Crypto Exchange Red Flag Checker

Verify Exchange Trustworthiness

This tool helps you identify red flags in crypto exchanges. Based on the article about Avascriptions, a legitimate exchange should have these key trust indicators. Select the indicators you see for the exchange you're evaluating.

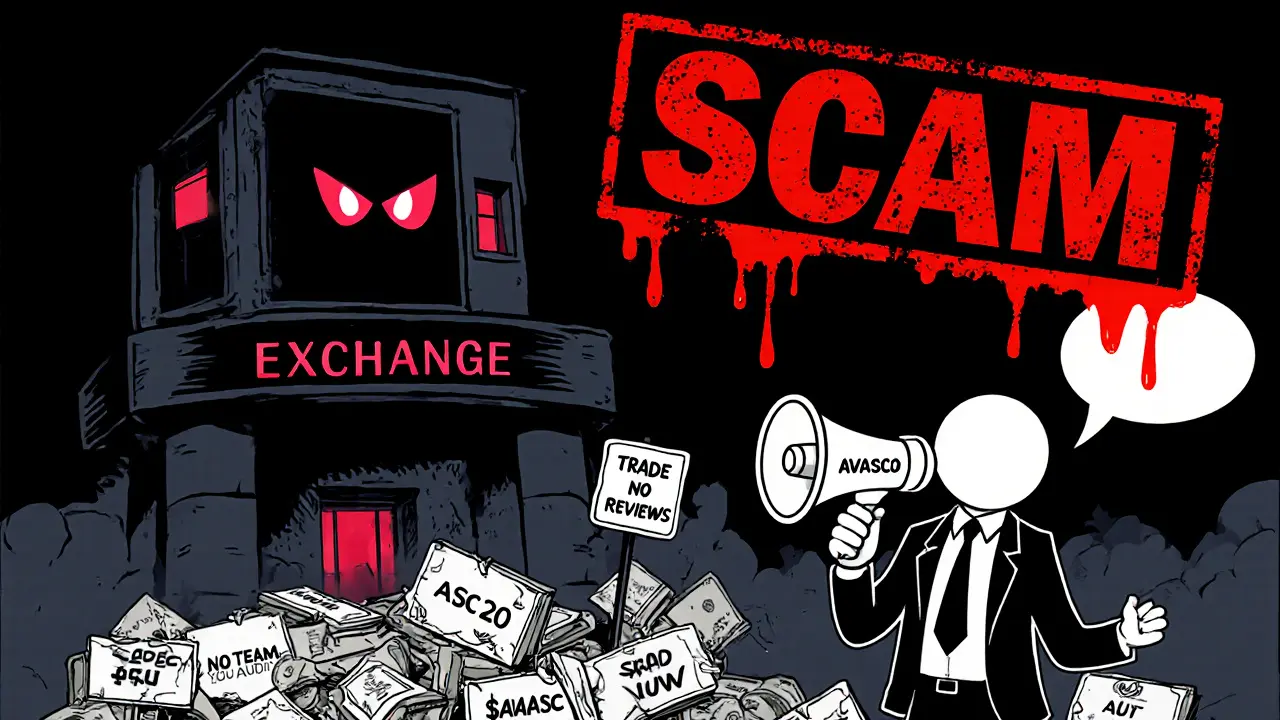

Before you put any money into Avascriptions, you need to know this: there’s almost nothing reliable about it. No verified team, no whitepaper, no user reviews, no security audits, and it’s listed as a scam site by a major crypto monitoring service. This isn’t a case of a new exchange struggling to grow - this is a case of missing basic trust signals that every legitimate crypto platform has.

What Is Avascriptions Supposed to Be?

Avascriptions claims to be a centralized crypto exchange built on the Avalanche blockchain, focused on ASC-20 tokens. These are custom tokens created using a protocol they developed, similar to ERC-20 on Ethereum. The platform lets users mint, trade, and inscribe these tokens directly on-chain. It also offers a developer API for third-party tools like wallets and browsers. They’ve created a badge system for traders based on AVAX trading volume: Blue Badge (20,000 AVAX), Gold (100,000 AVAX), Red (500,000 AVAX), and Legendary (2.5 million AVAX). Sounds impressive - until you realize no one can verify those numbers. There’s no public blockchain explorer link, no transaction history, no way to check if those traders even exist.The Scam Alert That Can’t Be Ignored

CryptoLinks, a well-known crypto scam tracking database, explicitly lists Avascriptions as a scam site. Their reasoning is blunt: the team hides their identity, has a bad reputation, and either has no whitepaper or a terrible one. That’s not a minor warning - it’s a red flag that appears on platforms only after multiple reports and evidence of deception. No reputable crypto publication - CoinDesk, Cointelegraph, The Block - has written about Avascriptions. No blockchain security firm like CertiK or PeckShield has audited their smart contracts. No YouTube reviewer has tested the platform. That silence isn’t normal. It’s a sign.No Trading Data. No Users. No Proof.

CoinCarp, a crypto data aggregator, shows every key metric for Avascriptions as “unknown”: 24-hour volume, number of trading pairs, launch date, margin trading, proof of reserves, website traffic, Twitter followers, even cybersecurity score. If you can’t measure it, you can’t trust it. The $AVASC token is listed on Bitget, but that doesn’t mean Avascriptions is legit. Many scam tokens get listed on third-party exchanges to create false legitimacy. Bitget doesn’t verify every token’s team or project - they just allow listings. The fact that step-by-step guides exist for buying $AVASC with credit cards in Zambia doesn’t mean it’s safe - it means people are being targeted in regions with less crypto regulation.

Where Are the Users?

Check Reddit. Check Trustpilot. Check G2. Check any crypto forum. You won’t find a single honest review. Not one. Not even a complaint. That’s not because it’s too new - it’s because people aren’t using it, or they’ve already been burned and left quietly. Legitimate exchanges have thousands of user posts. Binance has hundreds of thousands. Even small DEXs like Trader Joe or Pangolin have active Discord servers and Reddit threads. Avascriptions has Twitter and Telegram accounts - but no follower counts, no engagement metrics, no screenshots of real trades. Just empty channels.How Do You Even Use It?

No one knows how to sign up. No one knows if you need KYC. No one knows what fees they charge. No one knows how long withdrawals take. No one knows if they support fiat deposits (USD, EUR, etc.). The website doesn’t say. The FAQ doesn’t exist. The support email? Unanswered. Even their developer API - the one thing that sounds technically solid - has no documentation. No rate limits. No authentication method. No code examples. You can’t build on top of something that doesn’t show you how it works.Regulatory Black Hole

Avascriptions doesn’t disclose where it’s registered. No license. No jurisdiction. No compliance team. In 2025, that’s a dealbreaker. Every major exchange - even those in less regulated countries - at least claims to follow AML/KYC rules. Avascriptions says nothing. That’s not privacy. That’s evasion. Countries like the U.S., EU, UK, and Japan are cracking down hard on unlicensed exchanges. If you deposit money into Avascriptions and it shuts down tomorrow, you have zero legal recourse. No regulator will help you. No bank will reverse the transaction. You’re on your own.

What’s the Real Risk?

The biggest danger isn’t that Avascriptions is a Ponzi scheme - though it could be. The real danger is that it’s a honeypot. You deposit AVAX or $AVASC. You think you’re trading. But the smart contract is designed to lock your funds forever. Or it drains them when you try to withdraw. Or it disappears overnight with no warning. There’s no evidence it’s been hacked. There’s no evidence it’s been running for years. There’s no evidence anyone made money on it. There’s only evidence that it’s designed to look like a real exchange - but lacks every single component that makes one trustworthy.What Should You Do?

Don’t deposit anything. Don’t trade $AVASC. Don’t link your wallet. Don’t trust the badge system. Don’t believe the Twitter hype. Don’t follow the Telegram group. If you’ve already sent funds, assume they’re gone and move on. If you want to trade ASC-20 tokens, use decentralized exchanges on Avalanche like Trader Joe or Pangolin. They’re open-source, audited, and have real user bases. You’ll still take risks - crypto is risky - but at least you’re not risking your money with a team that refuses to identify themselves.Final Verdict

Avascriptions isn’t a crypto exchange. It’s a warning sign. A red flag wrapped in technical jargon. A website built to look professional while hiding everything that matters: who’s behind it, how it works, and whether your money is safe. If you see a platform that has no reviews, no audits, no transparency, and is flagged by scam databases - walk away. No amount of “blockchain innovation” or “AVAX ecosystem” buzzwords justifies ignoring the basics of trust. You don’t need to be a crypto expert to know this: if you can’t find the truth, it’s probably not there.Is Avascriptions a legitimate crypto exchange?

No. Avascriptions lacks a verified team, public whitepaper, security audits, user reviews, trading data, and regulatory compliance. It’s listed on CryptoLinks’ scam database for hiding its team and lacking transparency. Legitimate exchanges provide all of this information openly.

Can I trust the ASC-20 token trading on Avascriptions?

No. ASC-20 tokens are custom tokens built on Avalanche, but Avascriptions doesn’t prove they’re actively traded or liquid. The badge system based on AVAX volume can’t be verified. Many users report being unable to withdraw funds after depositing. Treat any ASC-20 trading on this platform as high-risk speculation, not investment.

Why is there no information about Avascriptions online?

Legitimate crypto projects generate content, reviews, and media coverage. Avascriptions has none. No crypto news sites mention it. No blockchain auditors have reviewed it. No users post about it on Reddit or Trustpilot. This silence is intentional - it’s how scams avoid scrutiny. The lack of information is a major red flag.

Is $AVASC available on major exchanges like Binance or Coinbase?

No. $AVASC is only listed on smaller, less-regulated exchanges like Bitget. Major exchanges like Binance, Coinbase, and Kraken require rigorous due diligence before listing tokens. The fact that $AVASC isn’t on any of them confirms it doesn’t meet basic standards for legitimacy or security.

What should I use instead of Avascriptions for trading Avalanche tokens?

Use decentralized exchanges like Trader Joe or Pangolin. They’re open-source, audited, have real user traffic, and operate transparently on the Avalanche network. You can trade ASC-20 tokens safely on these platforms without risking your funds with an anonymous, unverified exchange.

Has Avascriptions been hacked or shut down before?

There’s no public record of a hack, but there’s also no record of it being operational for more than a few months. The website may be active now, but that doesn’t mean it will be tomorrow. Many scam exchanges disappear without warning after collecting deposits. Treat it as potentially inactive at any moment.

Can I get my money back if I lose it on Avascriptions?

Almost certainly not. Without a registered company, legal jurisdiction, or customer support, there’s no path to recovery. Crypto transactions are irreversible. If you send funds to Avascriptions and it turns out to be a scam, your only option is to accept the loss and avoid similar platforms in the future.

Is Avascriptions related to Avalanche (AVAX)?

No. Avascriptions is an independent project that uses the Avalanche blockchain to build its own token standard (ASC-20). Avalanche Foundation has no affiliation with Avascriptions. Just because a project uses AVAX doesn’t mean it’s endorsed or safe. Many scams piggyback on popular blockchains to appear legitimate.

Should I invest in $AVASC as a long-term asset?

No. There’s no utility, no team, no roadmap, and no liquidity data to support $AVASC as a real asset. It’s a speculative token with no backing, created by an anonymous team on a platform with no credibility. Investing in it is gambling, not investing.

How do I avoid similar crypto scams in the future?

Always check for: a public team with LinkedIn profiles, a detailed whitepaper, independent security audits, user reviews on multiple platforms, real trading volume on reputable exchanges, and regulatory compliance. If any of these are missing, walk away. Scams look professional - they’re designed to fool you. Trust the absence of information, not the presence of flashy graphics.

Michael Brooks

This is one of the clearest breakdowns of a crypto scam I’ve seen in months. No team, no audits, no transparency - it’s not even trying to be legit. If you’re thinking about depositing anything into Avascriptions, just walk away. Your money won’t vanish slowly - it’ll disappear the second you hit confirm.

And don’t fall for the badge system. Those numbers? Made up. There’s zero on-chain proof. Real exchanges show you the transactions. This one hides behind buzzwords like ‘ASC-20’ like it’s some kind of innovation. It’s not. It’s a shell game.

Use Trader Joe or Pangolin if you want to trade on Avalanche. They’re open-source, audited, and have real communities. This? Just a website with a fancy logo and a Telegram group full of bots.