For years, Vietnam’s central bank told people: crypto is not money. No payments. No bank transfers. No official backing. But in June 2025, everything changed. The State Bank of Vietnam didn’t just soften its stance-it rewrote the rules. Cryptocurrencies like Bitcoin and Ethereum are now legal as virtual assets. You can own them. You can trade them. You can even leave them in your will. But here’s the catch: you can’t use them to buy coffee, pay rent, or send money abroad. And you won’t find a single licensed exchange operating yet.

What Changed in June 2025?

The big shift came with the Law on Digital Technology Industry, passed in June 2025. For the first time, Vietnam officially recognized Bitcoin, Ethereum, and other digital assets as property-not currency. That means they’re protected under civil law. You can hold them, sell them, inherit them. This wasn’t a small tweak. It was a legal reset. Before this, holding crypto was in a gray zone. Now, it’s clearly legal to own-but still illegal to use as payment.

The State Bank of Vietnam didn’t go all-in. They drew hard lines. Stablecoins tied to the US dollar? Still banned. Crypto tokens that act like stocks or bonds? Also banned. Only non-fiat-backed digital assets are allowed. That means tokens must be backed by real-world assets like gold, real estate, or commodities-not dollars or euros. And every trade must happen in Vietnamese dong (VND). No USDT. No USDC. No dollar pairs. Only VND.

The Five-Year Pilot: A Slow-Motion Experiment

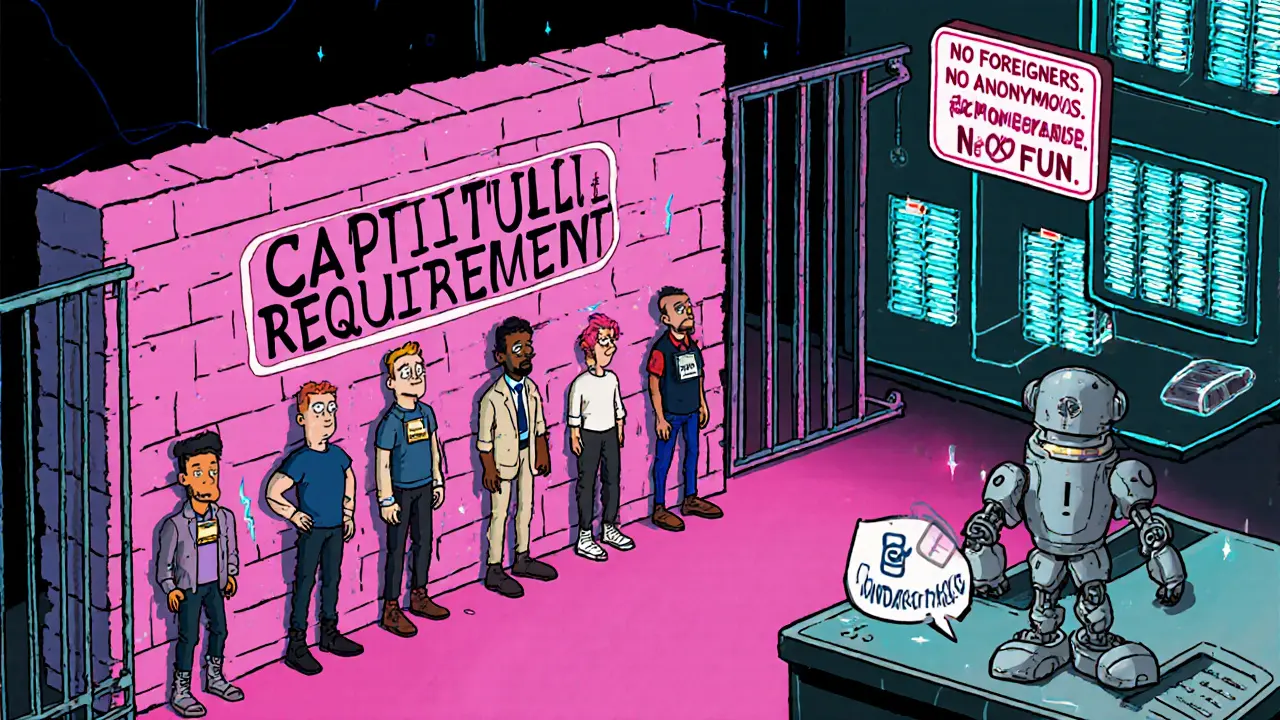

In September 2025, the State Bank launched a five-year pilot program to test how crypto fits into Vietnam’s financial system. It’s not a full rollout. It’s a controlled lab. Only five crypto exchanges will ever be licensed. And to even apply, a company needs at least 10 trillion VND-about $379 million-in capital. That’s more than most banks in Southeast Asia have in reserve.

Ownership rules are just as strict. Shareholders must come from approved sectors: commercial banks, securities firms, insurers, fund managers, or tech companies. And they must prove they’ve been profitable for two years straight. No startups. No foreign firms. No anonymous investors. Even the people behind the companies get vetted. This isn’t just regulation-it’s gatekeeping.

By 2026, licensed exchanges must offer trading pairs only in VND. That means if you want to buy Bitcoin, you pay in dong. No crypto-to-crypto trades. No USDT pairs. No foreign liquidity. The goal? Keep all financial flows visible to the central bank. Keep money moving through the Vietnamese banking system. Keep control.

Why No Exchanges Are Operating Yet

As of October 2025, not a single company has applied for a license. Not one. That’s surprising, given that Vietnam ranks fourth globally in crypto adoption, according to Chainalysis. Over 20% of tech-savvy Vietnamese own digital assets. Millions trade daily on Binance P2P, using dong to buy Bitcoin from strangers online. So why no applications?

The answer is simple: the rules are too heavy. The $379 million capital requirement is a wall. Most local fintech firms can’t raise that kind of money. Foreign exchanges like Binance or Kraken won’t bother-they can’t own the platform. And banks? They’re watching. Waiting. Testing the waters. But they’re not rushing in. The penalties for breaking the rules are brutal: fines, license revocation, even criminal charges. Why risk it when you can still profit quietly on P2P?

NDAChain: Vietnam’s Own Blockchain

While the exchange license program stalls, the government quietly built its own blockchain: NDAChain. Launched in July 2025, it’s a permissioned network-meaning only approved entities can use it. No public access. No anonymity. It’s designed for tokenizing bonds, carbon credits, and government assets. Think of it as Vietnam’s digital ledger for official transactions.

NDAChain gives the State Bank full visibility. Every token move is tracked. Every holder is known. This isn’t about decentralization. It’s about control. The central bank wants to experiment with blockchain technology without losing oversight. It’s a clear signal: innovation is welcome-as long as the government can see everything.

Why This Matters for Vietnam’s Economy

The State Bank isn’t just regulating crypto. It’s trying to fix the economy. Deputy Governor Pham Thanh Ha says crypto adoption could drive 20% credit growth in 2025. How? By unlocking new sources of liquidity. Imagine pension funds investing in tokenized gold. Insurance companies using blockchain for claims. Small businesses using digital assets as collateral. That’s the vision.

They also want tax revenue. Right now, crypto gains are untaxed. But with licensed exchanges, the government can track profits and collect taxes. They want to turn underground trading into formal, taxable activity. And they want foreign investors to come in-through Ministry of Finance-approved Crypto Asset Service Providers (CASPs). But so far, no one’s biting.

How Vietnam Compares to Neighbors

Singapore lets stablecoins fly. The Philippines lets banks offer crypto services. Thailand has a clear sandbox for DeFi. Vietnam? It’s the strictest in Southeast Asia. That’s why institutional investors still look elsewhere. The high barriers mean local startups can’t compete. Foreign giants won’t enter. The result? A thriving underground market and a stalled official one.

Yet Vietnam’s retail adoption is off the charts. People don’t wait for licenses. They trade on P2P. They use local payment apps. They convert dong to Bitcoin in minutes. The central bank knows this. That’s why their policy isn’t about stopping crypto-it’s about channeling it. They’re trying to build a dam, not a wall.

What’s Next?

The five-year pilot ends in 2030. That’s the real deadline. By then, the State Bank will decide: do we expand? Do we relax? Or do we double down? The answer will depend on three things: how many exchanges finally apply, how much tax revenue flows in, and whether local banks start using crypto as collateral.

Right now, the system is frozen. No exchanges. No institutional participation. But millions of people are still trading. That’s the tension at the heart of Vietnam’s crypto policy: the government wants control. The people want freedom. And for now, the middle ground is quiet-waiting for someone to take the first step.

Liz Watson

Oh wow. So Vietnam finally decided to let people own digital assets… as long as they can’t actually use them? Brilliant. It’s like giving someone a Ferrari and forbidding them from turning the key. The only thing more ironic than this policy is the fact that 20% of the population is already doing it anyway. Congrats, State Bank-you’ve created the world’s most expensive hobby.