When you hear about a new cryptocurrency called Kudai (KUDAI), you might think it’s the next big thing - maybe a game-changer in AI or NFTs. But here’s the truth: Kudai isn’t a revolutionary project. It’s a meme coin with no clear purpose, shaky technical foundations, and wildly inconsistent data across platforms. If you’re considering buying it, you need to know what you’re really getting into.

What is Kudai (KUDAI) actually?

Kudai (KUDAI) is a token that claims to sit at the intersection of artificial intelligence, bots, meme culture, and non-fungible tokens. Sounds impressive? It isn’t. There’s no whitepaper. No official team. No roadmap. No working product. Just a token with a name and a handful of trading pairs on decentralized exchanges.

It’s listed as an ERC-20 token on Ethereum by some sources, while others say it’s built on Solana. That’s not a minor detail - that’s a red flag. You can’t build a token on two blockchains at once. If even the most basic technical fact is in dispute, how can you trust anything else about the project? This confusion alone should make you step back.

Market data: Chaos in plain sight

Let’s look at the numbers - because numbers don’t lie, but they sure can be misleading.

Market cap? Around $1.1 million. That puts KUDAI at #2465 out of over 20,000 cryptocurrencies. You’re not investing in a project here - you’re gambling on a micro-cap token with less market value than some single NFT collections.

Circulating supply? 100 billion KUDAI tokens. That’s a lot. But here’s the catch: with a market cap under $1.2 million, each token is worth less than a penny. In fact, prices vary wildly:

- CoinMarketCap says $0.000010

- LiveCoinWatch says $0.000008

- CoinCodex says $0.00001221

Why the difference? Because there’s almost no liquidity. The token trades mostly on Uniswap V3 (Base), with a 24-hour volume of just $1,277. That’s less than what a single Tesla owner spends on coffee in a week. Low volume means price manipulation is easy. One whale with $50,000 can move the price 20% in minutes.

Price history: A rollercoaster with no safety rails

KUDAI hit an all-time high of $0.000169 - a 1,500% jump from its current price. But that peak didn’t come from adoption. It came from hype. And like most meme coins, the fall was just as fast.

Over the last 7 days, KUDAI dropped 64.25%. Meanwhile, the broader crypto market barely budged, up 0.16%. That tells you everything: KUDAI isn’t riding the wave - it’s being dragged under by it.

Its all-time low is $0.00000646. The current price is about 69% above that. So yes, it’s technically off its bottom - but that’s not a sign of strength. It’s just a bounce before the next drop.

Trading and where to buy

If you still want to buy KUDAI, you’ll need a wallet like MetaMask configured for the Base blockchain. That’s because most trading happens on Uniswap V3 (Base), not Ethereum or Solana - even though sources can’t agree which chain it’s even on.

You won’t find it on Coinbase, Binance, or Kraken. It’s only on niche decentralized exchanges. That means:

- No fiat on-ramps - you need ETH or USDC first

- No customer support if something goes wrong

- No insurance if the contract gets hacked

And forget about storing it long-term. With no real utility, no staking, no governance, and no community development, holding KUDAI is like holding a lottery ticket with no drawing date.

Predictions: Bullish? Or just blind hope?

CoinCodex claims KUDAI could hit $0.056 by the end of 2025. That’s a 4,500% increase from today’s price. Sounds insane? It is.

That forecast is based on zero real-world adoption. No product. No team. No use case. Just a chart pattern and a hope that someone else will buy it later. The same source also says there’s a 25% chance you could profit by shorting KUDAI over the next 84 days. In other words, even the “experts” think it’s going down.

The Fear & Greed Index for KUDAI is at 71 - “Greed.” That’s not a signal to buy. It’s a warning. When everyone’s excited, the smart money is already leaving.

Why Kudai (KUDAI) is a high-risk gamble

Here’s what you’re really buying into:

- No utility: It doesn’t power an app, a game, or a service. It’s just a token.

- No transparency: No team, no docs, no GitHub, no social media activity.

- No liquidity: A few thousand dollars in daily volume means you might not be able to sell when you want to.

- High volatility: It lost 64% in a week. That’s not normal market movement - that’s panic.

- Conflicting tech claims: Ethereum? Solana? Base? No one knows - and that’s terrifying for a crypto project.

This isn’t a startup. It’s not even a poorly executed project. It’s a placeholder - a name slapped onto a smart contract, then marketed with buzzwords to attract people who don’t know better.

Who should avoid Kudai (KUDAI)?

If you’re:

- Investing your savings

- Looking for long-term growth

- Uncomfortable with losing money

- Not already deep into crypto speculation

Then KUDAI is not for you. Period.

Who might consider it? (And how)

Only if you treat it like a lottery ticket - something you can afford to lose 100% of.

If you still want to try:

- Use only money you can afford to vanish overnight.

- Buy on Uniswap V3 (Base) using ETH or USDC.

- Set a sell target - say, 2x your investment - and stick to it.

- Don’t hold longer than a few days. No “HODL” here.

- Never invest more than 1% of your total crypto portfolio.

And even then - be ready to walk away with nothing.

Final thoughts

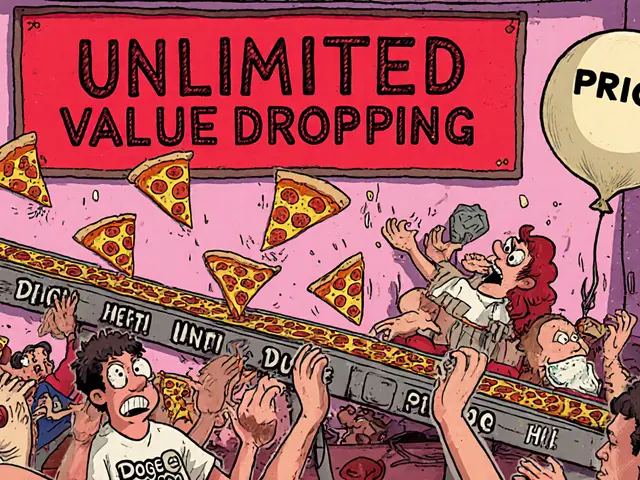

Kudai (KUDAI) isn’t a cryptocurrency. It’s a speculation vehicle wrapped in AI and NFT buzzwords. There’s no innovation. No community. No future plan. Just a token with a confusing backstory and a price that jumps around like a ping-pong ball in a storm.

If you’re looking for real value in crypto, look elsewhere. KUDAI doesn’t offer a product, a service, or even a believable story. It offers a gamble. And in crypto, the only thing more dangerous than a bad project is a meme coin with no limits.

Is Kudai (KUDAI) a good investment?

No, Kudai is not a good investment. It’s a low-liquidity meme coin with no utility, no team, and no clear blockchain foundation. Its price is highly volatile, and its market cap is under $1.2 million - making it extremely vulnerable to manipulation. Most experts view it as speculative at best, and a potential loss at worst.

What blockchain is Kudai (KUDAI) on?

There’s no clear answer. Some sources say it’s an ERC-20 token on Ethereum. Others claim it’s on Solana. But most trading happens on the Base blockchain via Uniswap V3. This inconsistency suggests poor transparency or possibly a mislabeled project. You’ll need a Base-compatible wallet like MetaMask to trade it.

Can I buy Kudai (KUDAI) on Coinbase or Binance?

No, Kudai is not listed on any major centralized exchanges like Coinbase, Binance, or Kraken. It’s only available on decentralized exchanges, primarily Uniswap V3 (Base). To buy it, you’ll need to connect a Web3 wallet like MetaMask and swap ETH or USDC for KUDAI directly on the Base network.

Why is Kudai’s price so unstable?

Kudai has extremely low trading volume - under $2,000 per day - and minimal market depth. This means a small amount of money can move the price dramatically. It’s also a meme coin with no underlying value, so its price depends entirely on hype, social media trends, and pump-and-dump schemes. That’s why it can swing 20% in an hour.

What are the price predictions for Kudai in 2025?

Some analysis, like from CoinCodex, predicts KUDAI could reach $0.056-$0.059 by late 2025. But that’s based on zero real-world adoption. The same analysis also suggests a 25% profit potential from shorting KUDAI. In reality, these predictions are speculative guesses with no foundation. Don’t rely on them - treat them as entertainment, not advice.

Does Kudai have any real use case?

No. Kudai claims ties to AI, bots, and NFTs, but there’s no evidence of integration with any platform, app, or service. It doesn’t power a game, a wallet, or a marketplace. It’s simply a token with no function beyond trading. Without utility, it has no long-term value.