ICDex Trading Fee Calculator

ICDex is a niche DEX built on the Internet Computer blockchain. With extremely low liquidity (less than $100 daily trading volume), even small trades can cause significant price movements. This calculator shows estimated fees based on ICDex's tiered structure, but actual trading may be affected by market volatility and order book depth.

Estimated Fees

Important Liquidity Warning

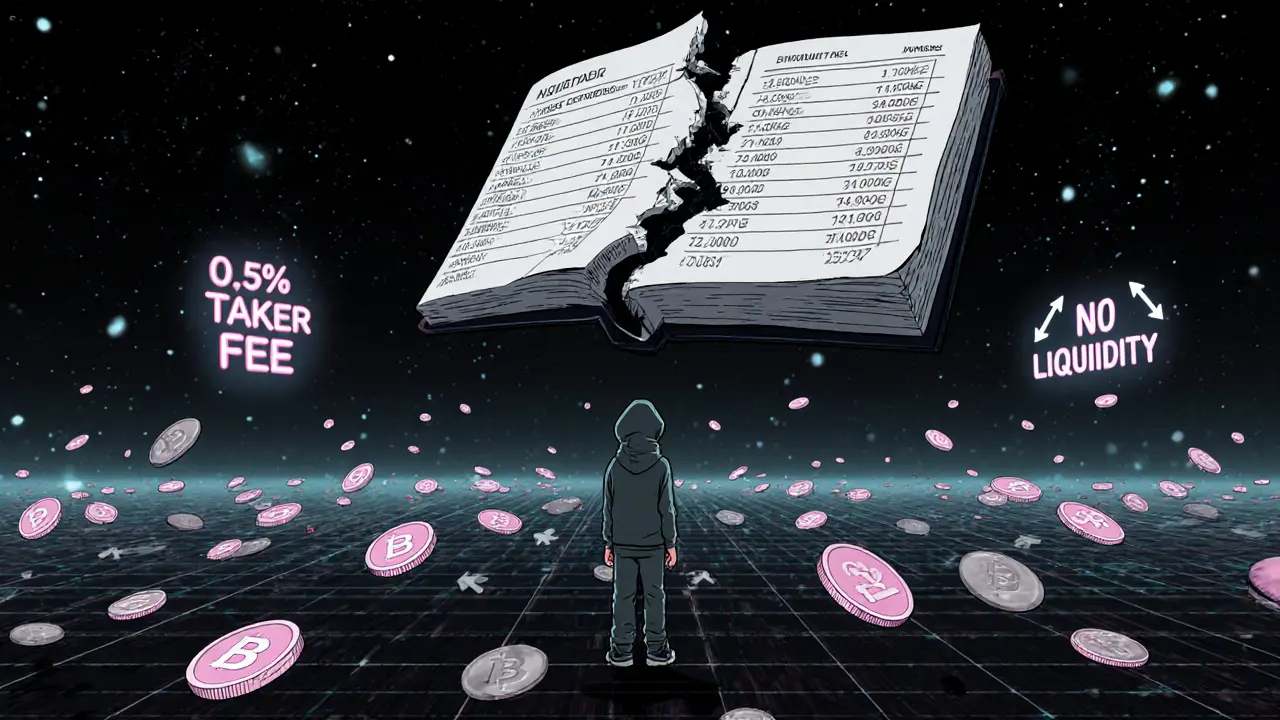

With less than $100 daily trading volume, even small trades may experience significant slippage. Orders may not fill, or may fill at prices substantially different from your intended price. Your trade may effectively cost more than shown here due to market impact.

Most crypto exchanges want you to trust them with your money. ICDex is different. It doesn’t hold your funds. It doesn’t need you to sign up. It runs entirely on the Internet Computer blockchain, letting you trade directly from your wallet - no middlemen, no KYC, no custody risk. But here’s the catch: ICDex has less than $100 in trading volume on a good day.

If you’re looking for a reliable place to trade Bitcoin, Ethereum, or even Solana, ICDex isn’t it. It’s not built for that. It’s built for one thing: trading ICP and a handful of other tokens native to the Internet Computer (IC) ecosystem. And even then, it’s not easy.

What Is ICDex, Really?

ICDex launched in 2021 as a decentralized exchange (DEX) built entirely on-chain using the Internet Computer Protocol. Unlike Uniswap or PancakeSwap, which use automated market makers (AMMs), ICDex uses a real, on-chain order book. That means buy and sell orders are stored directly on the blockchain, just like on Coinbase or Binance - except here, you never give up control of your coins.

This is technically impressive. Most DEXs fake the order book experience by using off-chain matching engines. ICDex doesn’t. Every trade, every limit order, every stop-loss is settled on the Internet Computer blockchain. That’s rare. And for users who care about true decentralization, that’s valuable.

But value doesn’t mean usability. The platform supports only 8 tokens and 8 trading pairs. The most active one? ICL/ICP. That’s it. If you’re not trading ICP or tokens tied to the Internet Computer, you won’t find much here.

How Does ICDex Compare to Other DEXs?

Let’s put this in perspective. Uniswap moves over $4 billion in trading volume daily. PancakeSwap handles $2 billion. dYdX, focused on derivatives, clears hundreds of millions. ICDex? On a busy day, it hits $100. CoinGecko recorded a 24-hour volume of just $93.79 - down 99.8% from the day before.

That’s not a glitch. That’s the norm. The exchange ranks 490th out of 600 crypto exchanges in organic traffic, according to Cashbackforex. Only 264 people visited the site last month. Most of them left without trading. The data shows 0% average visit duration - not because users loved it, but because they couldn’t do anything meaningful.

Other DEXs offer hundreds of tokens, liquidity pools, yield farming, and fiat on-ramps. ICDex has none of that. No credit card deposits. No USD onboarding. No mobile app. No customer support chat. You need to already have ICP or related tokens in a compatible wallet - and know how to use it.

Fees and Trading Structure

ICDex uses a tiered fee system with three boards:

- MAIN Board: 0.2% taker fee, 0% maker fee

- SECOND Board: 0.3% taker fee, 0% maker fee

- THIRD Board: 0.5% taker fee, 0% maker fee

Most trading happens on the THIRD Board, so the effective taker fee is usually 0.5%. Maker fees are always zero - a smart move to attract liquidity. But here’s the problem: no one’s making markets. With so little activity, even zero fees don’t help. There’s no incentive for large traders to place big orders because there’s no one to trade with.

Order types are advanced - limit, stop, fill-or-kill - which is rare for a DEX. But if you try to place a $1,000 limit order on ICL/ICP, you’ll likely see the price jump or drop instantly because the order book is paper-thin. One big trade can move the market 10% in seconds. That’s not liquidity. That’s volatility with no safety net.

Security and Audits

ICDex’s smart contracts have been audited, according to ICO Rankings. But no public audit report is available. No firm name. No date. No link. That’s not ideal. In crypto, transparency matters. If you can’t verify the audit, you’re trusting hearsay.

Still, the non-custodial model is its strongest security feature. Your keys stay with you. No exchange hacks. No frozen withdrawals. If you lose your wallet password, you lose your funds - but that’s true for every self-custody platform. At least you’re not risking a centralized exchange collapse.

There’s no regulation. ICDex is incorporated in Singapore, but the company isn’t licensed or overseen by any financial authority. That’s normal for DEXs - but again, it means zero legal recourse if something goes wrong.

Who Is ICDex For?

ICDex isn’t for beginners. It’s not for casual traders. It’s not for people who want to buy crypto with a credit card or trade Ethereum.

It’s only for one group: developers, investors, or enthusiasts who already hold ICP and want to trade it in a fully decentralized way - and are okay with near-zero liquidity, slow execution, and zero support.

If you’re building a dApp on the Internet Computer and need to swap ICP for another IC-native token, ICDex might be your only option. If you’re trying to exit a position in ICP without using a centralized exchange, it’s a possibility - but you’ll be fighting a ghost market.

For everyone else? It’s a tech demo, not a trading platform.

The Bigger Problem: The Internet Computer Itself

ICDex isn’t failing because it’s poorly built. It’s failing because the Internet Computer blockchain hasn’t taken off.

Compare it to Ethereum. Over 2 million daily active addresses. Thousands of dApps. Billions in locked value. Now look at Internet Computer: a few hundred thousand addresses, a handful of major projects, and almost no institutional adoption. Without a strong ecosystem, no DEX can survive.

ICDex is stuck in a chicken-and-egg loop. No traders → no liquidity → no traders. The team solved the technical problem - an on-chain order book - but not the economic one. They didn’t incentivize liquidity providers. They didn’t partner with major IC projects. They didn’t market to the broader DeFi community.

As a result, ICDex is a beautiful car with no fuel. The engine works. But there’s nothing in the tank.

Getting Started - If You Must

If you still want to try ICDex, here’s how:

- Get a wallet that supports the Internet Computer blockchain. Popular options include the Internet Computer Wallet (official) or Dfinity’s browser extension.

- Fund it with ICP or another IC-native token. You can’t deposit fiat. You must already own crypto on the IC network.

- Go to iclight.io (the official site, though it’s minimal and lacks documentation).

- Connect your wallet. No sign-up needed.

- Select a trading pair - likely ICL/ICP.

- Place your order. Be ready for slippage. Small orders only.

There’s no tutorial. No help center. No community forum. If you get stuck, you’re on your own.

Final Verdict: A Brilliant Idea, a Useless Platform

ICDex is a technical marvel. It’s one of the few DEXs that truly delivers a real on-chain order book. The code is clean. The architecture is sound. The team clearly understands DeFi.

But none of that matters if no one uses it.

For the average crypto user, ICDex is irrelevant. For the ICP community, it’s a last resort. For investors, it’s a warning sign - not an opportunity.

Unless the Internet Computer gains massive adoption - and fast - ICDex will remain a footnote in crypto history. A cool experiment. A dead end. A platform that solved the wrong problem.

If you want to trade crypto with full control, use Uniswap, SushiSwap, or dYdX. They have liquidity. They have support. They have users.

If you want to trade ICP - and you really, really have to - then ICDex is your only option. Just don’t expect to trade anything significant. And don’t be surprised if your order never fills.

Is ICDex safe to use?

Yes, but only in a limited sense. ICDex is non-custodial, so your funds aren’t held by the exchange. That reduces the risk of hacks or theft. However, the smart contracts haven’t been publicly audited with verifiable reports, and the platform has no regulatory oversight. Your main risk is trading in a market with almost no liquidity - where small trades can cause massive price swings and your orders may not execute at all.

Can I buy crypto with fiat on ICDex?

No. ICDex does not support fiat deposits or on-ramps. You must already own ICP or other Internet Computer tokens in a compatible wallet before you can trade. There’s no way to buy crypto with a credit card, bank transfer, or PayPal through this platform.

What tokens can I trade on ICDex?

You can trade only 8 tokens, all native to the Internet Computer blockchain. The most active pair is ICL/ICP. Other tokens include ICP, ICL, and a few minor IC-based projects. There are no major tokens like Bitcoin, Ethereum, Solana, or BNB. If you’re not trading ICP-related assets, you won’t find much here.

Why is ICDex’s trading volume so low?

Because the Internet Computer ecosystem itself has very low adoption. Without users holding ICP or other IC tokens, there’s no demand for trading. Even though ICDex offers advanced features, it’s stuck in a loop: no liquidity attracts no traders, and no traders mean no liquidity. The platform also lacks marketing, partnerships, and incentives for liquidity providers.

Is ICDex better than Uniswap or PancakeSwap?

Only if you’re trading Internet Computer tokens and demand a true on-chain order book. For everything else - including Ethereum, BNB Chain, or stablecoin trading - Uniswap and PancakeSwap are vastly superior. They have millions in daily volume, hundreds of tokens, and active communities. ICDex has less than $100 in volume and almost no users. It’s not a competitor - it’s a niche tool for a tiny audience.

Will ICDex grow in the future?

Unlikely. The platform shows no signs of growth. Trading volume has dropped by 99.8% in recent months. Monthly traffic is under 300 visits. There’s no roadmap, no new features announced, and no community engagement. Without a major boost in adoption of the Internet Computer blockchain - or a strategic partnership with a large project - ICDex will likely remain a technical curiosity, not a functioning exchange.

Suhail Kashmiri

This is why crypto keeps failing - people build tech for tech’s sake and forget people need to use it. ICDex is a museum piece. Beautiful, intricate, and completely useless unless you’re a historian with ICP in your pocket.