Cryptocurrency Trading Indonesia: What Works, What Doesn’t, and Where to Trade Safely

When it comes to cryptocurrency trading Indonesia, the practice of buying, selling, and holding digital assets by residents of Indonesia. Also known as crypto trading in Indonesia, it’s grown fast — but the rules are messy, the platforms are mixed, and scams are everywhere. Unlike countries with clear crypto laws, Indonesia’s stance has been a back-and-forth dance. The central bank, Bank Indonesia, doesn’t recognize crypto as legal tender — but it also doesn’t ban it. That gray zone is why millions of Indonesians trade anyway, using local exchanges, peer-to-peer apps, and sometimes VPNs to access global platforms like Binance.

Crypto exchange Indonesia, platforms licensed or used locally to trade digital assets. Also known as Indonesian crypto platforms, they’re the backbone of retail trading here. Exchanges like Pintu, Tokocrypto, and Indodax dominate because they support IDR deposits, have Bahasa Indonesia interfaces, and follow local KYC rules. But many traders also use global platforms — and that’s where things get risky. Some platforms pretend to be Indonesian but aren’t regulated at all. Others, like CreekEx or Woof Finance, are outright scams designed to drain your wallet. You can’t trust a site just because it has an Indonesian name or uses rupiah. The real question isn’t whether you can trade — it’s whether you’re trading on a platform that won’t vanish overnight. That’s why locals rely on community reviews, Telegram groups, and word-of-mouth more than official websites.

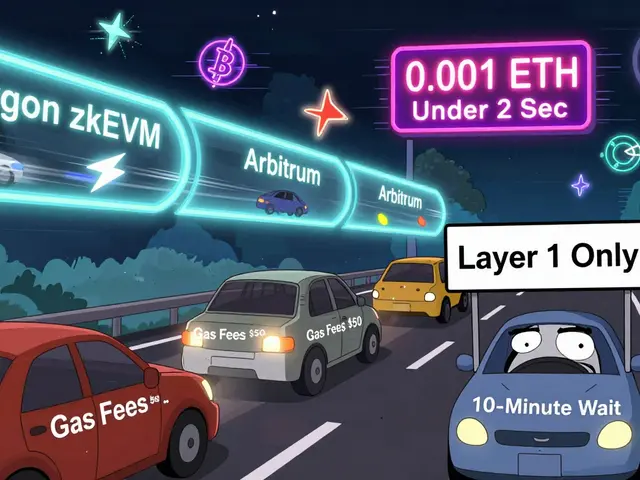

Crypto regulations Indonesia, the patchwork of rules from Bappebti and Bank Indonesia that shape how crypto can be used. Also known as Indonesian crypto laws, these rules changed in 2020 when Bappebti started licensing crypto asset trading platforms. Today, only about 10 exchanges are officially registered. But here’s the catch: registration doesn’t mean safety. It just means they’re allowed to operate under certain conditions. Many licensed exchanges still have weak security, slow withdrawals, or hidden fees. And if you’re using a P2P platform to buy Bitcoin with bank transfer, you’re not protected by any law if the seller disappears. That’s why smart traders keep small amounts on exchanges and store the rest in cold wallets. Meanwhile, Bitcoin Indonesia, the most popular crypto asset among Indonesian retail traders. Also known as BTC in Indonesia, it’s the default entry point for most new users — not because it’s the best investment, but because it’s the most recognized. People buy BTC to hedge against inflation, send money overseas, or just to join the trend. But they rarely understand how wallets work, how to secure private keys, or what happens if they lose their phone. That’s why so many lose funds to phishing sites or fake apps.

What you’ll find in the posts below isn’t a list of top exchanges or hype-filled price predictions. It’s real talk from people who’ve been burned, figured things out, or avoided disaster by asking the right questions. You’ll see how Nigerian traders deal with restrictions — and how similar issues show up in Indonesia. You’ll learn why Koinex failed in India and how that mirrors the fate of unregulated platforms here. You’ll find out which Indonesian traders use VPNs to access global tools, and which ones stick to local apps because they’re safer. There’s no magic formula. But there are patterns. And if you know what to look for, you can trade smarter — and safer — in Indonesia’s wild crypto landscape.