Solo Mining vs Pool Mining: Which Is Right for You in 2025?

Solo mining offers big rewards but extreme risk; pool mining gives steady income with low effort. Learn which method suits your hardware, budget, and goals in 2025.

When you hear cryptocurrency mining, the process of validating blockchain transactions and adding them to the public ledger in exchange for new coins. Also known as blockchain mining, it’s the original engine behind Bitcoin and still runs major networks like Litecoin and Bitcoin Cash. But mining today isn’t just people running old GPUs in their basements—it’s a global industry shaped by electricity costs, government rules, and hardware wars.

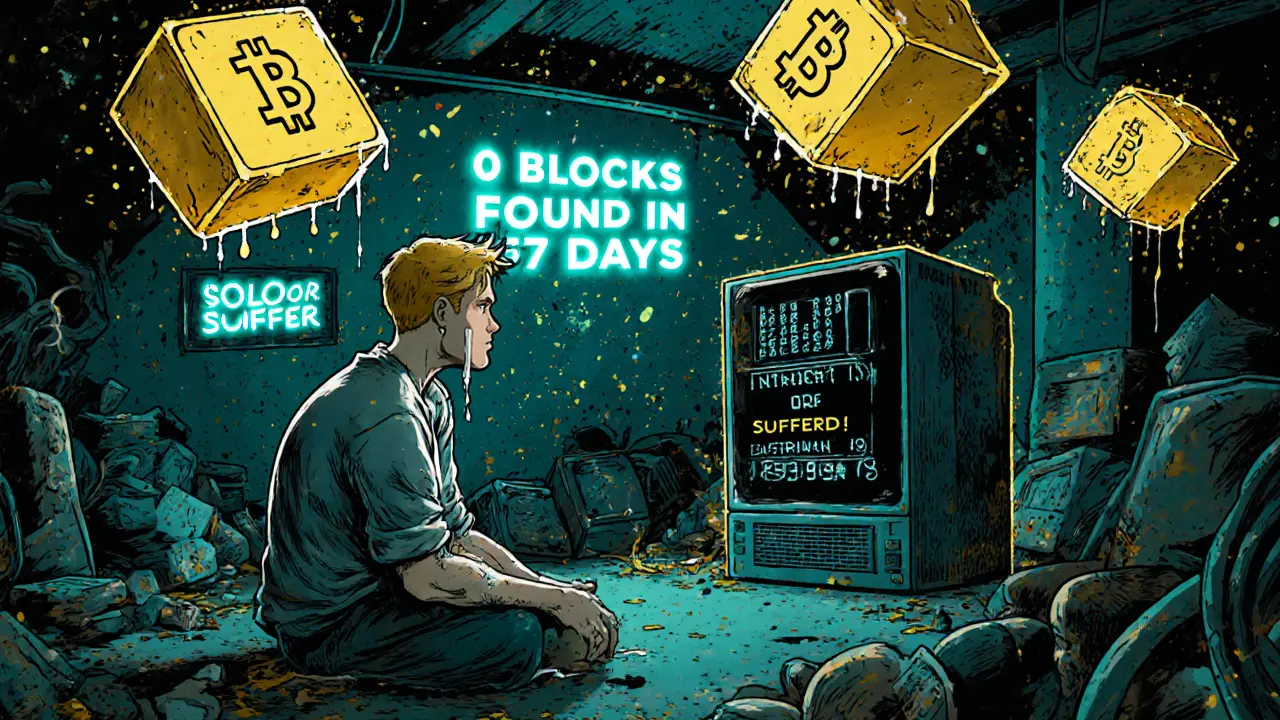

Mining pools, groups of miners who combine computing power to increase their chances of earning rewards dominate the scene now. Solo mining? Almost extinct. If you’re not joining a pool, you’re probably wasting time and electricity. And the hardware? ASICs—specialized machines built for one job—have replaced graphics cards. A single ASIC can outwork a room full of GPUs, but they cost thousands, run hot, and need serious power. That’s why mining shifted to places like Kazakhstan, Georgia, and parts of the U.S. where electricity is cheap and regulations are loose. But not everywhere. In Venezuela, a country where the government forces miners into state-controlled pools and demands licenses, you’re not just competing with machines—you’re fighting bureaucracy. And in places like China, mining got banned outright in 2021, forcing thousands of rigs to relocate overnight.

Proof of work, the system that makes mining possible, is under pressure. Ethereum ditched it in 2022. More coins might follow. But Bitcoin? It’s locked in. Its network hash rate hit record highs in 2024, proving that even with rising energy costs and regulatory crackdowns, the network keeps growing. That’s why mining still matters—not because it’s easy, but because it’s the only way new Bitcoin enters circulation. Without miners, the chain stops. No blocks. No transactions. No Bitcoin.

So what’s left for regular people? Not much, unless you’ve got access to cheap power or a way to rent hashing power. Most of the posts below expose fake mining schemes, shady hardware sellers, and governments trying to control who mines and where. You’ll find reviews of platforms that claim to offer "cloud mining"—but are just scams. You’ll see how Nigeria, India, and Vietnam handle mining under new laws. And you’ll learn why some "mining" projects aren’t mining at all—they’re just token sales with buzzwords.

If you’re thinking about getting into mining, ask yourself: Do I have access to power under $0.05 per kWh? Do I understand the heat, noise, and maintenance? Am I ready to lose money for a year just to break even? If not, you’re better off buying Bitcoin directly. But if you’re curious about how the system really works—why some countries thrive, others ban it, and why your old GPU won’t cut it anymore—what follows is a real-world look at who’s still mining, where, and what’s left to learn.

9 October

Solo mining offers big rewards but extreme risk; pool mining gives steady income with low effort. Learn which method suits your hardware, budget, and goals in 2025.