EmiSwap APR Calculator

Calculate Your Potential Earnings

Important Risk Warning

EmiSwap's claimed 1000% APR is extremely risky. The article states:

Article Insight: "No one's talking about EmiSwap on Twitter or Reddit for a reason." The platform offers no transparency or safety net.

⚠️ If you withdraw early: You'll lose eligibility for the 365% APR airdrop. ⚠️ If you stay invested: You risk total loss if the token crashes or the platform disappears.

Results

Note: These calculations assume continuous staking and no price volatility. The $ESW token's value could drop significantly as explained in the article.

EmiSwap is a decentralized exchange that promises big returns - like 1000% APR on liquidity farming and a 365% APR airdrop - but it’s hard to find anyone who’s actually used it long-term. If you’re looking for a DEX that’s as transparent as Uniswap or as trusted as PancakeSwap, EmiSwap doesn’t deliver the same clarity. It’s not a scam, but it’s not exactly safe either. The platform operates on Polygon, connects to MetaMask, and rewards users with its native $ESW token. But behind the flashy numbers, there’s a lot missing.

How EmiSwap Works (The Basics)

EmiSwap is an automated market maker (AMM), just like Uniswap or SushiSwap. You don’t trade with another person. Instead, you trade against a pool of funds locked in smart contracts. To earn rewards, you need to do two things: add liquidity and stake your LP tokens.Here’s how it works in practice:

- Connect your wallet (MetaMask or Fortmatic work).

- Go to the "Add Liquidity" tab and deposit two tokens - say, USDC and ETH.

- You get LP tokens in return, which represent your share of that pool.

- Go to the "Farming" tab and stake those LP tokens.

- You start earning $ESW tokens daily.

That’s it. No KYC. No sign-up. No bank account. Just crypto in, crypto out. But the real draw isn’t just swapping - it’s the rewards.

The Rewards: Too Good to Be True?

EmiSwap’s main selling point is its yield. They claim liquidity providers can earn up to 1000% APR. That’s not a typo. For comparison, Uniswap’s top pools rarely hit 10% APR. Even PancakeSwap’s best farms top out around 50-150% in normal conditions.Then there’s the 365% APR airdrop - a separate program for Polygon users. It promises 1% daily return on top of farming rewards. Sounds amazing, right? But here’s the catch: you have to keep your liquidity in the pool until the first airdrop distribution. If you pull out early, you lose eligibility. That’s a big risk. What if the $ESW token crashes? What if the project vanishes?

High yields like this usually mean one of three things:

- The token supply is being flooded to attract users.

- The project is burning through funds to buy attention.

- There’s no real demand for the token - it’s all speculation.

EmiSwap doesn’t publish its tokenomics. No whitepaper. No total supply. No vesting schedule. No roadmap. That’s not normal. Even newer DEXs like Trader Joe or Curve share basic details. EmiSwap doesn’t.

Who’s Behind EmiSwap?

EmiSwap is linked to Emirex, a centralized exchange registered in Estonia with a license from the Estonian Police and Border Guard Board (license FVT000400). That’s a good sign - at least someone behind it is regulated. But here’s the disconnect: Emirex is a centralized platform. EmiSwap is fully decentralized. No KYC. No customer support. No official help desk.So why does the Emirex connection matter? It suggests the team has experience with crypto compliance and infrastructure. But it doesn’t mean EmiSwap is secure, stable, or sustainable. You’re still trusting code - not a company. And that code hasn’t been publicly audited by a known firm. No CertiK. No PeckShield. No Hacken. Just a vague claim that "security audits have been performed."

Is EmiSwap Safe?

Safety in DeFi isn’t about whether a project has a logo or a team. It’s about transparency, audit history, and community trust.EmiSwap fails on all three.

- No public audit reports.

- No user reviews on Reddit, Trustpilot, or DeFiLlama.

- No major DeFi analytics site lists its TVL (total value locked).

That’s not just unusual - it’s a red flag. Uniswap has over $4 billion locked. PancakeSwap has $1.2 billion. EmiSwap? Nobody knows. If you can’t find its TVL on DeFiLlama or Dune Analytics, it’s either too small to track… or it’s hiding.

And here’s something else: the platform calls itself the "first community-governed DEX with NFT mechanics." But there’s no NFT interface. No governance dashboard. No voting system. Just a token that earns rewards. That’s marketing speak, not product.

What You’re Really Buying Into

You’re not investing in a platform. You’re betting on a token - $ESW - that has no clear use case beyond staking rewards. No utility. No partnerships. No integration with other protocols. It’s not even listed on major exchanges like KuCoin or Gate.io. You can only get it by farming on EmiSwap.That’s a classic pump-and-dump setup. Early users get rewarded with newly minted tokens. They sell. The price crashes. New users join, thinking they can catch the next wave. Rinse and repeat.

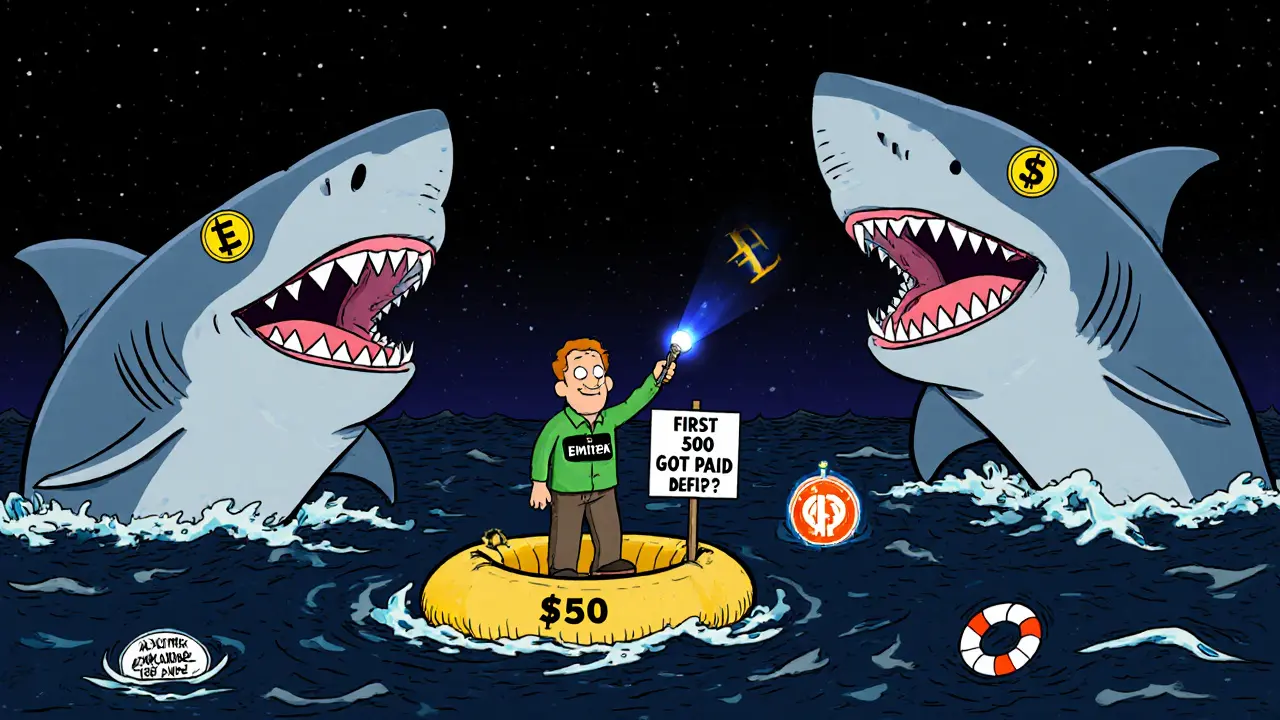

Some people have made money on EmiSwap - probably the first 500 people who joined. But if you’re reading this now, you’re likely entering late. The high yields won’t last. They never do.

EmiSwap vs. The Big Players

| Feature | EmiSwap | Uniswap | PancakeSwap |

|---|---|---|---|

| Network | Polygon only | Ethereum | BSC |

| Trading Fee | 0.2% | 0.3% (standard) | 0.2% (standard) |

| APR for LPs | Up to 1000% | 1-10% | 50-150% |

| Audits | Not public | Multiple, public | Multiple, public |

| TVL (Total Value Locked) | Not listed | $4B+ | $1.2B+ |

| User Reviews | None | Thousands | Thousands |

| Token Utility | Staking only | None (UNI is governance) | Staking, voting, fees |

EmiSwap’s only advantage is yield. Everything else - security, transparency, liquidity, reputation - falls behind. You’re trading safety for speed. And in crypto, speed without substance is just noise.

Should You Use EmiSwap?

If you’re okay with risking money on a platform that’s barely visible in the DeFi world - yes, you can try it. But only with money you’re willing to lose.Here’s what to do if you still want to try:

- Start with $50. Not $500. Not $5,000.

- Only add liquidity to the most popular pairs - USDC/ETH or WETH/USDT.

- Don’t stake more than you can afford to lock up for 30+ days.

- Watch the $ESW price. If it drops 30% in a week, get out.

- Don’t believe the hype. No one’s talking about EmiSwap on Twitter or Reddit for a reason.

EmiSwap isn’t dead. But it’s not thriving either. It’s floating in a gray zone - too risky for serious investors, too tempting for those chasing quick gains.

What Comes Next?

If EmiSwap wants to survive, it needs to do three things:- Release a public audit report from a trusted firm.

- Publish its tokenomics - supply, distribution, vesting.

- Launch real governance - let users vote on fee changes, new pairs, or upgrades.

Until then, treat it like a lottery ticket. Buy small. Know the odds. And don’t count on winning.

Is EmiSwap a scam?

EmiSwap isn’t confirmed as a scam, but it has all the warning signs of a high-risk project. No public audits, no tokenomics, no user reviews, and no TVL data make it impossible to trust fully. It’s not fraudulent - yet - but it’s not safe either. Treat it like a speculative bet, not an investment.

Can I withdraw my funds anytime?

You can remove your liquidity from pools at any time. But if you’re participating in the 365% APR airdrop, you must keep your tokens staked until the first distribution. If you pull out early, you lose eligibility for that reward. Always read the fine print before staking.

What wallet works with EmiSwap?

EmiSwap supports MetaMask and Fortmatic. Both work on the Polygon network. Make sure your wallet is connected to Polygon (not Ethereum mainnet) before adding liquidity. Using the wrong network can result in lost funds.

Where can I buy $ESW tokens?

You cannot buy $ESW on any major exchange. The only way to get it is by providing liquidity and staking LP tokens on EmiSwap. This makes the token highly illiquid and dependent on the platform’s continued operation. If EmiSwap shuts down, $ESW becomes worthless.

Is EmiSwap better than Uniswap?

No. Uniswap has $4 billion in locked value, multiple security audits, thousands of users, and a proven track record. EmiSwap offers higher yields, but with zero transparency and no safety net. Higher returns don’t mean better. They mean higher risk. Stick with Uniswap unless you’re comfortable gambling.

Edward Phuakwatana

Bro, this EmiSwap thing is like a neon sign in a dark alley that says 'FREE MONEY'... but the alley is full of mirrors. 🤔💸 I’ve seen this movie before - high APR, no audit, zero transparency. The only thing being pumped here is the token supply. If you’re not already holding $ESW, you’re not getting in early. You’re getting in *last*. Still... if you’ve got spare change and a gambling addiction, go for it. Just don’t cry when the rug gets pulled. 🚀💀