Ref Finance Fee Calculator

Calculate Your Swap Costs

Ref Finance isn’t just another crypto coin-it’s the backbone of decentralized trading on the NEAR Protocol. Launched in 2021, it started as a decentralized exchange (DEX) designed to solve one big problem: how to trade crypto fast and cheap on a blockchain that doesn’t charge $50 in fees per swap. Today, it’s evolved into something bigger: Rhea Finance, a full DeFi hub that lets you swap, lend, and earn yield-all without leaving NEAR.

What exactly is Ref Finance?

Ref Finance is a decentralized exchange built on the NEAR blockchain. Think of it like Uniswap or PancakeSwap, but optimized for speed and low cost. Instead of running on Ethereum, where gas fees spike during traffic jams, Ref Finance runs on NEAR, which processes transactions in 1-2 seconds and costs less than a penny per trade. Its native token, REF, powers the platform: you use it to pay fees, earn rewards, and vote on upgrades.Unlike centralized exchanges like Binance or Coinbase, Ref Finance doesn’t hold your money. You connect your NEAR wallet-like Near Wallet or Meteor Wallet-and trade directly from your account. No KYC. No middlemen. Just smart contracts doing the work.

How does Ref Finance work?

Ref Finance uses an Automated Market Maker (AMM) model. That means instead of buyers and sellers matching orders, trades happen against liquidity pools-groups of token pairs locked in code. If you want to swap NEAR for USDT, you’re trading against a pool filled with both tokens by other users like you.Every trade costs $0.005. That fee doesn’t disappear-it gets split between liquidity providers (the people who supply the tokens) and the protocol treasury. This incentivizes people to add funds to pools, which keeps prices stable and trades smooth.

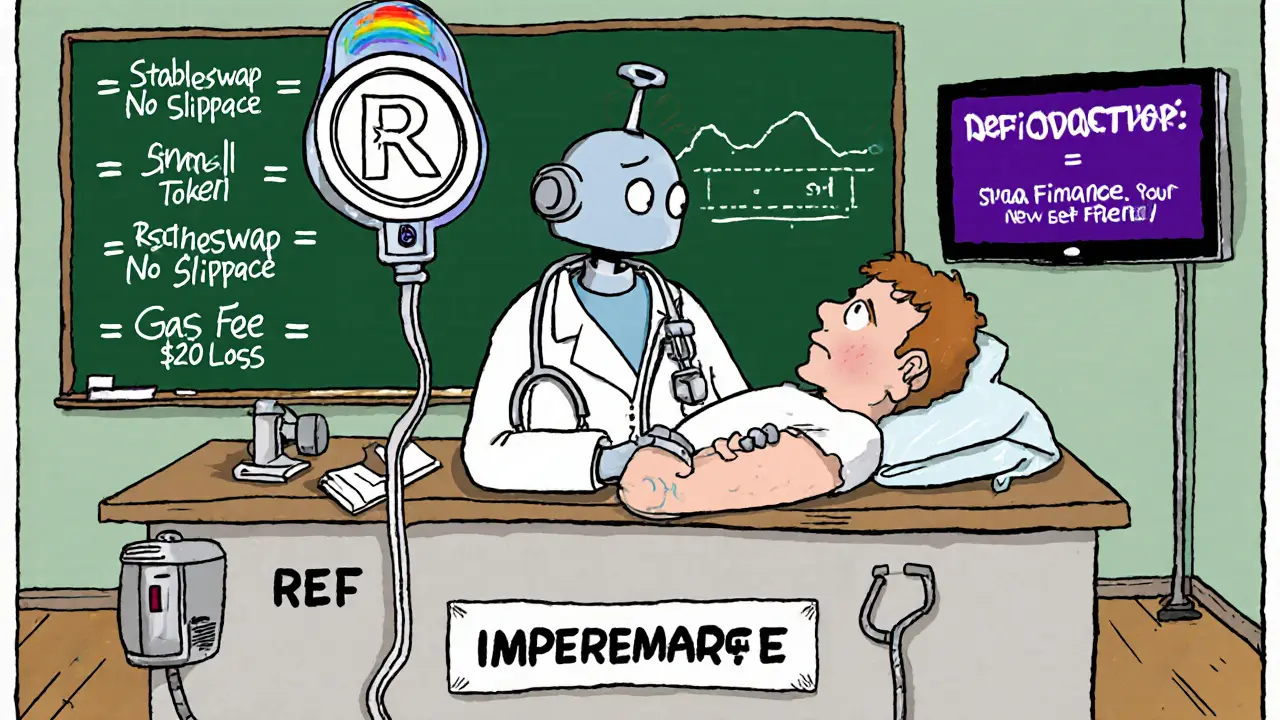

Ref Finance supports three types of pools:

- Standard AMM pools-for most token pairs, using the x*y=k formula (same as Uniswap).

- Stableswap pools-optimized for stablecoins like USDT, USDC, and DAI. These have near-zero slippage, so $10,000 trades move less than 0.05% in price.

- Concentrated liquidity pools-launched in mid-2023. These let you put your money only in a specific price range (like $1.00-$1.05 for USDC/NEAR), making your capital work harder. This feature alone boosted capital efficiency by up to 20x.

Why does Ref Finance matter?

The real power of Ref Finance isn’t just its low fees-it’s its bridge to Ethereum. Through the Rainbow Bridge, you can move Ethereum-based tokens (like USDT, DAI, or even ETH) onto NEAR, then trade them on Ref Finance with near-instant finality and fees under $0.01. This is huge. On Ethereum, swapping USDT for DAI might cost $5 and take 30 seconds. On Ref Finance? $0.005 and 1.5 seconds.This makes Ref Finance the go-to tool for anyone who wants Ethereum’s liquidity but NEAR’s speed. It’s why over 1,200 token pairs are listed there, and why daily trading volume regularly hits $500,000-$2 million.

REF token: What is it used for?

The REF token is the engine of Ref Finance. Here’s what it does:- Transaction fee discount-holding REF reduces swap fees by up to 25%.

- Staking rewards-you can lock REF to earn a share of trading fees and new token emissions.

- Governance-REF holders vote on protocol upgrades, fee changes, and treasury spending.

- Liquidity mining-you get REF rewards for adding liquidity to certain pools.

As of October 2023, REF had a market cap of around $28 million, with a circulating supply of 220 million tokens. It’s not a top-10 coin, but it’s the most important token in the NEAR ecosystem.

How does Ref Finance compare to other DeFi platforms?

Here’s how Ref Finance stacks up against major competitors:| Feature | Ref Finance (NEAR) | Uniswap (Ethereum) | Raydium (Solana) |

|---|---|---|---|

| Average swap fee | $0.005 | $1.50 | $0.002 |

| Transaction speed | 1-2 seconds | 13-15 seconds | 0.4-0.8 seconds |

| TVL (Oct 2023) | $15.7M | $4.2B | $1.1B |

| Stablecoin slippage ($10K trade) | 0.02%-0.05% | 0.1%-0.3% | 0.05%-0.1% |

| Cross-chain bridge | Rainbow Bridge (Ethereum) | None (native) | Wormhole (Ethereum, Solana) |

| Developer tools | Rust + WASM | Solidity | Move (limited) |

Ref Finance loses on total value locked (TVL)-it’s tiny compared to Uniswap. But it wins on cost and cross-chain access. For users already on NEAR, or those tired of Ethereum fees, it’s the best option.

Who uses Ref Finance?

The user base is growing. As of October 2023, over 43,000 unique wallets interacted with Ref Finance in the past 30 days. The biggest groups:- NEAR ecosystem users-people who already hold NEAR, staking it or using other NEAR apps like Aurora or Burrow.

- Ethereum refugees-traders fed up with high gas fees who moved assets via Rainbow Bridge.

- Yield farmers-those chasing REF rewards by providing liquidity.

- Stablecoin traders-people who swap USDT, USDC, and DAI daily and need near-zero slippage.

Geographically, 32% of users are in North America, 27% in Asia, and 22% in Europe. It’s not global yet, but it’s expanding fast.

What are the downsides?

No platform is perfect. Ref Finance has a few real issues:- Low liquidity on small tokens-if you try to swap a new, obscure token, you might get 5-10% slippage. Stick to major pairs.

- Steep learning curve for advanced features-concentrated liquidity and yield optimization need time to learn. Beginners should start with simple swaps.

- Slow customer support-email replies take up to 72 hours. Use Telegram for faster help.

- Dependent on NEAR-if NEAR’s network slows down or has an outage, Ref Finance goes with it.

One Reddit user summed it up: “Swapping USDT to USDC takes 2 seconds and costs less than a penny. But trying to swap a new token? I lost $20 in slippage and got zero help.”

What’s next for Ref Finance?

Ref Finance isn’t standing still. In late 2023, it rebranded to Rhea Finance to reflect its expansion beyond trading. Here’s what’s coming:- Native stablecoin-launching in December 2023, a NEAR-native stablecoin pegged to the USD.

- Cross-chain lending-by Q1 2024, you’ll be able to borrow against your NEAR assets using funds from Ethereum.

- Institutional API-by Q2 2024, hedge funds and traders will be able to connect directly to Ref Finance’s trading engine.

The goal? To become the one-stop DeFi platform for NEAR users-not just a DEX, but a full financial operating system.

How to get started

If you want to try Ref Finance, here’s how:- Create a NEAR wallet-go to wallet.near.org and set one up. Takes 2 minutes.

- Get NEAR or Ethereum tokens-buy NEAR on Coinbase or Binance, or bridge USDT/USDC from Ethereum using Rainbow Bridge.

- Connect to Ref Finance-visit app.ref.finance, click “Connect Wallet,” and select your NEAR wallet.

- Start swapping-pick a token pair, set slippage to 0.5% (for stablecoins) or 1-2% (for volatile ones), and click swap.

For beginners: stick to USDT, USDC, or NEAR pairs. Avoid small-cap tokens until you’re comfortable.

Final thoughts

Ref Finance (now Rhea Finance) isn’t trying to beat Uniswap. It’s solving a different problem: making DeFi fast, cheap, and accessible on a blockchain built for it. If you’re tired of paying $10 to swap two stablecoins, or if you’re already on NEAR, Ref Finance is the most practical DeFi tool out there.It’s not the biggest. It’s not the flashiest. But for real-world use-fast swaps, low fees, seamless cross-chain access-it’s hard to beat.

Is Ref Finance safe to use?

Yes, but with caveats. Ref Finance’s smart contracts were audited by Quantstamp in June 2023, and all medium-severity bugs were patched within 72 hours. It’s fully decentralized-no central server to hack. But like all DeFi platforms, you’re responsible for your own funds. Always double-check token addresses, and never send crypto to unknown contracts.

Can I buy REF coin on Coinbase or Binance?

Not directly. REF is only listed on decentralized exchanges like Ref Finance itself, or on smaller CEXs like KuCoin and Gate.io. You can’t buy it with a credit card on Coinbase. You’ll need to first get NEAR or USDT, then swap for REF on Ref Finance.

What’s the difference between Ref Finance and Rhea Finance?

Ref Finance was the original DEX. Rhea Finance is the new name for the upgraded platform that now includes lending, yield optimization, and native stablecoin features. The REF token remains the same. You’ll see both names used, but the official platform is now Rhea Finance.

How do I earn rewards with REF?

You can earn REF in two ways: by providing liquidity to trading pools (you get a share of swap fees + new REF tokens), or by staking REF directly in the platform’s staking contract. Both options give you passive income, but staking is simpler. Liquidity provision is riskier because of impermanent loss.

Why is Ref Finance’s TVL so low compared to Uniswap?

Because NEAR is still a smaller ecosystem. Uniswap runs on Ethereum, which has over $100 billion in total DeFi value. NEAR’s entire DeFi space is around $1.2 billion. Ref Finance holds about 32% of that. As NEAR grows, so will Ref Finance’s TVL. It’s a matter of time and adoption, not technology.

Do I need to know how to code to use Ref Finance?

No. Basic swapping is as easy as using a regular app. You just connect your wallet and click buttons. Advanced features like concentrated liquidity require learning, but there are free video guides on YouTube and the official GitHub wiki. Most users master swaps in under 10 minutes.

What to do next

If you’re new to DeFi, start small: swap $10 worth of USDT for USDC on Ref Finance. See how fast it is. Then try adding liquidity to the USDT/USDC pool for a day. Watch your rewards grow. Once you’re comfortable, explore staking REF or trying concentrated liquidity.Don’t try to chase big returns right away. DeFi isn’t a lottery-it’s a tool. Ref Finance is one of the best tools for fast, cheap, cross-chain trading today. Use it wisely, and it’ll save you money every time you trade.

Nidhi Gaur

Just swapped $20 of USDT for USDC on Ref Finance - took 1.2 seconds and cost me 0.003 NEAR. Mind blown. Why are people still using Uniswap when this exists? 😅