Most people assume that if you can buy Bitcoin in Mexico, then banks there must support it. That’s not true. In fact, Mexican banks are blocked from offering any crypto services to customers - not because they don’t want to, but because they legally can’t. This isn’t a glitch in the system. It’s by design.

Why Mexican Banks Can’t Touch Crypto

The core rule blocking banks from crypto is Banxico’s Rule 4/2019. It’s simple: no custody, no trading, no sending, no receiving. Banks can’t let you buy Bitcoin through your account. They can’t hold your Ethereum. They can’t even let you pay someone else in crypto via their app. This isn’t a temporary freeze - it’s been in place since 2019 and still stands in 2026. The Bank of Mexico (Banxico) didn’t ban crypto. It banned banks from touching it. That’s a big difference. Virtual assets like Bitcoin and Ethereum are legal to own. You can buy them on exchanges like Bitso or Binance. But if you try to link your Banorte or BBVA account to buy crypto directly, it won’t work. The system is built to keep the two worlds separate. Even internal use is restricted. Banks can’t use crypto for settlement between themselves unless Banxico gives special permission. And as of 2026, no such permission has been granted. So while the technology exists, the legal path doesn’t. That means every crypto transaction in Mexico happens outside the banking system - on peer-to-peer apps, decentralized exchanges, or unregulated platforms.Who’s Actually Running Crypto in Mexico?

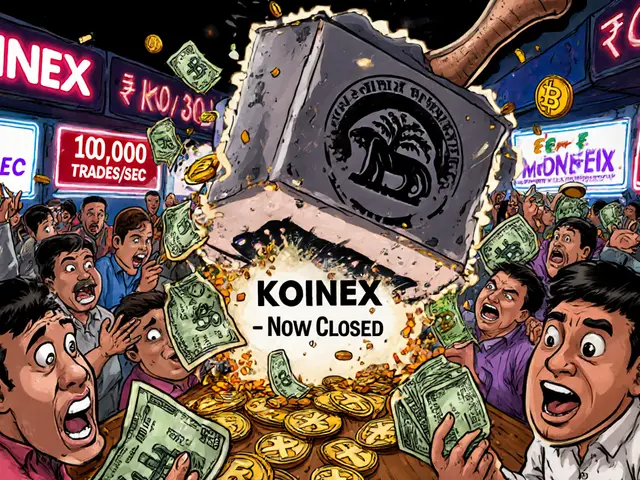

If banks can’t do it, who is? The answer is fintech startups and unregulated platforms. Companies like Bitso, Ripio, and Kriptown operate under the Fintech Law of 2018, which requires them to register with the National Banking and Securities Commission (CNBV). But registration doesn’t mean full oversight. It means they’ve filed paperwork and agreed to basic AML rules - like checking IDs and reporting large transactions. These platforms let you buy, sell, and store crypto. But they can’t offer loans, savings accounts, or interest-bearing crypto wallets - at least not legally. Some do anyway. Crypto lending platforms like Nexo or Celsius-style services are active in Mexico, but they don’t say they’re regulated. They put disclaimers in small print: “This service is not supervised by Banxico or CNBV. You assume all risk.” That’s the reality for most users. You’re not protected. If the platform gets hacked, freezes withdrawals, or disappears, you have no legal recourse through the banking system. No deposit insurance. No government bailout. Just a Terms of Service agreement you probably didn’t read.What About Stablecoins and NFTs?

Stablecoins like USDT or USDC? They’re treated like any other virtual asset. No special rules. No legal backing. Even though they’re pegged to the U.S. dollar, Mexican authorities don’t recognize them as currency. That means if you use USDT to pay for groceries in Mexico City, the seller has to treat it as a barter transaction - not a payment. NFTs? Even less regulated. You can buy a digital artwork or a virtual land parcel, but there’s no legal framework for ownership disputes. If someone steals your NFT, you can’t go to court and say, “This is mine.” You can report it to the platform, but if the platform doesn’t care, you’re out of luck. The same goes for utility tokens - tokens that give you access to a service, like voting rights in a DAO or early access to an app. They’re not securities. They’re not commodities. They’re just digital keys. And no one in Mexico’s government has decided what to do with them.

Taxes: You Still Owe Money

Just because the system doesn’t regulate crypto doesn’t mean the taxman ignores it. The Mexican tax authority (SAT) treats crypto profits as income from selling goods. If you bought Bitcoin at $30,000 and sold it at $60,000, you owe tax on the $30,000 gain. That’s it. No special crypto tax form. No exemption for holding long-term. Just regular income tax. The Ministry of Finance says virtual assets have “no intrinsic value,” but that doesn’t stop them from taxing the money you make from them. And if you earn crypto as income - say, from freelancing or staking - you must declare it. Failure to do so can trigger audits. There’s no amnesty program. No grace period. The rules are clear: report it, or risk penalties.Why Is Mexico Doing This?

Mexico’s approach isn’t random. It’s a balancing act. On one side, the government wants to protect the banking system from crypto’s volatility and potential for fraud. On the other, it doesn’t want to stifle innovation entirely. That’s why Banxico is building its own digital currency - Project Agorá. This isn’t just a digital peso. It’s a strategic move to control the future of money in Mexico. By launching a central bank digital currency (CBDC) by the end of 2025, Banxico aims to give unbanked citizens access to fast, low-cost digital payments - without letting private companies like Coinbase or Telegram take over. The CBDC will be fully regulated, traceable, and backed by the state. It won’t be Bitcoin. It won’t be decentralized. But it will be digital. And that’s exactly what Banxico wants: a government-controlled alternative to private crypto.

The Bigger Picture: Basel III and Bank Safety

Mexican banks aren’t just restricted from crypto - they’re under heavy pressure to stay safe in every other way. Since 2020, they’ve had to follow Basel III rules, which force them to hold more capital and keep more cash on hand. Systemically important banks like BBVA and Santander must hold extra capital buffers - up to 2.25% more than smaller banks. They’re also limited in how much they can lend to one person or company. They can’t take crazy risks with derivatives or proprietary trading without paying a heavy capital penalty. All of this is designed to prevent another financial crisis - and crypto, with its wild swings and unregulated players, looks like a threat. So while crypto users in Mexico enjoy freedom to trade, the banks are being forced to play it safe. That’s why you won’t see a “Buy Bitcoin” button in your online banking app. Not because they’re backward. Because they’re legally bound not to.What’s Next for Mexico’s Crypto Scene?

The Fintech Law is being updated. Talks are happening. But no one knows when or what will change. Some experts expect new rules by 2027 that might allow banks to offer limited custody services under strict conditions. Others think Banxico will double down on its CBDC and keep private crypto out of the banking system forever. For now, the divide remains wide. You can own crypto. You can trade it. You can even use it to pay for services. But you can’t do any of that through your bank. And that’s the core truth of Mexico’s crypto landscape in 2026.What This Means for You

If you’re in Mexico and you want to use crypto:- Use a registered exchange like Bitso or Ripio - they’re the safest option.

- Never link your bank account directly to a crypto platform unless you’re sure it’s approved by CNBV.

- Don’t use unregulated lending platforms unless you’re ready to lose your money.

- Keep records of every transaction. You’ll need them for taxes.

- Understand that your crypto is not protected by the government. If something goes wrong, you’re on your own.

Can Mexican banks offer cryptocurrency services?

No. Mexican banks are legally prohibited from offering cryptocurrency services like buying, selling, storing, or transferring crypto to customers. This restriction comes from Banxico’s Rule 4/2019, which blocks all direct crypto interactions by regulated financial institutions. Even internal use requires special authorization - and none have been granted as of 2026.

Is cryptocurrency legal in Mexico?

Yes. Cryptocurrency is legal to own, buy, and sell in Mexico. The Fintech Law of 2018 recognizes virtual assets as digital representations of value used as a means of payment - but not as legal tender. You can use crypto for transactions, but businesses aren’t required to accept it, and banks can’t facilitate those transactions.

Are crypto lending platforms regulated in Mexico?

No, not directly. Crypto lending services are not licensed or supervised by Banxico or CNBV. However, if they operate as non-financial entities offering loans, they fall under the Anti-Money Laundering Law and must identify users and report large transactions to the Ministry of Finance. Most platforms include disclaimers stating their services are unregulated and users assume all risk.

Do I have to pay taxes on crypto in Mexico?

Yes. The Mexican tax authority (SAT) treats crypto profits as income from the sale of goods. If you sell Bitcoin for more than you paid, you owe income tax on the gain. Crypto earned as payment (e.g., from freelancing) must also be declared as income. There are no special crypto tax rates - just standard income tax rules.

What is Banxico’s Project Agorá?

Project Agorá is Banxico’s initiative to develop a Central Bank Digital Currency (CBDC) - a digital version of the Mexican peso. Scheduled for release by the end of 2025, it aims to improve financial inclusion by offering secure, government-backed digital payments to unbanked populations. Unlike Bitcoin or Ethereum, Agorá will be centralized, traceable, and fully regulated by the central bank.

Are NFTs and stablecoins regulated in Mexico?

No. NFTs, stablecoins, and other token types are not specifically regulated under Mexican law. They’re treated as virtual assets under the Fintech Law, but no rules define their legal status, ownership rights, or consumer protections. Users bear all risks - from fraud to loss - with no recourse through financial authorities.

Callan Burdett

This is actually one of the most balanced takes I’ve seen on crypto in Latin America. Finally, someone gets that it’s not about banning tech-it’s about protecting the system. Kudos to Banxico for not falling for the hype.