Spot Trading: What It Is, How It Works, and Where to Do It Right

When you buy spot trading, the immediate purchase or sale of a cryptocurrency at its current market price. Also known as cash trading, it’s the most straightforward way to own crypto—no leverage, no expiry, no complexity. You see Bitcoin at $60,000, you click buy, and it’s yours. No waiting. No contracts. Just real coins in your wallet. This is how most people start—and how smart traders stay grounded.

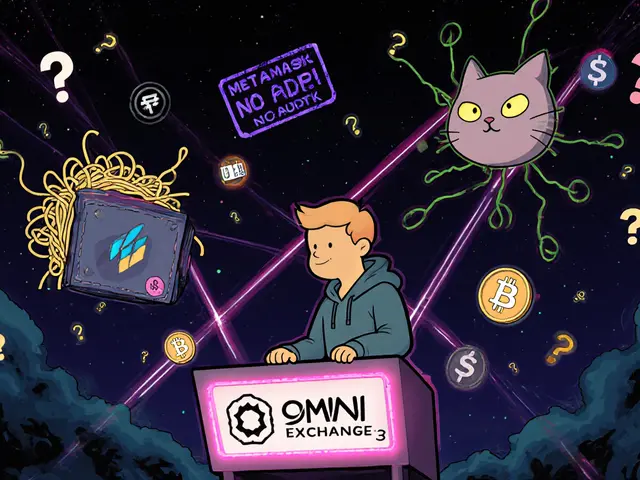

Spot trading works on crypto exchanges, platforms where buyers and sellers meet to trade digital assets. But not all exchanges are built the same. Some, like decentralized exchanges, peer-to-peer platforms that don’t hold your funds, let you trade directly from your wallet. Others, like Koreadax or MEXC, act as middlemen with faster trades but more rules. The key difference? Control. On a DEX, you’re your own bank. On a centralized exchange, they hold your keys—and your risk.

Spot trading doesn’t require fancy tools. But it does need smart choices. You can’t just hop on Binance or KuCoin and hope for the best. You need to know which platforms are licensed, which have real liquidity, and which are just front ends for scams. That’s why posts here cover real cases: why CreekEx is a fraud, why OpenSwap on Harmony died, and why SushiSwap on Arbitrum Nova has almost no traders. Spot trading only works when the market is alive—and the exchange is real.

It’s not about chasing pumps. It’s about knowing where you can actually buy and hold. If you’re in Nigeria, you need to know which exchanges still work after the 2025 regulatory shuffle. If you’re in Korea, you need a platform that supports local banks. If you’re in Bangladesh, you might need a VPN just to access your account. Spot trading is simple—but the environment around it isn’t.

And don’t confuse spot trading with airdrops or token swaps. Those are giveaways or upgrades. Spot trading is about buying and selling what’s already out there. You’re not waiting for a free token. You’re deciding whether to buy now or wait. That’s the power—and the pressure.

Below, you’ll find real reviews of exchanges that actually work, warnings about fake platforms, and breakdowns of platforms that looked promising but collapsed. You’ll learn what to look for when choosing where to trade, how to avoid scams dressed up as opportunities, and why some DEXs are dead on arrival. This isn’t theory. It’s what’s happening right now—in 2025, on the ground, in real markets.