Proxy Risk Calculator

Calculate Your Proxy Risk Score

Enter your trading details to assess the risk of using residential proxies for your crypto activities.

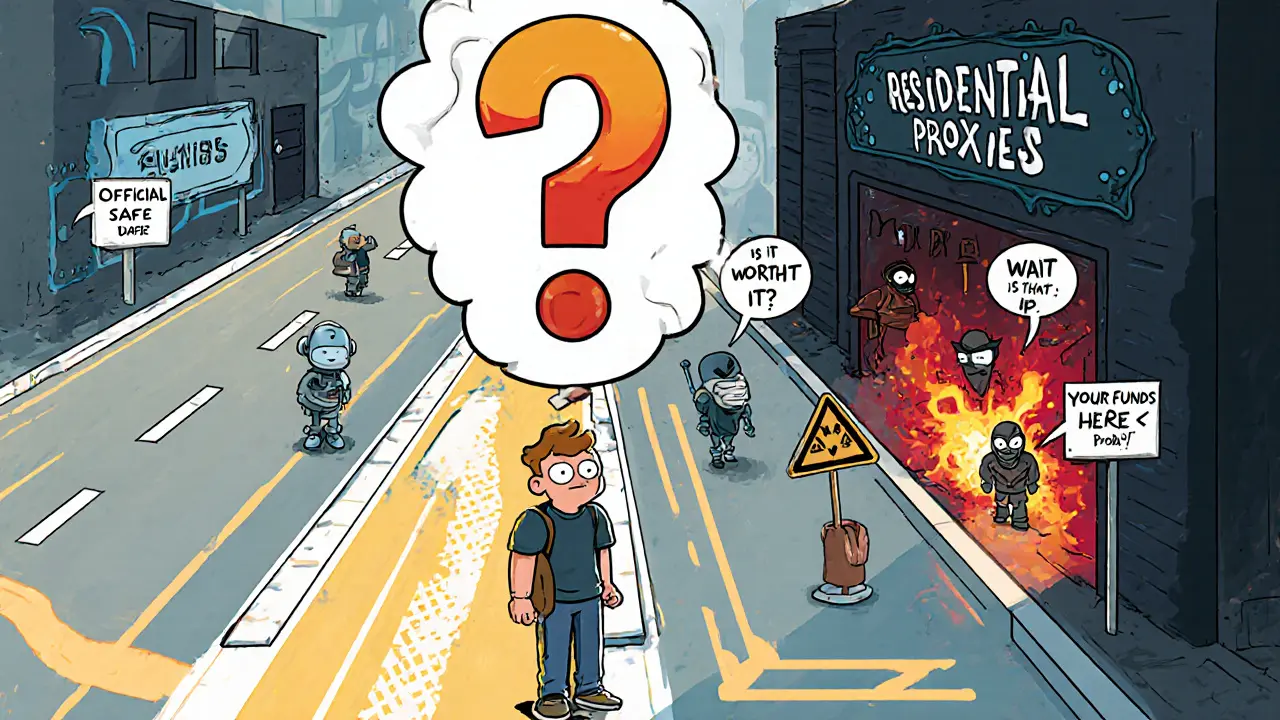

When you're trading cryptocurrency, speed and anonymity matter. A single second can mean the difference between locking in a profit or missing the window entirely. That’s why many traders turn to residential proxies-tools that make your internet traffic look like it’s coming from a real home user’s device, not a server farm. But while these proxies can help you run multiple accounts, avoid bans, and automate trades, they’re also a favorite tool for fraudsters. Understanding both the power and the danger of residential proxies is critical if you want to trade safely and legally.

How Residential Proxies Work in Crypto Trading

Residential proxies route your connection through real IP addresses assigned to ordinary households-think someone’s Wi-Fi in Chicago, Tokyo, or Berlin. Unlike datacenter proxies, which come from known server clusters and are easy for exchanges to flag, residential IPs look completely normal. This makes them far harder to block. For crypto traders, this means you can run multiple trading bots or manage several exchange accounts from one computer without triggering anti-bot systems. Platforms like Binance, Kraken, and Coinbase have systems that detect suspicious patterns: rapid logins, repeated trades from the same IP, or multiple wallets created in minutes. Residential proxies bypass this by making each action appear to come from a different person in a different location. Most residential proxy services offer two modes: sticky sessions and rotating sessions. Sticky sessions keep the same IP for up to 30 minutes, which is useful for completing a series of trades without interruption. Rotating sessions change the IP with every request, helping you avoid detection when creating new accounts or scraping price data across exchanges. The best services offer high-speed connections with low ping times, which is non-negotiable in a market where prices move in milliseconds.Why Traders Use Them: Legitimate Use Cases

Not everyone using residential proxies is breaking the rules. Many professional traders rely on them for legitimate reasons. Arbitrage trading-buying a coin on one exchange at a lower price and selling it on another for a profit-requires speed and multiple accounts. Without residential proxies, your bot might get banned after a few automated trades. With them, you can monitor dozens of markets simultaneously, execute trades in real time, and avoid being flagged as a bot. Some traders use proxies to access region-restricted features. Certain exchanges limit staking, lending, or margin trading based on geography. A residential proxy lets you appear to be in a country where those features are available, without needing to move or open a local bank account. Privacy is another big draw. Your IP address can reveal your location, ISP, and even your home address in some cases. By masking it, you reduce the risk of being targeted by hackers who scan for active crypto wallets linked to specific IPs. For traders who handle large sums, this layer of obscurity is valuable.The Dark Side: How Criminals Abuse Residential Proxies

The same features that help honest traders also make residential proxies a nightmare for regulators and exchanges. In 2022, Forbes analyzed trading data from 157 cryptocurrency exchanges and found that over half of daily Bitcoin trading volume likely involved fraud. A major enabler? Residential proxies. Criminals use them to run wash trading schemes-buying and selling assets to themselves to fake demand and manipulate prices. They also use them to create hundreds of fake accounts to pump and dump coins, then vanish before anyone notices. Cybercriminals also use these proxies to bypass bank fraud systems. Stolen credit cards are used to buy crypto on exchanges that don’t require strict KYC. The proxy makes the transaction look like it’s coming from a real person in a real home, tricking payment processors into approving the purchase. Once the crypto is bought, it’s quickly moved to untraceable wallets. This is a key step in money laundering chains that move billions every year. Underground forums are full of ads for residential proxy services specifically marketed to fraudsters. Sellers boast about “bank-proof IPs” and “unblockable exchanges.” The market is growing fast-the global proxy services industry hit $1.8 billion in 2023 and is projected to grow over 13% annually through 2028. Much of that growth comes from crypto-related abuse.

The Risks You Can’t Ignore

Even if you think you’re using residential proxies legally, you’re still playing with fire. Most major exchanges explicitly ban the use of proxies in their Terms of Service. If they detect you’re using one-even for something as simple as managing multiple wallets-you risk account suspension, frozen funds, or permanent bans. There’s no appeal process. Once flagged, your money could be locked indefinitely. Then there’s the risk of using a bad provider. Many proxy services are fronts for malware distributors. Some sell stolen IPs-addresses that were once used by real homes but were hijacked by hackers. If you connect through one of those, you could be unknowingly participating in a criminal network. Worse, your own trading data might be logged and sold. And let’s not forget the legal gray zone. In many countries, using proxies to circumvent geolocation restrictions or hide your identity during financial transactions could be considered fraud or money laundering, even if you’re not stealing anything. Regulators are catching up. By 2025, expect stricter rules around proxy usage in crypto trading, with exchanges required to report suspicious traffic patterns.Real User Experiences: What Traders Actually Say

Reddit and crypto forums are full of mixed reviews. Some users swear by residential proxies: “I run five bots across three exchanges and haven’t been banned in six months.” Others report disaster: “Used a $500/month service. Got flagged anyway. Lost $12,000 in trading funds.” The difference often comes down to setup. Simply buying a proxy isn’t enough. You need to understand session timing, IP rotation speed, and how different exchanges respond to traffic patterns. One trader spent three months testing combinations before finding a setup that worked with Binance without triggering alerts. Others give up after a few failed attempts. There’s also the cost. High-quality residential proxies for serious trading operations cost between $300 and $1,500 per month. That’s on top of exchange fees, bot subscriptions, and market analysis tools. For most retail traders, the expense isn’t worth the risk.

Alternatives to Residential Proxies

Before you spend thousands on proxies, consider safer alternatives. If you need multiple accounts, use different devices or virtual machines with unique browser fingerprints. Tools like Multilogin or Incogniton let you create isolated browser profiles that mimic real users without needing proxy IPs. For arbitrage, use APIs instead of scraping. Most major exchanges offer official APIs that don’t require proxies and are designed for automated trading. They’re faster, more reliable, and fully compliant. If privacy is your goal, use a reputable VPN with a no-logs policy. While not as effective as residential proxies for bypassing account limits, a good VPN still hides your real IP and protects your data from snoopers.Should You Use Residential Proxies for Crypto Trading?

The answer isn’t yes or no-it’s “under what conditions?” If you’re a professional trader running high-volume arbitrage bots, and you’ve done your homework on compliance, legal boundaries, and provider reputation, then residential proxies might be a necessary tool. But you need to treat them like a weapon: powerful, dangerous, and only for experts. For everyone else? The risks far outweigh the benefits. The chance of losing funds to a ban, the possibility of being linked to fraud, and the growing regulatory crackdown make this a high-stakes gamble. Most retail traders would be better off focusing on improving their strategy, using official APIs, and keeping their operations simple and transparent. The crypto market doesn’t need more hidden actors. It needs more trustworthy participants. If you’re serious about trading, your best asset isn’t a proxy-it’s your reputation.Are residential proxies legal for crypto trading?

It depends. Using residential proxies isn’t illegal in most countries, but most cryptocurrency exchanges prohibit them in their Terms of Service. Violating those terms can lead to account bans, frozen funds, or legal action if regulators link your activity to fraud. Even if you’re not stealing money, using proxies to bypass geolocation rules or hide your identity may be considered deceptive under financial regulations.

Can I get banned for using residential proxies?

Yes, and it’s common. Exchanges like Binance, Kraken, and Coinbase actively scan for proxy traffic. Even if your proxy looks legitimate, patterns like rapid logins, multiple wallets from the same device, or unusual trading frequency can trigger automated bans. There’s no warning. Your account can be suspended instantly, and recovering funds is often impossible.

How much do residential proxies cost for crypto trading?

High-quality residential proxies for active crypto trading typically cost between $300 and $1,500 per month. Prices vary based on the number of IPs, rotation speed, and location coverage. Cheaper services under $100/month often use low-quality or stolen IPs, increasing your risk of detection or malware exposure.

Do residential proxies work better than datacenter proxies for crypto?

Yes, for bypassing detection. Datacenter proxies come from known server IPs that exchanges easily flag as bots. Residential proxies use real home internet connections, making them appear as normal users. This gives them much higher success rates for tasks like account creation, multi-login, and automated trading. But they’re slower and more expensive than datacenter options.

Can I use residential proxies to access region-restricted crypto features?

Technically yes, but it violates most exchange policies. Some platforms restrict staking, lending, or trading pairs based on your location. Using a proxy to appear in a permitted country may give you access, but if detected, you risk account termination and loss of funds. It’s not worth the risk unless you fully understand the legal consequences in your jurisdiction.

What’s the biggest risk of using residential proxies for crypto?

The biggest risk is being unknowingly linked to criminal activity. Many residential proxy providers sell hijacked IPs-addresses once used by real homes but taken over by hackers. If you use one of these, your trades could be tied to money laundering, stolen cards, or fraud. Even if you’re innocent, regulators and exchanges may treat you as part of the problem.

Are there safer ways to run multiple crypto accounts?

Yes. Use browser isolation tools like Multilogin or Incogniton to create unique browser profiles with different fingerprints, cookies, and device settings. You can run multiple accounts on the same machine without needing proxies. Combine this with official exchange APIs for automated trading-this approach is compliant, reliable, and far less risky.

Is it worth it for a beginner to use residential proxies?

No. Beginners lack the experience to set up proxies correctly, avoid detection, or recognize malicious providers. The cost is high, the risk is extreme, and the learning curve is steep. Focus on learning the market, using official tools, and building a solid strategy before considering advanced tools like residential proxies.

taliyah trice

Proxies are just a crutch. If you need them to trade, you’re already playing a losing game.