Crypto Project Validator

Validate Your Crypto Project

Check if a crypto project meets industry standards for legitimacy using the criteria from the article. Projects meeting all 5 criteria are legitimate; those failing 3+ are high-risk.

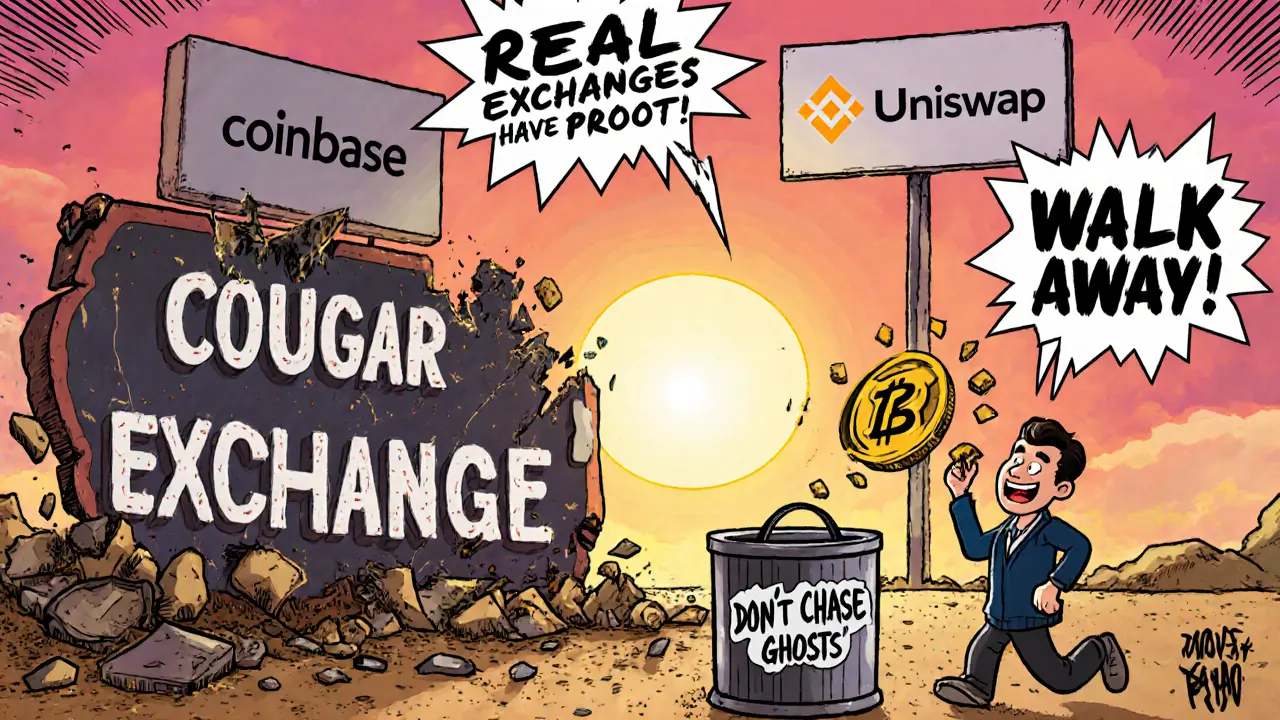

There’s no such thing as a legitimate crypto exchange called Cougar Exchange. If you’re searching for it, you’ve likely stumbled across two confusingly named projects: Cougar Exchange (CGX), a token with no trading activity, and CougarSwap (CGS), a decentralized platform with almost no public footprint. Neither is a real alternative to Binance, Kraken, or Uniswap. And here’s the hard truth: if you’re thinking of buying either, you’re risking your money on something that may not even exist as a functioning service.

What Is Cougar Exchange (CGX)?

Cougar Exchange (CGX) isn’t an exchange. It’s a token - and a dead one at that. As of October 2025, CoinCodex confirms there’s no historical price data available for CGX. That means no one has traded it in the last 48 hours, maybe not even in the last 48 days. Without trading volume, there’s no liquidity. Without liquidity, there’s no market. And without a market, it’s just a digital file with a name.Some websites try to predict CGX’s future price by claiming it follows Bitcoin’s 4-year halving cycle. That sounds technical, but it’s meaningless without actual price history. You can’t predict the weather if you’ve never seen a thermometer. The same goes here. CoinDesk’s head of research, Noelle Acheson, calls tokens like this “low-liquidity tokens prone to manipulation.” That’s not a warning - it’s a red flag flashing in neon.

What About CougarSwap (CGS)?

Then there’s CougarSwap (CGS), often confused with Cougar Exchange. This one is listed on CoinGecko, which might make it seem real. But here’s what’s missing: zero documentation, no whitepaper, no team info, and no security audit. CoinGecko lists it, but doesn’t verify it. That’s not an endorsement - it’s a cataloging system. Think of it like a library that shelves every book ever printed, whether it’s Shakespeare or a self-published pamphlet.BitScreener claims CGS could hit $0.03553 by the end of 2025 - but also could crash to $0.00001948. That’s an 1,823x swing. That’s not volatility. That’s gambling. Compare that to Binance Coin (BNB), which stayed within 15% of its predicted range in 2024. CGS has no track record, no user base, and no clear use case. Is it a DEX? A yield farm? A meme coin? Nobody knows. And if the creators don’t know either, why should you?

Why These Projects Don’t Belong in a Real Review

Real crypto exchanges - even small ones - have something these don’t: proof. They have:- Live trading pairs on at least one major exchange

- Public team members with LinkedIn profiles

- Smart contract audits from firms like CertiK or PeckShield

- Active Discord or Telegram communities with hundreds of real users

- Clear instructions on how to buy, store, or swap their tokens

Cougar Exchange and CougarSwap have none of that. Not one. CryptoSlate’s 2025 Exchange Trust Index says platforms with zero verifiable user reviews are automatically labeled “non-operational or high-risk.” That’s not opinion - it’s methodology. And both CGX and CGS fit that label perfectly.

What Happens If You Buy CGX or CGS?

Let’s say you buy $100 worth of CGS on a small, obscure DEX. What then?- You can’t sell it. No one’s buying.

- You can’t swap it. The platform might not even be live.

- You can’t withdraw it. The wallet address might be controlled by a single person who vanished months ago.

Delphi Digital’s 2025 Crypto Survival Report found that tokens without exchange listings or liquidity pools within 30 days of launch have a 98.7% failure rate. CGX and CGS have been around longer than 30 days - and still show no signs of life. That’s not a bad investment. That’s a ghost.

And here’s the kicker: if you bought either token, you’d be among the first - and likely last - people to ever trade it. There are no reviews on Trustpilot. No Reddit threads. No YouTube tutorials. No Medium articles explaining how it works. That’s not because it’s “undiscovered.” It’s because it’s abandoned.

How to Spot a Fake Crypto Project

You don’t need to be a tech expert to avoid scams. Here’s your quick checklist:- No price data? Skip it. If CoinGecko or CoinCodex says “no data available,” it’s dead.

- No team? Skip it. Real projects name their founders. Fake ones hide behind “anonymous devs.”

- No audit? Skip it. If there’s no CertiK or Hacken report, assume it’s unsecured.

- Price predictions with wild swings? Skip it. Real analysts don’t predict 1,800% swings - they look at volume and adoption.

- No user reviews anywhere? Skip it. If no one’s talking about it, no one’s using it.

These aren’t opinions. These are industry standards. Every major crypto publication uses them. If a project fails all five, it’s not a hidden gem - it’s a trap.

What to Do Instead

If you’re looking for a crypto exchange, here’s what actually works in 2025:- For beginners: Use Coinbase or Kraken. Simple, regulated, insured.

- For traders: Binance or Bybit. Low fees, deep liquidity, 24/7 support.

- For DeFi: Uniswap or SushiSwap. Fully decentralized, open-source, audited.

These platforms have millions of users, years of history, and real customer support. They don’t need to promise you 100x returns. They make money by letting you trade - not by selling you a dream.

Final Word: Don’t Chase Ghosts

The crypto market is full of noise. There are hundreds of new tokens every week. Most vanish in 30 days. A few become the next Bitcoin. But none of them look like Cougar Exchange or CougarSwap.They don’t have websites. They don’t have teams. They don’t have trading volume. They don’t have reviews. And if you’re reading this, you already know something’s off.

Don’t waste your time. Don’t waste your money. Walk away.

Is Cougar Exchange a real crypto exchange?

No. Cougar Exchange (CGX) is not an exchange. It’s a cryptocurrency token with no trading activity as of October 2025. There is no platform, no website, and no way to trade it. It’s a dead project.

What is CougarSwap (CGS)?

CougarSwap (CGS) is a token associated with an unverified decentralized platform. It has no public documentation, no team, no security audit, and no user reviews. While listed on CoinGecko, it lacks the basic features of a functioning DEX. It’s considered high-risk and likely non-operational.

Can I buy CGX or CGS on Binance or Coinbase?

No. Neither CGX nor CGS is listed on any major exchange like Binance, Coinbase, Kraken, or Bybit. You can only find them on obscure, low-liquidity DEXs - if at all. Buying them means trading on platforms with zero oversight and high risk of scams.

Why do some websites predict CGS will hit $0.035?

Those predictions are algorithmic guesses with no human analysis behind them. They’re based on zero historical data and ignore basic market principles. Real crypto analysts only make projections after 90+ days of trading activity. These predictions are marketing tools - not financial advice.

Are CGX and CGS scams?

They’re not confirmed scams, but they meet every red flag for a failed or abandoned project. With no team, no liquidity, no audits, and no user activity, they’re more likely to be abandoned than malicious. Either way, they’re not worth investing in.

What should I do if I already bought CGX or CGS?

If you already bought CGX or CGS, don’t panic - but don’t expect to get your money back. These tokens have no market. You might be able to sell them for pennies on a low-volume DEX, but you’ll likely lose most or all of your investment. The best move is to learn from this and avoid similar projects in the future.

Michael Heitzer

Let’s be real - crypto’s become a graveyard of half-baked ideas with flashy names and zero substance. Cougar Exchange? More like Cougar Ghost. If a project can’t even get a single trade in 48 days, it’s not ‘undiscovered,’ it’s dead on arrival. The fact that people still chase these things is wild. You wouldn’t buy a car with no engine and call it a ‘future Tesla.’ Why do this with crypto?

It’s not about FOMO. It’s about basic due diligence. No team? No audit? No liquidity? That’s not an investment - it’s a donation to someone’s vanity project.