Remittance Cost Comparison Calculator

The article states traditional remittances in developing countries cost up to 12% in fees, while crypto transfers typically cost less than 1%. For example, sending $100 through traditional services might cost $12 in fees, while crypto would cost less than $1.

Traditional Remittances

Fee: Up to 12% (as mentioned in article)

$0.00

Amount Received

Example: Sending $100

$88.00 received

Crypto Transfers

Fee: Less than 1% (as mentioned in article)

$0.00

Amount Received

Example: Sending $100

$99.00 received

Real-world example from article: In Nigeria, where remittances hit $20 billion in 2024, crypto-based transfers now account for nearly 18% of all incoming funds. This tool demonstrates the real savings that make this possible.

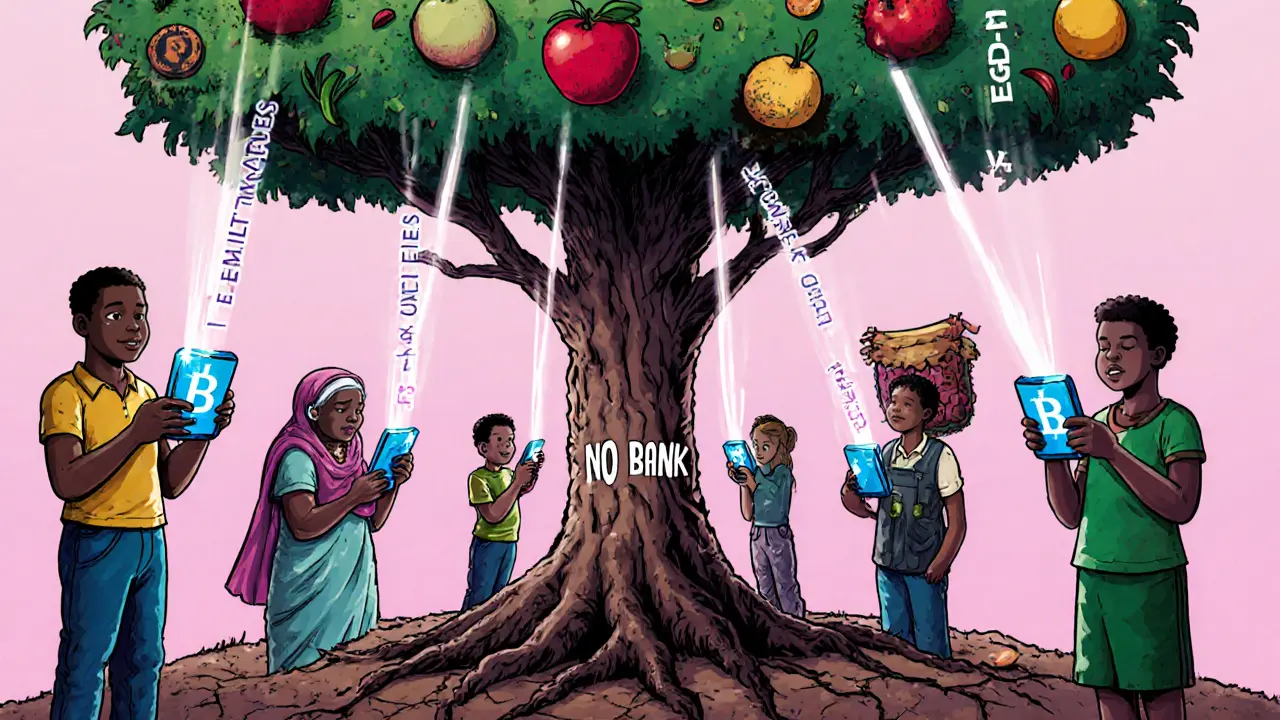

More than 1.4 billion people around the world don’t have a bank account. In places like rural Nigeria, remote parts of Kenya, or villages in Bangladesh, getting access to basic financial services means walking miles to the nearest branch-assuming there even is one. Even if you make it there, you might need ID papers you don’t have, a minimum balance you can’t afford, or a credit history you’ve never had a chance to build. For these people, traditional banking isn’t broken-it’s just not built for them.

Cryptocurrency is changing that. Not because it’s perfect, but because it doesn’t need permission. You don’t need a government-issued ID to create a wallet. You don’t need a physical branch. You just need a smartphone and a signal. In 2025, that’s more possible than ever.

Why Crypto Works Where Banks Don’t

Think about sending money home to your family in Uganda while you work in South Africa. With Western Union or MoneyGram, you pay up to 12% in fees. The transfer takes days. If the recipient doesn’t have a bank account, they have to pick up cash in person-another long trip, another risk.

With crypto, you send Bitcoin or USDT from your phone in minutes. The fee? Less than 1%. The recipient gets it in their wallet, converts it to local currency via a nearby kiosk, and walks away with cash-no bank required. In Nigeria, where remittances hit $20 billion in 2024, crypto-based transfers now account for nearly 18% of all incoming funds. That’s not a niche trend. That’s a lifeline.

And it’s not just remittances. Farmers in Ghana who sell crops to buyers in neighboring countries used to rely on middlemen who paid them in cash and took half the profit. Now, some use crypto to get paid directly from buyers overseas. No intermediaries. No delays. No hidden fees.

Storing Value When Your Currency Is Falling

In Argentina, Venezuela, and Lebanon, people watched their savings vanish overnight as inflation hit 200%, 300%, even 1,000% per year. Banks didn’t help. Interest rates couldn’t keep up. Savings accounts became traps.

Crypto, especially stablecoins like USDC or USDT, became a way out. These digital tokens are pegged to the U.S. dollar. They don’t crash with local currencies. People started buying them with cash, storing them on phones, and using them to buy groceries, pay rent, or send money abroad. In 2024, over 60% of crypto users in Argentina said they used it primarily to protect their income from inflation-not to speculate.

This isn’t about getting rich. It’s about not losing everything you’ve worked for. And for millions, crypto is the only tool that lets them do that.

It’s Not Just Bitcoin-It’s the Whole System

People think crypto means Bitcoin. But the real innovation is the underlying system: blockchain. It’s a public ledger that doesn’t need a central authority to verify transactions. That’s why it works where banks fail.

Traditional banks require layers of paperwork, compliance checks, and physical infrastructure. Crypto skips all that. A person in a village in Malawi can open a wallet using just a phone number. No address. No proof of income. No credit score. The system trusts the math, not the paperwork.

Even central banks are taking notice. Ghana and Nigeria have launched digital versions of their national currencies-eNaira and eCedi-designed to reach people without bank accounts. These aren’t crypto, but they borrow the same ideas: fast, digital, accessible. They’re proof that the model works.

The Real Barriers-And Why They’re Not What You Think

Crypto isn’t a magic fix. It has real problems.

First, internet access. In rural areas, 4G is still a luxury. A smartphone costs more than a month’s wages for many. Without reliable connectivity, crypto is useless.

Second, security. If you lose your private key-or someone steals your phone-you lose everything. No bank can reverse it. No customer service line can help. For people unfamiliar with digital tools, this is terrifying.

Third, volatility. Bitcoin’s price swings can wipe out savings in hours. That’s why stablecoins are becoming the real workhorses. They’re not flashy, but they’re the only crypto most people can trust to hold value.

And then there’s regulation. In some countries, crypto is banned. In others, it’s legal but unregulated. That means no legal protection if you get scammed. No recourse if a platform shuts down. That’s why adoption is high in cities like Lagos and Nairobi, but still low in rural areas-where people don’t know if they’re breaking the law just by using it.

What’s Working-Real Examples

Let’s look at what’s actually making a difference:

- Chipper Cash (Africa): A mobile app that lets users send crypto or fiat across borders in seconds. Over 15 million users in 10 African countries. No bank account needed.

- Strike (Latin America): Built on Bitcoin, it lets Salvadorans get paid in crypto and spend it instantly at local stores. Over 30% of the country now uses it regularly.

- Chivo Wallet (El Salvador): The government’s Bitcoin wallet app. Even people without smartphones can use it via SMS. Over 4 million downloads.

- Stablecoin kiosks in Kenya: You walk in, hand over cash, get USDT on your phone. Walk out, use it to pay your child’s school fees online. No bank involved.

These aren’t experiments. They’re daily tools for real people. And they’re growing fast.

What Comes Next?

Crypto won’t replace banks overnight. But it’s already replacing the parts of banking that never worked for the poor.

The future isn’t about everyone holding Bitcoin. It’s about having access to fast, cheap, secure financial tools-no matter where you live or what your income is.

That means:

- More affordable smartphones and data plans in rural areas

- Clear, simple regulations that protect users without crushing innovation

- Local education programs that teach wallet safety, stablecoin use, and scam prevention

- Partnerships between crypto platforms and local mobile money providers like M-Pesa

The goal isn’t to make everyone a crypto trader. It’s to make sure no one is locked out of the financial system because they live in the wrong place or earn too little.

That’s not just technology. That’s justice.

Is Crypto the Answer for Everyone?

No. But it’s the only answer that’s already working for millions who were told they didn’t qualify for anything else.

For the first time in history, a farmer in Zambia can pay for fertilizer, send money to his daughter in Johannesburg, and save for his grandchildren-all without ever stepping into a bank. That’s not theoretical. It’s happening right now.

Crypto isn’t perfect. But for those who had no options before, it’s not just a tool. It’s a door.

Can crypto really help people without smartphones?

Yes, but indirectly. In places like Kenya and Nigeria, people use SMS-based crypto services where they text a code to receive or send money. Some kiosks allow cash-in/cash-out without a phone-just a fingerprint or ID number. While smartphones are ideal, the system is being adapted for low-tech access.

Is crypto safer than cash?

It depends. If you lose your phone or private key, you lose your crypto permanently. But if you keep your funds in a secure wallet and avoid scams, it’s safer than carrying cash. Cash can be stolen, burned, or devalued by inflation. Crypto, especially stablecoins, can’t be physically taken and holds value better in unstable economies.

Why do governments oppose crypto?

Governments fear losing control over money. Crypto bypasses central banks, makes tax collection harder, and can be used for illegal activity. But many are shifting from bans to regulation-especially after seeing how crypto helped citizens during currency crises. Countries like El Salvador and Nigeria now see it as a tool for economic resilience.

Do I need to understand blockchain to use crypto?

No. You don’t need to know how a car engine works to drive. Apps like Chipper Cash or Strike handle the technical side. You just need to know how to send money, receive cash, and protect your PIN. Simple education-like a 10-minute video in local language-is enough to get started.

Can crypto replace traditional banking in developing countries?

Not replace-complement. Banks still handle large loans, mortgages, and business accounts. Crypto fills the gaps: remittances, small payments, savings in unstable currencies, and cross-border trade. The future is hybrid: banks offering crypto services, and crypto apps offering basic banking features. Together, they cover more people than either could alone.

Is crypto just for young tech-savvy people?

No. In Nigeria, users over 50 are the fastest-growing group using crypto for remittances. In El Salvador, elderly farmers use Bitcoin to get paid for their crops. The apps are designed to be simple. Age doesn’t matter-accessibility does.

Douglas Tofoli

this is actually life-changing for so many people 🙌 i just saw a video of a grandma in Nairobi using a kiosk to get usdt for her grandkids' school fees. no bank, no paperwork, just cash in, code out. it's not perfect but it's working.

and honestly? i'm jealous. we still need checks and wires here.