Abandoned Crypto: What Happens to Dead Coins and Failed Exchanges

When a crypto project dies, it doesn’t just fade away—it leaves behind abandoned crypto, digital assets with no team, no liquidity, and no future. These aren’t just low-priced tokens. They’re ghost towns built on blockchain: exchanges that vanished overnight, tokens with zero trading volume, airdrops that never launched, and apps that stopped updating after a single tweet. The crypto space moves fast, but most projects don’t survive the first year. And when they collapse, your wallet doesn’t get a warning—it just shows a $0 balance.

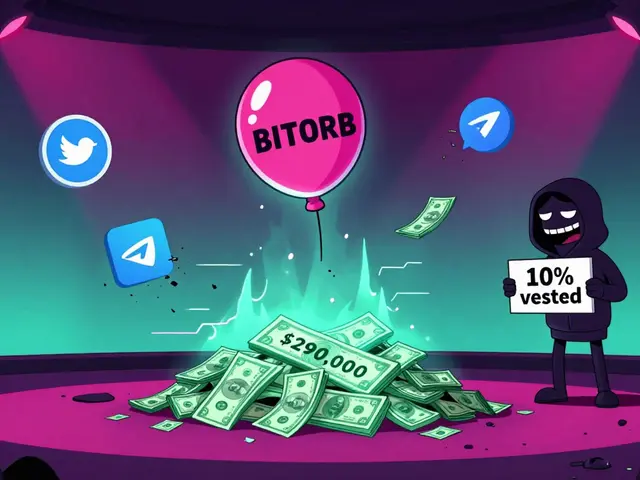

Many failed crypto exchanges, platforms that promised easy trading but vanished without a trace like Koinex, CreekEx, and Woof Finance weren’t just poorly run—they were designed to disappear. They took user funds, disappeared from social media, and left behind confusing names that mimic real ones (like Armoney instead of Harmony). These aren’t accidents. They’re tactics. Scammers rely on people typing fast, trusting similar names, and ignoring red flags like zero trading volume or no KYC. Meanwhile, orphaned tokens, crypto assets with no development, no community, and no exchange listings like TajCoin, QBIT, and METANIA sit on wallets with no way to sell, no roadmap, and no one to ask for help. Some were never meant to be real—they were just bait for hype-driven buyers.

What’s worse? Many of these projects still show up in search results, airdrop lists, and Telegram groups. You’ll see fake price charts, bots pretending to be support, and old Medium posts recycled as “news.” The crypto community has learned to spot these traps, but new users keep falling in. That’s why this collection exists. Below, you’ll find real reviews of dead exchanges, broken airdrops, and tokens that vanished after a single tweet. You’ll learn how to tell the difference between a project that’s paused and one that’s dead for good. No fluff. No guesses. Just facts from people who’ve been burned—and figured out how to avoid it next time.