Bitcoin Mining in Iran: Rules, Risks, and Realities in 2025

When you think of Bitcoin mining, the process of validating Bitcoin transactions and adding them to the blockchain using powerful computers. It's not just about electricity and hardware—it's about where you can do it legally, cheaply, and safely. In Iran, this process is happening at massive scale, even as global regulators crack down. The country has become one of the top five Bitcoin mining hubs on Earth, not because of tech innovation, but because of one thing: dirt-cheap electricity.

Iran’s government doesn’t ban mining—it regulates it, a system where miners must register, pay fees, and use state-approved power allocations. Unlike Venezuela’s forced state pools, Iran lets individuals mine, but only if they stay under a monthly power quota. Go over that limit? Your equipment can be seized. The rules are messy, inconsistently enforced, and change fast. And while the government claims it wants to control energy use, it also quietly profits from mining taxes and export fees on mining gear. This isn’t some underground operation—it’s a hybrid of legal gray zones and state-tolerated activity. Many miners use subsidized residential power, while others lease industrial units with bulk rates. Either way, the real challenge isn’t the tech—it’s keeping the lights on when sanctions hit and power cuts hit harder.

Crypto mining hardware, specialized machines like ASIC miners designed for Bitcoin’s proof-of-work algorithm. These rigs are expensive, noisy, and burn through power. In Iran, you’ll find them in basements, warehouses, and even rural homes. Miners often import gear through unofficial channels because official imports are slow or blocked. The most common machines? Antminer S19s and WhatsMiner M30s—tools that work everywhere, but only thrive where electricity costs less than a penny per kilowatt-hour. That’s why Iran beats the U.S., Germany, or Canada in mining efficiency. But here’s the catch: those same miners face constant risk. Power blackouts last for days. Banks freeze transactions. Foreign exchange controls make it hard to cash out profits. And if you’re caught using grid power meant for homes, you could face fines—or worse.

What’s surprising isn’t that Iran mines Bitcoin—it’s how many people do it. Thousands of small operators, not just big farms. Families run rigs in their garages. Young engineers repurpose old computers. It’s a grassroots economy built on desperation and opportunity. And while global crypto news focuses on ETFs and regulations, Iran’s miners are quietly shaping the real-world supply of Bitcoin—using power no one else can afford.

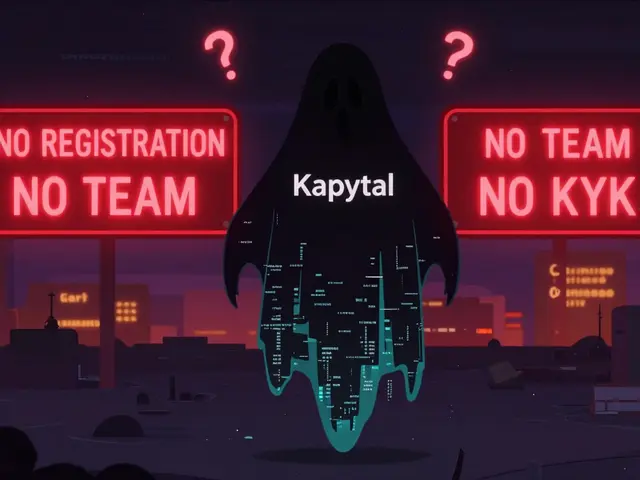

Below, you’ll find real reviews, warnings, and breakdowns from people who’ve been there. Some posts expose scams pretending to sell mining gear in Iran. Others show how locals bypass restrictions with VPNs and local exchanges. A few even detail how the government tracks miners through electricity meters. This isn’t theory. It’s what’s happening right now—in basements, warehouses, and living rooms across the country.