Iran’s cryptocurrency mining industry is no longer just about electricity bills and cooling rigs. Since early 2025, every miner operating in Iran - whether they run a single ASIC in their garage or a warehouse full of machines - is required to sell a portion of their mined cryptocurrency directly to the Central Bank of Iran (CBI). This isn’t a suggestion. It’s the law.

Why the Iranian government forced miners to hand over their crypto

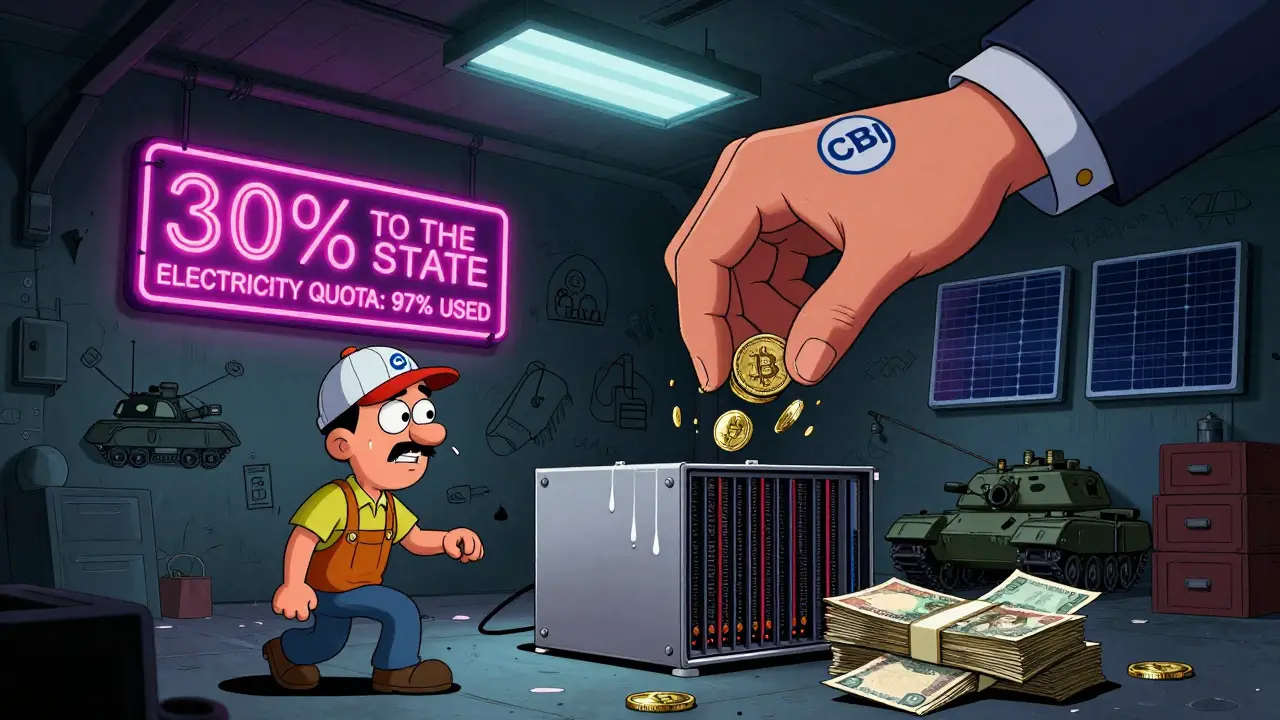

Iran has been mining Bitcoin and other cryptocurrencies for years, not because its people love digital money, but because it’s one of the few ways to earn hard currency under crippling U.S. sanctions. With banks cut off from global systems and the rial losing value by the day, mining became a lifeline - for individuals and the state. The problem? Most miners were selling their coins on unofficial exchanges, pocketing dollars or euros, and bypassing the government entirely. The Central Bank saw billions in potential revenue slipping away. So in January 2025, it stepped in with a new rule: all licensed miners must sell at least 30% of their monthly output to the CBI at a fixed rate in Iranian rials. This isn’t about controlling crypto use. It’s about controlling cash flow. The government doesn’t care if you hold Bitcoin in your wallet - it just wants its cut of the mining profits. And since Iran’s electricity is among the cheapest in the world, the country now accounts for about 4.5% of global Bitcoin mining. That’s a lot of coins. A lot of dollars. And a lot of money the state wants to capture.How the mandatory sales system actually works

It’s not as simple as handing over a USB drive with your coins. Here’s how it works in practice:- Every miner must apply for a license from the Central Bank of Iran. No license? No mining. Period.

- Licensed miners are assigned a unique digital ID tied to their mining rig’s hash rate and location.

- Every 30 days, the CBI pulls a data feed from the miner’s pool or wallet - automatically transferring 30% of mined coins to a state-controlled wallet.

- The miner receives payment in Iranian rials, based on a fixed exchange rate set weekly by the CBI - not the open market rate.

- The remaining 70% can be sold on government-approved exchanges or held privately, but any transfer out of Iran requires CBI approval.

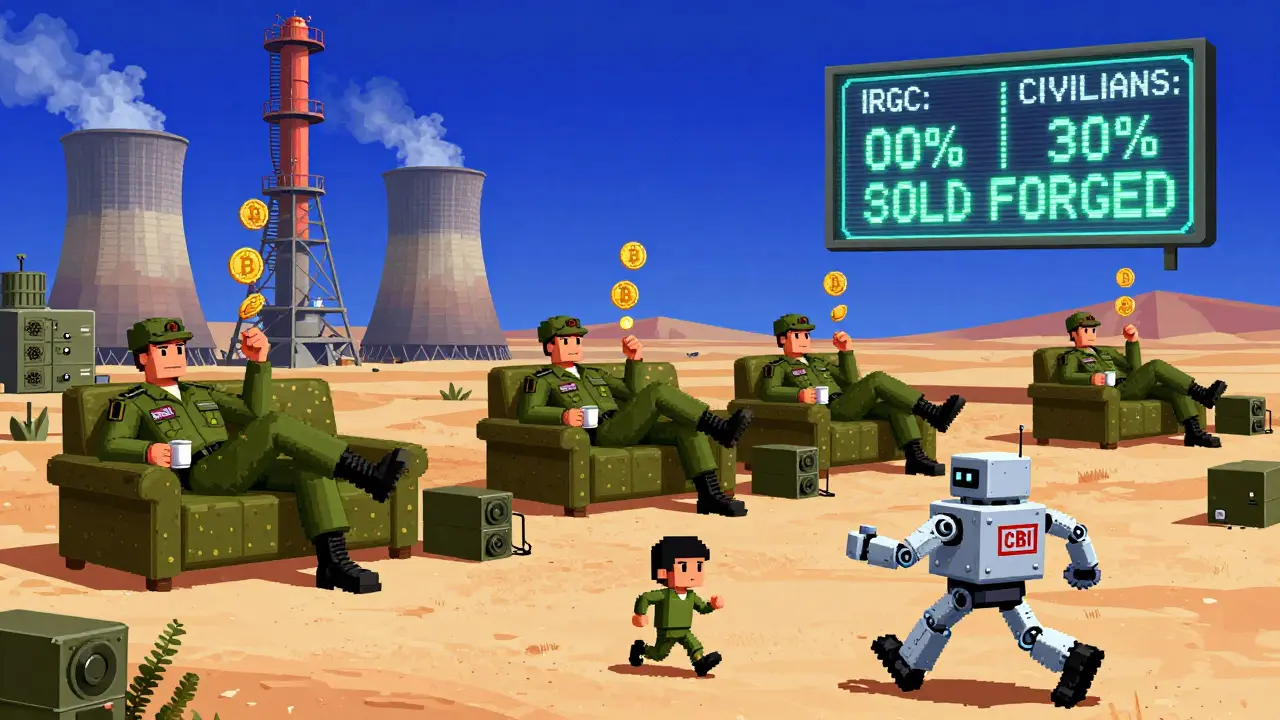

Who’s really mining in Iran - and who’s controlling it

You might picture a guy in Tehran running a few rigs in his basement. But that’s not the reality anymore. Since 2020, the Islamic Revolutionary Guard Corps (IRGC) has taken over the biggest mining operations. They’ve built massive farms - like the 175-megawatt facility in Rafsanjan - with dedicated power lines, military-grade cooling, and Chinese-made hardware. These aren’t just businesses. They’re state assets. The IRGC mines Bitcoin not to make money for itself, but to fund operations that can’t be paid for in dollars. When Iran needs to buy weapons, medicine, or tech from countries that won’t deal with its banks, Bitcoin becomes the middleman. The CBI takes the 30% cut from every miner, but the IRGC’s farms? They’re exempt from the mandatory sales rule - because they’re the ones running the system. This creates a two-tiered mining economy: ordinary citizens pay their dues to the state. The powerful? They mine for the state - and keep everything.

The energy crisis behind the crackdown

Iran’s power grid is falling apart. In late 2024, rolling blackouts hit 12 provinces. The government blamed unauthorized mining for draining up to 10% of the national electricity supply. That’s why the CBI didn’t just impose sales rules - it also capped power use for mining. Each licensed miner gets a monthly energy quota based on their rig size. Go over it? Your license gets suspended. Repeat offenses? Your equipment gets seized. The irony? The same people who can’t afford to pay their electricity bills are being told they can’t mine - while IRGC-run farms, hidden behind military walls, use more power than entire cities.What happens if you don’t comply?

The penalties are harsh - and public. - First offense: Fine of 50 million rials (about $1,000 USD) and immediate suspension of mining rights. - Second offense: Confiscation of all mining equipment. - Third offense: Criminal charges under anti-money laundering laws, with possible jail time. In March 2025, Iranian media reported the seizure of over 8,000 mining rigs in Tehran, Mashhad, and Isfahan. Most belonged to unlicensed operators. The government didn’t just shut them down - they livestreamed the destruction of the rigs on state TV. Even if you’re not mining, holding crypto without reporting it to the CBI can land you in trouble. The bank now has access to every transaction on approved exchanges. If you buy Bitcoin from a local seller and don’t declare it, you’re flagged.

Can you still mine profitably under these rules?

It’s tight. But yes - if you’re smart. The fixed rate the CBI pays for crypto is usually 15-20% below the open market price. That means if Bitcoin is trading at $70,000, you’ll get paid for 30% of your output at around $56,000. That’s a big hit. But here’s the catch: electricity costs less than 1 cent per kWh in Iran. That’s cheaper than most places in the world. So even after the forced sale, many miners still break even - or even turn a small profit - if they run efficient hardware and keep their rigs running 24/7. The real winners? Companies that own large-scale farms with direct access to cheap power and government contracts. They buy mining rigs in bulk, get priority power allocation, and sell the rest of their output on local exchanges at market rates. For a small miner? It’s a grind. But it’s still better than working a minimum-wage job in a country where inflation hit 55% in 2025.The underground market is still alive

Despite all the rules, crypto trading hasn’t disappeared. In fact, it’s thriving - in secret. Thousands of Iranians still use peer-to-peer apps like LocalBitcoins clones or Telegram groups to trade Bitcoin for rials. Some use VPNs to bypass CBI tracking. Others pay cash in parking lots or basements. The CBI knows this is happening. But going after every individual trader is impossible. So they focus on the big fish: miners, exchanges, and large-scale transfers. The result? A split economy. One side is legal, monitored, and controlled. The other is underground, risky, and growing.What’s next for crypto in Iran?

The government isn’t done. In late 2025, officials announced plans to launch a state-backed digital currency - the digital rial - to replace cash and reduce reliance on foreign currencies. They’re also testing blockchain-based payment systems on Kish Island, a free-trade zone where foreigners can legally buy crypto. The goal? Use crypto as a tool for international trade - but only under strict state control. As for miners? The mandatory sales rule is here to stay. And if the CBI’s revenue from crypto keeps rising - as it did in 2025, hitting $1.2 billion annually - don’t expect the 30% requirement to drop. The message is clear: Iran doesn’t want to ban crypto. It wants to own it.Is cryptocurrency mining legal in Iran?

Yes, but only if you’re licensed by the Central Bank of Iran. Unlicensed mining is illegal and can lead to fines, equipment seizure, or criminal charges. All miners must register their rigs and connect to government-mandated data systems.

Do I have to sell my mined crypto to the government?

Yes. All licensed miners must sell at least 30% of their monthly mining output directly to the Central Bank of Iran. The payment is made in Iranian rials at a fixed rate set by the bank, not the market price. The remaining 70% can be held or sold on approved exchanges.

Why does Iran force miners to sell to the state?

Iran uses crypto mining to bypass U.S. sanctions and earn foreign currency. By requiring miners to sell a portion of their output to the Central Bank, the government captures revenue that would otherwise flow into private hands. This helps fund state operations and stabilize the rial.

Can I mine crypto without a license in Iran?

Technically, yes - but it’s extremely risky. Unlicensed miners are targeted by authorities, and their equipment is routinely seized. The government has access to blockchain data and can trace unregistered mining activity. Penalties include fines, confiscation, and possible jail time.

Is Bitcoin used for everyday payments in Iran?

No. Using Bitcoin or other cryptocurrencies for daily purchases, online shopping, or bills is banned by the Central Bank. Iranians use crypto mainly as a store of value to protect savings from inflation - not as a payment method.

How does Iran’s crypto mining compare to other countries?

Iran is one of the top 10 global Bitcoin miners, accounting for about 4.5% of total network hash rate. It’s the only country where mining is legally mandated to feed revenue directly to the central bank. Unlike the U.S. or Kazakhstan, where mining is private and unregulated, Iran treats mining as a state-controlled economic activity.

Denise Paiva

The state owns your hash rate now and you’re okay with this

Imagine if the IRS demanded 30% of your mining profits in cash every month

But no no this is different because it’s Iran and they’re just trying to survive sanctions

Meanwhile my ASIC sits in a basement in Ohio and I pay taxes in Bitcoin and nobody cares

How is this not a crypto dictatorship

They’re not banning it they’re weaponizing it

And the fact that the IRGC gets a free pass is the most American thing about this whole mess