Imagine you own a house. You have the only key. No one else can get in. Not your neighbor, not the bank, not the government. That’s what private keys are in crypto - the only key to your digital assets. If you don’t have them, you don’t own your crypto. Not really. You’re just holding an IOU from someone else.

What Exactly Is a Private Key?

A private key is a long string of letters and numbers - usually 64 characters long in hexadecimal format - that acts like a digital signature for your crypto. It’s generated when you create a wallet, and it’s mathematically tied to a public key. Think of the public key as your crypto address - the one you share to receive funds. The private key is the secret that lets you spend those funds.

Here’s how it works: when you send Bitcoin or Ethereum, your wallet uses your private key to sign the transaction. The network checks that signature against your public key to make sure it’s valid. But here’s the catch - no one can reverse-engineer your private key from your public key. Not even with the most powerful supercomputer today. That’s why it’s called asymmetric cryptography. It’s one-way math.

Without your private key, you can’t move your coins. Period. Even if you know your wallet address, even if you have access to your exchange account, if you don’t have the key, you’re locked out.

Not Your Keys, Not Your Coins

You’ve probably heard this phrase before. It’s not a slogan - it’s the core truth of crypto. If your crypto is on Coinbase, Binance, or any exchange, those companies hold the private keys. You’re trusting them to keep your money safe. But what happens when they get hacked? Or go bankrupt? Or freeze accounts because of new regulations?

In 2022, FTX collapsed. Thousands of users lost everything. Not because the blockchain failed. Not because the code was broken. Because they didn’t control the keys. The exchange did. And when the company went under, so did their access.

Compare that to someone who kept their Bitcoin in a hardware wallet. When FTX crashed, they didn’t blink. Their coins were still there. Still under their control. That’s the difference between owning something and renting it.

How Private Keys Are Stored - Hot vs Cold Wallets

There are two main ways to store private keys: online (hot) and offline (cold).

Hot wallets are connected to the internet. These include mobile apps like MetaMask, desktop wallets, or exchange accounts. They’re convenient. You can send crypto in seconds. But they’re also vulnerable. If your phone gets infected with malware, or you click a phishing link, your private key can be stolen in seconds.

Cold wallets are offline. Hardware wallets like Ledger, Trezor, or OneKey are the gold standard. They look like USB drives. Your private key never leaves the device. Even if your computer is hacked, the key stays safe. To send crypto, you plug the device in, confirm the transaction on its screen, and sign it physically. No internet needed during signing.

There’s also paper wallets - a printout of your private key and public address. They’re cheap and simple, but easily damaged, lost, or stolen. Not recommended unless you’re very careful.

Most serious users use a combination: a hardware wallet for long-term storage, and a hot wallet for small, everyday transactions.

The Real Risk Isn’t Hacking - It’s You

People think crypto is risky because hackers are smart. But the biggest threat isn’t hackers. It’s human error.

Every year, millions of dollars in crypto are lost forever because someone:

- Forgot their password

- Lost their seed phrase

- Deleted their wallet app without backing up

- Typed their private key into a fake website

- Stored their seed phrase on their phone or cloud drive

Seed phrases - usually 12 or 24 words - are how you recover your wallet if you lose your device. They’re the master key to your private keys. Treat them like the most important thing you’ll ever own. Write them on paper. Store them in a fireproof safe. Never take a photo. Never upload them anywhere. Never share them with anyone - not even your spouse, not even your tech-savvy friend.

There’s no customer service for lost keys. No reset button. No “I forgot my password” option. Once it’s gone, it’s gone. Forever.

Why Self-Custody Is Growing - And Why It Matters

The crypto wallet market hit $7.3 billion in 2023. Hardware wallet sales jumped 300-500% after major exchange collapses. Why? Because people learned the hard way.

Companies like MicroStrategy and Tesla now hold billions in Bitcoin using institutional-grade self-custody systems. They don’t trust banks. They don’t trust exchanges. They trust math - and their own control.

Regulators are starting to notice too. The EU’s MiCA law and proposed U.S. rules are beginning to treat custodial and non-custodial services differently. If you’re holding your own keys, you’re not subject to the same rules as a bank. That’s the power.

And it’s not just about security. It’s about freedom. No one can freeze your account. No one can block your transaction. No one can take your money just because they disagree with your politics, your location, or your spending habits. That’s what crypto was built for.

Getting Started With Self-Custody

You don’t need to be a coder to own your keys. Here’s how to start:

- Buy a hardware wallet - Ledger Nano X or Trezor Model T are reliable choices.

- Set it up on a clean computer (no malware). Follow the official guide - don’t skip steps.

- Write down your 24-word seed phrase. Do it by hand. Use a pen and paper. No typing.

- Store the paper in a secure, dry place. A safe or safety deposit box works.

- Send a small amount of crypto to test it. Send it back. Confirm the transaction works.

- Never, ever enter your seed phrase on a website - even if it looks real.

It takes 2-4 hours to set up right. But once you do, you’ll never feel the same way about exchanges again.

What’s Next? Quantum Threats and MPC

Some worry that quantum computers will break crypto encryption. Experts say that’s 10-30 years away - if it happens at all. Even then, the crypto community is already working on quantum-resistant algorithms. The system adapts.

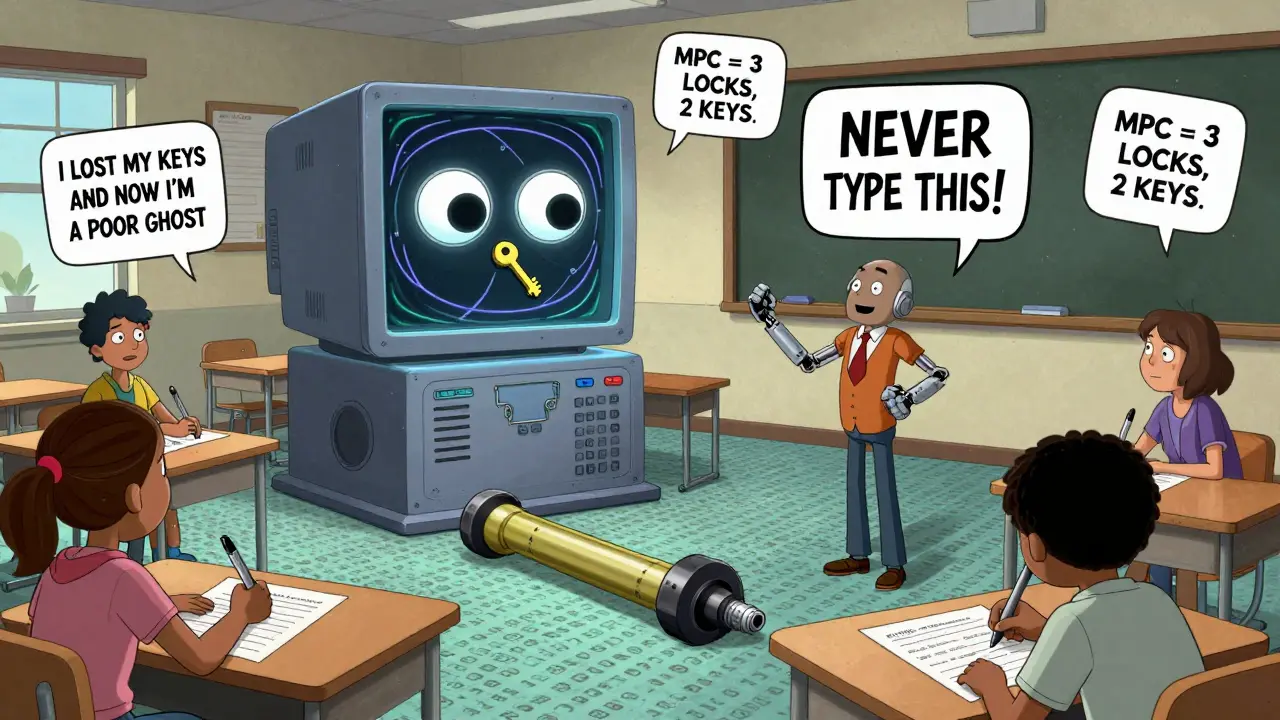

Meanwhile, new tech like Multi-Party Computation (MPC) is making self-custody easier. Instead of one private key, MPC splits control across multiple devices. Lose one? Still safe. Get hacked on one? Still safe. It’s like having three locks on your door - and you need two keys to open it.

But none of this changes the rule: private keys control your assets. Whether it’s a single key on a hardware wallet, or a distributed system - if you don’t control the keys, you don’t control your crypto.

Final Thought: Ownership Is a Skill

Crypto isn’t magic. It’s math. And like any powerful tool, it demands responsibility. Owning your private keys isn’t about being tech-savvy. It’s about being careful. About being disciplined. About understanding that your freedom comes with real work.

Most people will keep their crypto on exchanges. They’ll say it’s easier. And maybe it is - until it’s not.

But if you want real ownership - if you want to truly be your own bank - then your private key is your only path. Protect it like your life depends on it. Because in crypto, it does.

Lynne Kuper

Oh wow, so you’re telling me the entire crypto revolution is just… a really fancy version of hiding your house key under the mat? Except if you lose it, your entire life savings vanishes into the digital ether? Thanks, I’ll just keep my money in a bank that at least lets me call someone when I forget my PIN.