State-Licensed Mining: What It Means and Where It Actually Happens

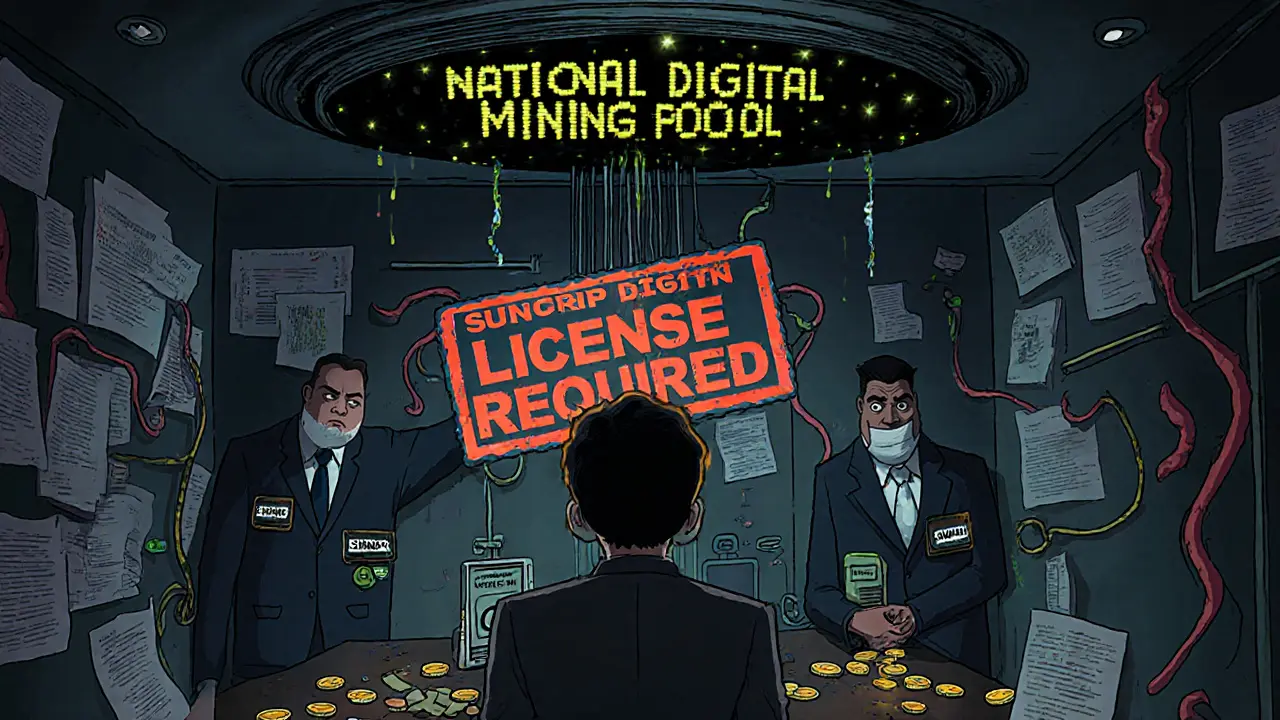

When you hear state-licensed mining, crypto mining operations that have official approval from a government body to operate legally within a country or region. Also known as government-approved mining, it’s not just about having powerful rigs—it’s about having paperwork that says you’re allowed to run them. Most people think if you own a miner, you can plug it in anywhere. But that’s not true. In places like Vietnam, the State Bank of Vietnam legalized crypto as virtual assets in 2025, yet no licensed mining platforms operate because the capital requirements are too high. In Nigeria, crypto trading is legal again, but mining licenses? Still unclear. Meanwhile, South Korea’s COREDAX exchange is regulated, but that’s for trading—not mining. The rules vary wildly, and most miners don’t even know they’re operating in a legal gray zone.

State-licensed mining isn’t just about the government saying yes. It’s tied to crypto mining regulations, the legal framework that defines who can mine, where energy can be sourced, and how taxes are applied. In the UK, HM Treasury brought exchanges under FCA oversight, but mining? Still mostly unregulated at the state level. In Indonesia, trading is legal under OJK rules, but mining energy use is monitored separately. And in the U.S., some states like Texas welcome miners with tax breaks, while others like New York slap moratoriums on proof-of-work mining entirely. This isn’t about technology—it’s about politics, energy policy, and local power structures. If you’re mining without checking local laws, you might be fine today… and fined tomorrow.

Then there’s the mining licenses, official permits issued by authorities that allow entities to legally conduct mining operations, often requiring proof of financial stability, environmental compliance, and tax registration. These aren’t easy to get. In places like Germany or Canada, you need environmental impact reports, utility agreements, and proof you’re not laundering money. In contrast, in countries like Kazakhstan or Russia, licenses exist on paper but are rarely enforced. And in many places—like Vietnam, where the capital barrier for exchanges is $379 million—mining licenses might as well not exist. The truth? Most retail miners never apply for one. They just plug in. But if your country cracks down, you don’t get a warning—you get your gear seized.

What you’ll find in the posts below aren’t theoretical guides. These are real stories from people who ran miners in places where the rules changed overnight. One guy in Bangladesh used a VPN just to access an exchange—then got hit with a mining crackdown. Another in Nigeria thought he was safe until his bank froze his account for ‘crypto-related activity.’ There’s also the case of Koinex in India, which shut down after the RBI ban, even though it wasn’t even a miner—it was an exchange. The line between mining, trading, and banking is blurrier than you think. And if you’re thinking about starting out, you need to know which countries actually issue licenses, which ones pretend to, and which ones don’t care until it’s too late. This isn’t about getting rich fast. It’s about staying out of jail while you mine.

![What is BitTorrent [New] (BTT) Crypto Coin? A Clear Breakdown of How It Works and Why It Matters](/uploads/2026/02/thumbnail-what-is-bittorrent-new-btt-crypto-coin-a-clear-breakdown-of-how-it-works-and-why-it-matters.webp)