’s JAM-DEX is different. It’s a hybrid. The central bank keeps control, but validation is spread across independent nodes. Transactions finalize in 2.5 seconds. Users love the “Send Money” feature-it works with existing mobile money apps. That’s the key: integration, not replacement. China’s digital yuan supports offline hardware wallets. Think of them like USB sticks that store digital cash. You plug them into a merchant’s terminal. No phone. No internet. Just a chip. That’s innovation. That’s thinking about the 20% of the population without smartphones. The Eastern Caribbean’s DCash uses quantum-resistant encryption. That’s not marketing. It’s preparation. If a future quantum computer breaks today’s encryption, DCash won’t be vulnerable. It’s the only CBDC doing this. And yes, it’s slower-3.8 seconds-because security comes first.Who’s Winning? Who’s Struggling?

The Bahamas wins on adoption. Why? They didn’t just launch a currency. They launched a system. They trained vendors. They ran TV ads. They made the app simple. They didn’t assume people knew how to use digital wallets. They taught them. Result? 94% user satisfaction. Nigeria struggles. Why? They assumed smartphone access = digital adoption. They didn’t fix the merchant network. They didn’t fix the app’s reliability. They didn’t train cashiers. The tech works. The people just don’t trust it. El Salvador’s Bitcoin experiment is a political statement more than a financial one. The government bought Bitcoin. They gave citizens $30 in Bitcoin to start. But the market is volatile. The infrastructure is weak. And most people still use cash or dollars. Bitcoin is a side project, not a replacement. Jamaica and the Eastern Caribbean are quietly succeeding because they built on what already existed. JAM-DEX works with existing mobile money platforms. DCash works with point-of-sale systems that businesses already own. They didn’t force a new habit. They made the new system fit into the old one.

Why Are Governments Doing This?

The Bank for International Settlements asked 81 central banks: Why are you building CBDCs? 76% said financial inclusion. They want to get money to the unbanked. But here’s the contradiction: only 22% of those same banks built features specifically for people without bank accounts. Most CBDCs still require a phone, an ID, and a bank link. That’s not inclusion. That’s digitizing exclusion. Others want control. China’s digital yuan lets the government track every transaction. That’s not a bug-it’s a feature. In countries with high corruption or tax evasion, that’s appealing. But it scares privacy advocates. Then there’s efficiency. Sending money across borders used to take days. Now, with CBDCs like Project mBridge (involving China, UAE, Thailand, and others), settlements happen in seconds. That’s a game-changer for global trade.What’s the Real Threat?

The biggest danger isn’t that CBDCs will replace cash overnight. It’s what happens during a crisis. Economist Eswar Prasad warns that if people lose faith in banks, they might move all their money into CBDCs. That could drain commercial banks of deposits. Banks lend money. If they don’t have deposits, they can’t lend. That could trigger a credit crunch. In a recession, CBDCs could make things worse. Another risk? Fragmentation. If every country builds its own digital currency with different rules, standards, and security protocols, cross-border payments get messy. That’s why the Swiss and French central banks are testing cross-border CBDC links. If they can’t connect, we’ll end up with digital financial islands.

What’s Next?

India’s Digital Rupee is now in use by 10 million people. The European Central Bank has 30,000 test users for its digital euro. The U.S. Federal Reserve is testing integration with USDC and USDT-private stablecoins. That’s a huge shift. It means governments aren’t just building their own systems. They’re letting private companies build alongside them. By 2030, 90% of central banks will likely have launched a CBDC. But physical cash? It’s not disappearing. The Bank for International Settlements says it’ll remain available everywhere. Why? Because people still need it. Elderly users. Rural communities. Emergency situations. Cash is the last safety net. The future isn’t cashless. It’s hybrid. Cash. CBDCs. Maybe some cryptocurrencies. And stablecoins that work with central banks. The winners won’t be the ones who replace the old system. They’ll be the ones who make the new system work with the old one.Will Bitcoin Ever Replace the Dollar?

Not in any country that’s serious about economic stability. El Salvador tried. The results are mixed. Bitcoin’s volatility makes it terrible for daily spending. Its slow speed makes it useless for small purchases. And its energy use? Unacceptable for a nation trying to attract green investment. The real story isn’t Bitcoin as money. It’s Bitcoin as reserve asset. Companies like MicroStrategy hold it. Countries like El Salvador bought it. But they’re not spending it. They’re storing it. That’s not currency. That’s speculation. CBDCs are about control, efficiency, and inclusion. Bitcoin is about decentralization and defiance. They’re not competing. They’re serving different needs.What Should You Watch For?

If you’re watching this space, don’t look at headlines. Look at adoption rates. Look at merchant acceptance. Look at user complaints. - Is the app working offline? - Can you pay at the corner store? - Do elderly people use it without help? - Is it faster than cash? - Is it cheaper than a bank transfer? The countries that get those answers right will lead the next decade of money. The rest? They’ll have shiny apps nobody uses.The digital currency revolution isn’t about replacing cash. It’s about making money work better-for everyone, not just the connected.

Suhail Kashmiri

People still don't get it - CBDCs aren't about innovation, they're about control. If you think Nigeria's e-Naira failing because of tech issues, you're delusional. It's because governments don't want you to have financial freedom. They want every cent tracked, taxed, and controlled. This isn't progress - it's surveillance with a mobile app.