Iranian Crypto Sanction Risk Calculator

Calculate Your Transaction Risk

How OFAC Sanctions Have Cut Off Iranian Crypto Access

Since 2015, the U.S. Treasury’s Office of Foreign Assets Control (OFAC) has systematically targeted Iranian cryptocurrency activity, turning blockchain transactions into a frontline for sanctions enforcement. Iranian users can no longer freely trade on major exchanges like Binance, Coinbase, or Kraken. These platforms now block IP addresses from Iran, require strict KYC checks, and automatically freeze transactions linked to sanctioned wallet addresses. The result? Iranian individuals and businesses have been largely locked out of the global crypto ecosystem - not because Bitcoin or Ethereum are banned, but because the financial infrastructure around them is.

The First Crack in the Wall: Ransomware and Wallet Addresses

Before 2018, OFAC focused on freezing bank accounts and seizing physical assets. Then came the SamSam ransomware attacks. Hackers, linked to Iranian actors, infected hospitals, universities, and government agencies across the U.S. and Europe, demanding payments in Bitcoin. When victims paid, the funds didn’t vanish - they flowed through Iranian intermediaries who converted Bitcoin into Iranian rials and deposited them into local banks.

On November 28, 2018, OFAC made history. For the first time, they published specific Bitcoin wallet addresses tied to these intermediaries. This wasn’t just a warning - it was a blueprint. Suddenly, every exchange in the world could scan the blockchain and spot these addresses. If a transaction came from or went to one of those addresses, it was flagged, frozen, or blocked. The message was clear: blockchain is transparent, and OFAC is watching.

From Ransomware to Oil Money: The $600 Million Network

By September 2025, the scale had exploded. OFAC exposed a $600 million shadow banking network used to launder oil proceeds for Iran’s military. This wasn’t just a few hackers. It involved front companies in Hong Kong, Dubai, and Shenzhen, all working together to move crypto across borders. One company, Alpha Trading Co. in Hong Kong, acted as the financial hub. Another, Blue Sky General Trading LLC in the UAE, used Dubai’s loose financial oversight to funnel money without raising alarms.

The crypto side of the operation was just as sophisticated. OFAC identified five wallet addresses tied to Arash Estaki Alivand - two Ethereum addresses and three Tron addresses. These wallets held Tether, Ether, and Bitcoin. Each one was added to OFAC’s public sanctions list. Now, any exchange that processes a transaction involving those addresses risks fines, lawsuits, or being shut down entirely.

Why Exchanges Pay Millions to Stay Compliant

ShapeShift AG learned this the hard way. Once a major crypto exchange founded by early Bitcoin advocate Erik Vorhees, ShapeShift allowed users from Iran, Cuba, Sudan, and Syria to trade over $12.5 million in digital assets between 2019 and 2021. They didn’t have proper screening tools. They didn’t check wallet addresses against OFAC’s list. In September 2025, they paid $750,000 to settle the case.

That settlement wasn’t just a fine - it was a warning to every crypto platform. If you don’t screen transactions, you’re a target. Today, even small exchanges spend thousands on blockchain analytics tools like Chainalysis or Elliptic. These tools scan every incoming and outgoing transaction in real time, matching addresses against OFAC’s SDN list. If a match is found, the transaction is blocked before it completes.

How Iranians Bypass the Blockade - And Why It’s Riskier Than Ever

Iranians didn’t stop using crypto. They just moved underground. Many now use peer-to-peer (P2P) platforms like LocalBitcoins or Paxful, where users trade directly with each other. Others turn to decentralized exchanges (DEXs) like Uniswap or PancakeSwap, where no central company controls the flow of funds. Some even use privacy coins like Monero or Zcash, which obscure transaction histories.

But these workarounds come with huge downsides. P2P trades often involve higher prices and scams. DEXs have lower liquidity, meaning users can’t easily cash out large amounts. Privacy coins are harder to trade and often flagged by regulators. And every time someone uses a sanctioned wallet - even accidentally - they risk having their funds frozen permanently.

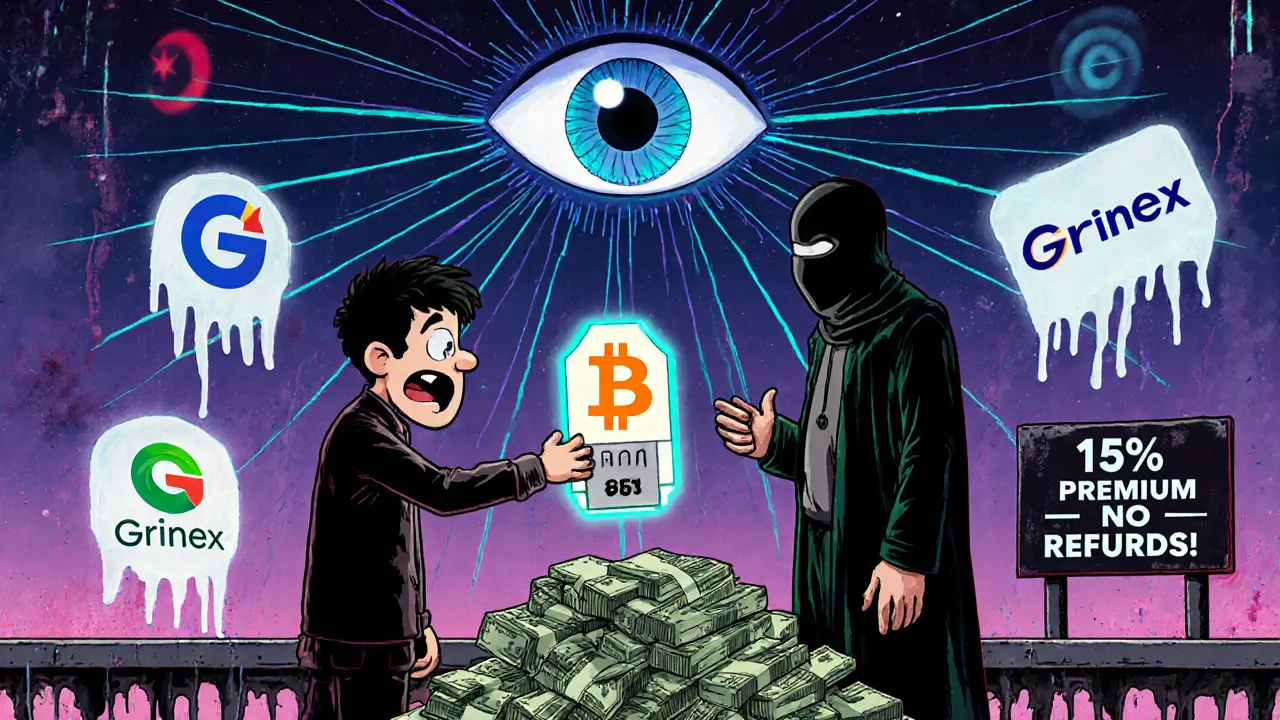

The Rise of Shadow Exchanges: Grinex and the Game of Whack-a-Mole

When U.S. authorities shut down Garantex in March 2025, the operators didn’t disappear. They launched Grinex - a direct replacement - within days. Grinex’s own marketing materials admitted it was created because Garantex was frozen. They even created a new token, A7A5, backed by Russian rubles, to help users regain access to their locked funds.

Grinex has since processed billions in transactions. But OFAC designated it in May 2025. Now, exchanges that interact with Grinex’s wallet addresses are at risk. This pattern is repeating: shut one down, another pops up. The U.S. government can’t keep up with every new platform - but they don’t need to. They just need to make it too risky for big exchanges to touch them.

What This Means for Iranian Crypto Users Today

If you’re in Iran and want to buy Bitcoin today, you’re not going to sign up for Coinbase. You’re going to find someone in Turkey or Pakistan who’ll trade you cash for crypto over Telegram. You’ll pay a 15-30% premium. You’ll risk being scammed. You’ll have no customer support. And if you ever try to move those funds to a mainstream wallet, you might trigger a freeze.

Even if you use a non-U.S. exchange based in Turkey or Russia, those platforms are under pressure. Most now require users to prove they’re not from sanctioned countries. Some ask for passport scans. Others use geolocation tools to detect VPNs. If you’re caught using a fake location, your account gets closed - and your money might disappear.

The Future: AI, Privacy Coins, and a Growing Arms Race

OFAC is now using AI to detect patterns in crypto flows. Instead of just blocking known bad addresses, they’re looking for unusual behavior: small transfers from multiple wallets to one large one, rapid movement between exchanges, or transactions that follow the same timing pattern as past sanctions evasion. Machine learning models are being trained to spot these signals before they become obvious.

Meanwhile, Iranian actors are turning to decentralized finance (DeFi) protocols, cross-chain bridges, and privacy-focused networks. But these tools aren’t foolproof. Every bridge leaves a trail. Every DeFi transaction is recorded on-chain. And every time someone tries to launder money through a new protocol, regulators take note.

The truth is, the game has changed. It’s no longer about whether Iran can access crypto. It’s about how much it costs - in time, money, and risk - to do it. The U.S. hasn’t blocked crypto. It’s blocked the easy path to it.

Can Iranian citizens still buy Bitcoin legally?

Iranian citizens can technically buy Bitcoin through peer-to-peer trades or non-U.S. exchanges, but there’s no legal pathway to use major global platforms like Coinbase or Binance. Most international exchanges block Iranian IP addresses and require verified identification, which most Iranians cannot provide under current sanctions. Any transaction linked to a sanctioned wallet address will be frozen or reversed.

Why do OFAC sanctions target cryptocurrency wallets specifically?

Cryptocurrency transactions are recorded on public blockchains, making them traceable. Unlike traditional bank accounts, which can be hidden behind layers of secrecy, every Bitcoin or Ethereum transaction leaves a permanent, searchable record. OFAC uses this transparency to identify and block the exact digital addresses used by Iranian facilitators, making it easier for exchanges to enforce sanctions automatically.

Are privacy coins like Monero safer for Iranians to use?

Privacy coins offer more anonymity, but they’re not safe. Exchanges that accept them are increasingly blacklisted by regulators. Many financial institutions refuse to process funds linked to Monero or Zcash. Plus, using privacy coins raises red flags with law enforcement - making users more likely to be investigated, even if they’re not involved in illegal activity.

What happens if someone accidentally receives funds from a sanctioned wallet?

If your wallet receives funds from a sanctioned address, your exchange may freeze your account and report the transaction. You’ll likely need to prove the source was unintentional - which is difficult without transaction history or documentation. In many cases, the funds are permanently locked. There’s no appeal process through the exchange, and contacting OFAC directly is nearly impossible for individuals.

Can Iranian users use VPNs to access banned exchanges?

Some try, but it’s risky. Exchanges now use advanced geolocation tools that detect VPN usage. If caught, accounts are permanently banned. Worse, using a VPN to bypass sanctions may violate U.S. law and expose users to legal consequences if they later travel abroad or conduct business with U.S.-based entities. Many platforms now require identity verification tied to real-world documents - which a VPN cannot fake.

Is there any hope for Iranian crypto users to regain access to global markets?

Unless U.S. sanctions are lifted or significantly modified, access to major exchanges remains blocked. Some Iranian developers are building local crypto ecosystems, but these lack liquidity, security, and international trust. Without diplomatic changes, Iranian users will continue to rely on risky, expensive, and unstable alternatives - with no guarantee of safety or recovery if things go wrong.

dhirendra pratap singh

This is insane!! 😱 Iran’s just trying to survive while the US plays global banker with blockchain?! The hypocrisy is OFF THE CHARTS!!!