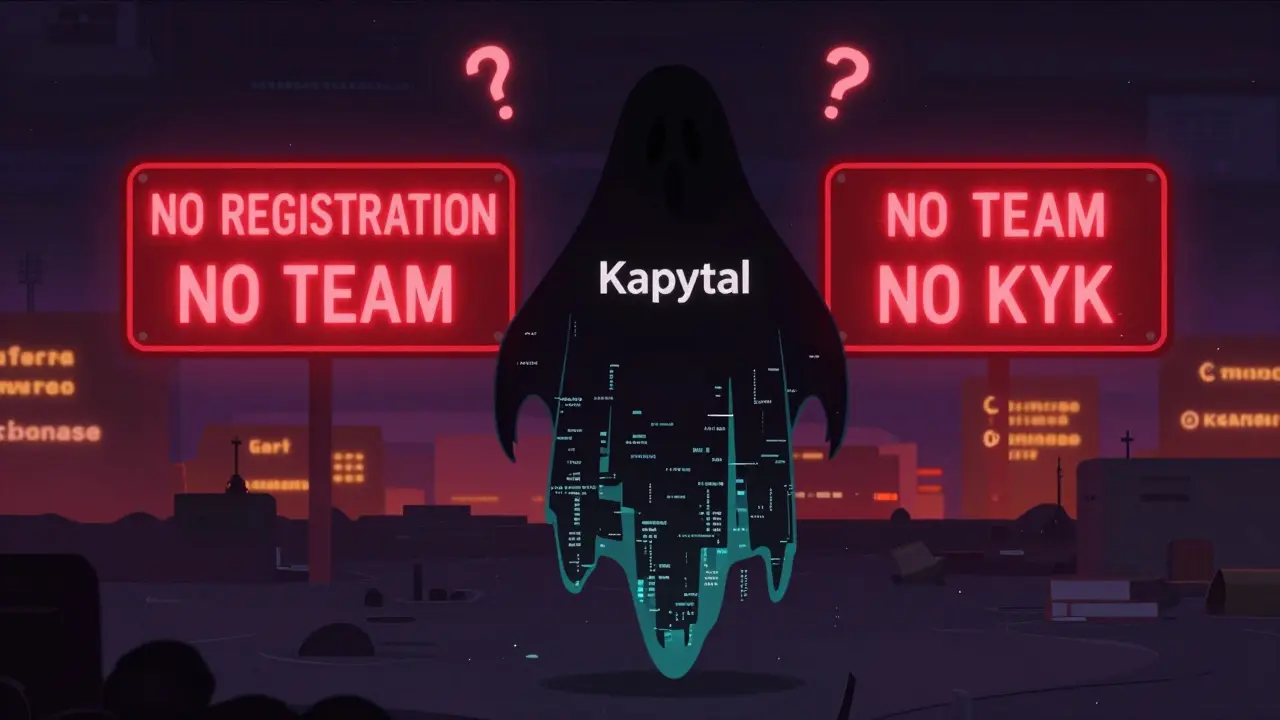

There’s no verified information about a crypto exchange called Kapytal. Not on its official website. Not on CoinMarketCap, CoinGecko, or any major crypto news outlet like CoinDesk or The Block. Not even in regulatory filings from the SEC, FCA, or CySEC. If you’re seeing ads, social media posts, or YouTube videos promoting Kapytal as a new crypto exchange, be careful. This isn’t a case of a startup flying under the radar-it’s a case of a missing footprint.

Where is Kapytal? The Digital Ghost

A legitimate crypto exchange doesn’t vanish from public records. It has a domain, a team, a history, and regulatory compliance. Kapytal has none of these. A quick WHOIS lookup for kapytal.com shows a domain registered through a privacy service, with no physical address, no contact email, and no traceable company registration. That’s not normal. Even small, new exchanges like Bitget or Bybit had public teams and clear regulatory paths before they gained traction.Compare that to KuCoin. It launched in 2017, published its founding team, and later obtained licenses in multiple jurisdictions. Or Kraken-registered with FinCEN, audited by Deloitte, and listed on major crypto indexes. Kapytal doesn’t even have a Wikipedia page, a LinkedIn profile, or a single verified tweet from an employee. That’s not stealth. That’s suspicion.

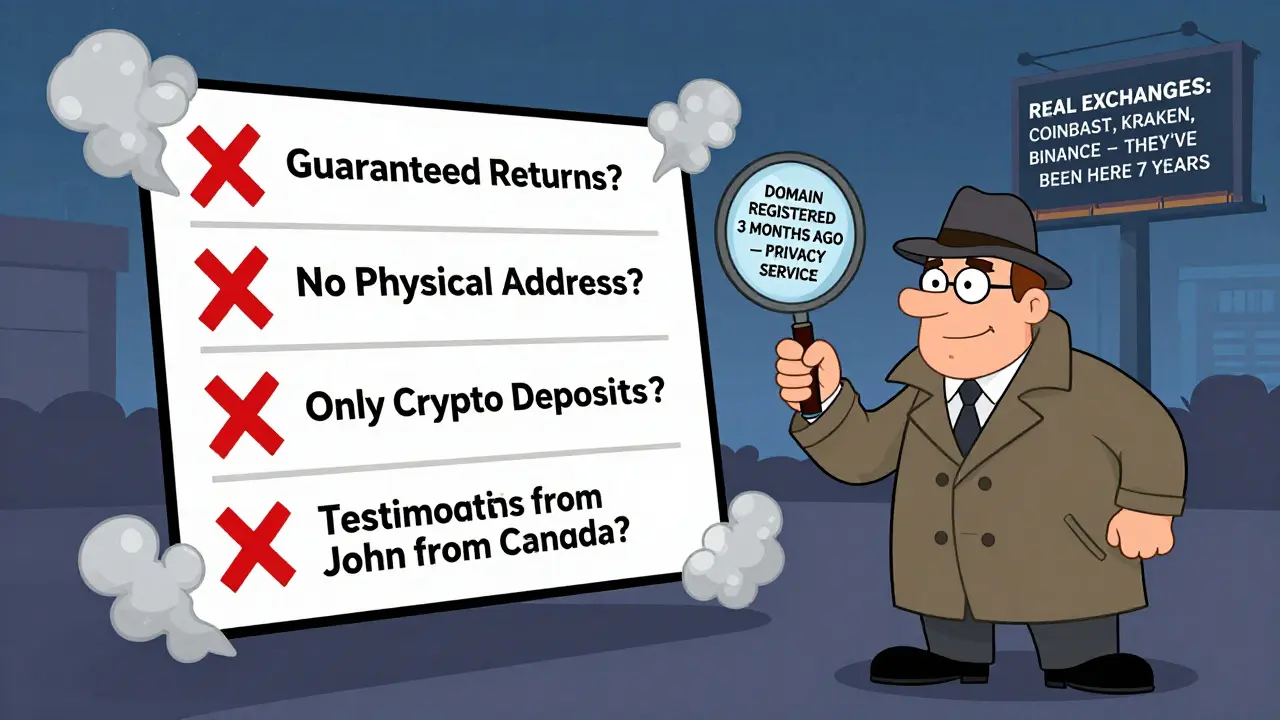

Red Flags You Can’t Ignore

If you’re being pushed to sign up for Kapytal, watch for these patterns:- Guaranteed returns - “Earn 15% daily with Kapytal!” That’s not trading. That’s a Ponzi scheme talking.

- No KYC - Legit exchanges require identity verification. If Kapytal says you can trade without ID, they’re avoiding regulators-and your money.

- Only crypto deposits - No bank transfers, no PayPal, no credit cards. Just Bitcoin or USDT? That’s how scams hide.

- Copy-pasted website - Check the site’s design. If it looks like a template from ThemeForest with stock photos of smiling people holding phones, it’s fake.

- Testimonials from “John from Canada” - Real users leave detailed reviews with wallet addresses and trade screenshots. Fake ones say, “I made $50,000 in 3 days!” with no proof.

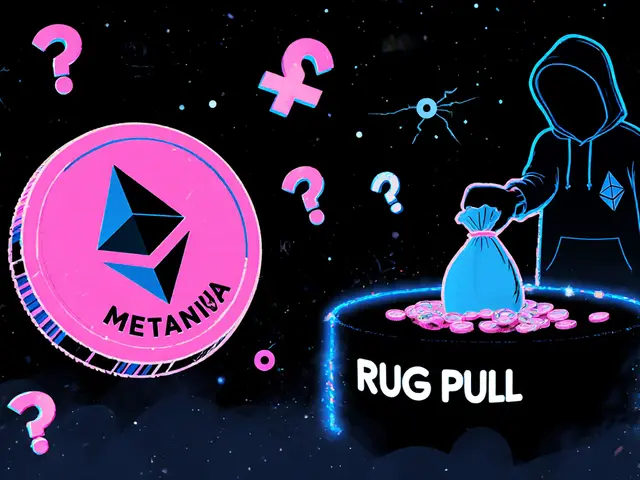

These aren’t just warnings. They’re textbook signs of a rug pull waiting to happen.

What Happens When You Deposit

Let’s say you ignore the red flags and send $1,000 in USDT to Kapytal. What’s next?You’ll see your balance update instantly. The interface looks clean. The charts work. You even make a small trade. Everything feels real. That’s the trap.

Then you try to withdraw. The system says “processing.” Then “under review.” Then “compliance check pending.” Days pass. You email support. No reply. You call the number on their site-it’s disconnected. Your funds? Gone. Not locked. Not frozen. Gone. The servers shut down. The domain disappears. The social media accounts vanish.

This isn’t hypothetical. In 2024, the FBI seized over $120 million from fake crypto platforms. One of them, called “BitFuryX,” looked almost identical to what Kapytal is selling now. Same UI, same promises, same silence after deposits.

Real Alternatives You Can Trust

If you want to trade crypto safely, here are platforms with real track records:| Name | Regulated In | Supported Coins | Fees (Spot Trading) | Withdrawal Speed |

|---|---|---|---|---|

| Coinbase A U.S.-based exchange with SEC registration and FDIC insurance on fiat balances | USA, EU, UK | 200+ | 0.5% - 1.5% | 1-3 business days |

| Kraken One of the oldest exchanges, audited since 2015, and compliant with global AML standards | USA, Canada, EU, Japan | 250+ | 0.16% - 0.26% | Under 1 hour |

| Binance Largest global exchange by volume, with regional entities in Singapore and Dubai | Singapore, Dubai, Malta | 500+ | 0.1% | Under 30 minutes |

| Bitstamp Established in 2011, regulated by Luxembourg’s CSSF | EU | 70+ | 0.1% - 0.25% | 1-2 hours |

All of these exchanges have been around for years. They publish annual audits. They report to financial authorities. And they’ve survived multiple crypto winters. That’s what you’re looking for-not a name you just heard on TikTok.

How to Spot a Fake Exchange Before You Lose Money

Here’s a simple checklist to use before signing up for any new platform:- Search the name + “scam” on Google. If you see multiple Reddit threads or YouTube exposés, walk away.

- Check if the domain was registered less than 6 months ago. Use whois.domaintools.com.

- Look for a physical address. Type it into Google Maps. If it’s a warehouse, a virtual office, or a residential home, it’s not legit.

- Verify if they’re registered with any financial regulator. For example, search “SEC registered crypto exchange” or “FCA authorized crypto firm.”

- Try to find a real person on LinkedIn who works there. No names? No team? No trust.

- Test withdrawal with $10 first. If they delay, excuse, or disappear-you’ve got your answer.

These steps take 10 minutes. Losing your life savings takes 10 seconds.

Why This Keeps Happening

Crypto scams thrive because they exploit hope. People see others making quick money. They think, “If I just get in early, I’ll be next.” But the market doesn’t reward luck. It rewards due diligence.Scammers don’t need to fool everyone. Just enough. One viral ad, one influencer post, one fake testimonial-and they’re off to the races. By the time victims realize they’ve been scammed, the money’s already moved through mixers, converted to Monero, and vanished into offshore wallets.

The real winners? The people who waited. Who learned. Who stuck with platforms that have been tested by time and regulation.

Final Verdict: Avoid Kapytal

Kapytal isn’t a crypto exchange. It’s a warning sign. There’s no evidence it exists as a real business. Everything about it points to a scam designed to take your money and disappear.If you’re new to crypto, start with Coinbase or Kraken. Learn how trading works. Understand wallets, private keys, and cold storage. Don’t chase hype. Don’t trust anonymous platforms with glowing reviews. The safest crypto investment you can make right now is your own time and caution.

There will always be another Kapytal. But there’s only one you. Protect it.

Is Kapytal a real crypto exchange?

No, Kapytal is not a real crypto exchange. There is no verifiable evidence that it exists as a registered, operational platform. No regulatory filings, no official team, no domain history, and no presence on trusted crypto directories like CoinMarketCap or CoinGecko. All signs point to it being a scam.

Can I trust Kapytal with my crypto?

Absolutely not. If you deposit any cryptocurrency into Kapytal, you will likely lose it. Scam exchanges often let you see fake balances and even make small trades to build trust. But when you try to withdraw, they’ll delay, demand more fees, or vanish entirely. There is no customer support, no recourse, and no recovery.

Why do people fall for Kapytal?

People fall for Kapytal because it looks professional. It uses real-looking charts, fake testimonials, and influencer promotions. It preys on the fear of missing out-especially when crypto prices are rising. Scammers know that emotion overrides logic. That’s why they avoid transparency and push urgency: “Sign up now before it’s too late!”

What should I do if I already sent money to Kapytal?

If you’ve already sent crypto to Kapytal, act fast. Stop all communication. Do not send more money to “unlock” your funds-that’s a common follow-up scam. Report the incident to your local financial crime unit and file a report with IC3.gov (the FBI’s Internet Crime Complaint Center). Unfortunately, crypto transactions are irreversible, so recovery is unlikely. Your next step is to learn how to avoid this in the future.

Are there any legitimate exchanges similar to Kapytal?

There are no legitimate exchanges named Kapytal. But there are many trustworthy alternatives like Coinbase, Kraken, and Binance. These platforms are regulated, audited, and have been operating for years. They don’t promise unrealistic returns. They focus on security, transparency, and user protection-exactly what you need.

Callan Burdett

Bro, I saw this Kapytal ad on TikTok yesterday and thought it was legit until I did a quick search. Now I’m just mad I almost sent $500. These scams are getting scarily good at mimicking real platforms. The UI looked like a premium version of Binance. I almost fell for it. Lesson learned: if it’s too shiny, it’s probably fake.