Crypto Trading Nigeria: How to Trade Safely and Avoid Scams

When it comes to crypto trading Nigeria, the practice of buying, selling, and holding digital currencies by individuals and businesses in Nigeria. Also known as Nigerian cryptocurrency trading, it’s become one of the most active retail markets in Africa—despite government pushback and banking restrictions. Over 30% of Nigerian adults have traded or owned crypto, according to local surveys, making it one of the highest adoption rates globally. But high demand doesn’t mean high safety. Many traders lose money not because prices dropped, but because they used fake exchanges, got phished, or didn’t understand local rules.

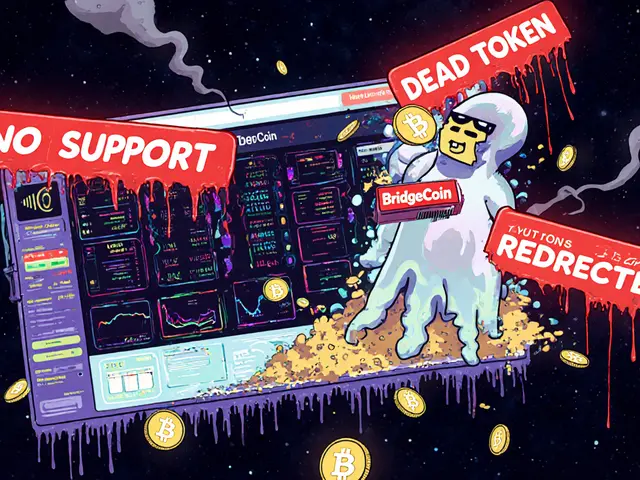

Nigerian crypto exchanges, platforms that allow Nigerians to buy and sell Bitcoin, USDT, and other tokens using Naira. Also known as Naira-to-crypto gateways, they’re often peer-to-peer (P2P) based because banks block direct deposits from major platforms like Binance and Coinbase. Platforms like Paxful, Binance P2P, and Luno are popular, but many others are outright scams. You’ll see ads for "10x returns in 24 hours" or "Nigeria’s #1 exchange"—but if there’s no public trading volume, no customer support, and no verifiable team, it’s a trap. The Central Bank of Nigeria doesn’t license crypto exchanges, so any claim of "official approval" is false. That’s why traders rely on community reviews, Telegram groups, and wallet history checks before sending funds.

Crypto scams Nigeria, fraudulent schemes targeting crypto users through fake platforms, impersonated support teams, or rigged airdrops. Also known as Nigerian crypto fraud, they’ve grown into a multi-million dollar industry. From fake exchanges like CreekEx and Woof Finance to fake airdrops promising free tokens that steal your private keys, the tactics are always the same: urgency, secrecy, and too-good-to-be-true rewards. Many of the posts below expose these exact scams—like Armoney, which isn’t a real exchange, or DSG token, which has zero trading volume but still tricks people into depositing funds. Even legitimate tools like VPNs, used to bypass bank blocks, can be misused by scammers to hide their operations.

Regulations are messy. The Nigerian government doesn’t ban crypto outright—it bans banks from facilitating it. That’s why P2P trading dominates. You can legally own Bitcoin, but you can’t easily convert Naira to USDT through your bank. And while some traders use residential proxies to avoid IP bans, those same tools are used by fraudsters to run bot farms and fake trading volumes. It’s a double-edged sword.

What you’ll find here isn’t theory. These are real stories from Nigerian traders who lost money, figured out how to recover, or avoided disaster by spotting red flags early. You’ll learn which exchanges actually work, how to verify a platform before depositing, why most "free token" offers are lies, and what to do if your funds get frozen. This isn’t about getting rich overnight. It’s about staying safe in a market built on trust—and where trust is often the first thing scammers steal.