Crypto Volatility Calculator

Volatility Impact Calculator

Based on 2025 market data showing fragmented volatility across cryptocurrencies

Projected Volatility Impact

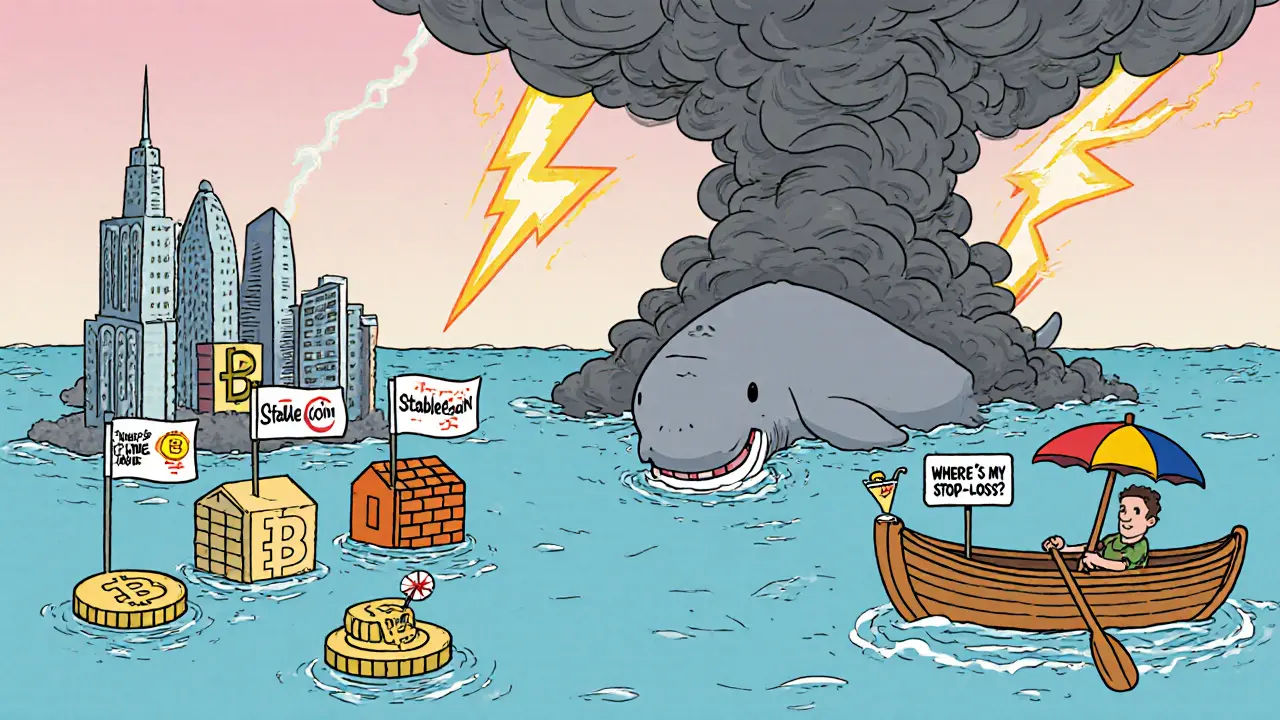

Is cryptocurrency getting calmer? It’s a question many investors are asking in 2025. After years of wild swings-Bitcoin dropping 50% in a week, Ethereum surging 30% overnight-the market seems to be changing. Some say crypto is maturing. Others say the crashes are just getting more painful. The truth? It’s not one story. It’s two, maybe three, happening at once.

Volatility Isn’t Uniform Across Coins

Look at XRP. Between July and August 2025, its price swung between $2.73 and $3.66. By September and October, that range shrank to $2.68-$3.14. That’s a noticeable drop in daily swings. Gate.com reported a 15% overall decline in crypto market volatility during 2025, pointing to institutional buying and clearer rules as reasons why. But then look at Bitcoin. On October 10, 2025, it crashed from $122,000 to $104,000 in under 24 hours. That wasn’t just a dip-it was a freefall. The 30-day implied volatility for Bitcoin, measured by Volmex’s BVIV index, jumped from 40% to over 60%. That’s higher than it’s been since early 2024. Meanwhile, the S&P 500’s VIX, a measure of stock market fear, spiked to 29% and then fell back below 20%. Crypto didn’t calm down. It stayed tense. Ethereum had its own drama in August 2025. It surged 24% in a single month, fueled by $4 billion flowing into Ethereum-based exchange-traded products (ETPs). That kind of move isn’t normal. It caused stop-loss orders to fail, traders to lose thousands, and even market makers to widen their quotes by 18%. VanEck called it a "violent resurgence" of volatility. Solana tells a similar story. It hit $295 in February 2025, then dropped to $95 after Trump’s tariff announcement. It’s now trading in an upward channel, but still down 15% year-to-date. That’s not stability. That’s a rollercoaster with no safety rail.Why Some Coins Are Calmer, Others Are Wilder

The difference isn’t random. It’s structural. Coins like XRP and some stablecoin-pegged assets are seeing less volatility because institutions are treating them like semi-stable assets. They’re not gambling. They’re allocating. Regulatory clarity in the U.S. helped. The pro-crypto legislative shift in early 2025 gave banks and pension funds confidence to dip toes in without fearing sudden crackdowns. But Bitcoin and Ethereum? They’re still the market’s emotional core. Every Fed announcement, every tariff threat, every geopolitical headline hits them first. Bitcoin’s price is now seen as a bellwether-not just for crypto, but for global risk sentiment. When markets panic, Bitcoin leads the sell-off. When confidence returns, it leads the rally. New market mechanics are making things worse, not better. Auto-deleveraging (ADL) systems on exchanges like Binance and OKX automatically liquidate leveraged positions when prices move fast. During the October 10 crash, these systems triggered a chain reaction. Liquidity vanished. Orders couldn’t fill. Traders lost money not because they were wrong, but because the system couldn’t handle the speed.What’s Really Driving the Changes

Three big forces are at play:- Institutional adoption is stabilizing some assets. ETPs, corporate treasuries holding Bitcoin, and hedge funds using crypto as a macro hedge are creating deeper, more resilient order books.

- Regulatory clarity is reducing uncertainty. The U.S. Treasury’s October 2025 guidance on market structure is expected to cut volatility by 12-18% by improving liquidity and reducing exchange risk.

- Macroeconomic linkages are increasing volatility. Bitcoin now moves in sync with tech stocks, bond yields, and dollar strength. It’s no longer an isolated asset. That means it’s more exposed to global shocks.

Real People, Real Losses

Behind the numbers are real traders. One Reddit user, u/CryptoTrader89, posted on October 12: "The Oct 10 crash wiped out my 3x long on BTC-liquidations were insane with no liquidity to stop the slide." He wasn’t alone. Thousands had positions auto-liquidated because the market collapsed faster than the system could react. On the other side, u/StableHodler said: "XRP has been surprisingly stable the last two months-finally seeing that institutional adoption paying off in reduced swings." That’s the duality. Some coins are calming. Others are getting more dangerous. A Coinbase user lost $2,300 in August because ETH’s 24% jump happened too fast for their stop-loss to trigger. Slippage ate their profit. That’s not speculation. That’s systemic risk.What This Means for You

If you’re trading crypto in 2025, here’s what you need to know:- Don’t assume all crypto is calmer. XRP might be stable. Bitcoin isn’t.

- Watch leverage. Fidelity’s data shows that during "high profit, high volatility" phases (like Ethereum in August), you should reduce leverage by 25-40%. Backtesting from 2015-2025 proves this cuts losses.

- Institutions have rules now. 68% of traditional finance firms won’t put more than 5% of their portfolio into crypto unless the 30-day volatility is under 45%. That’s new. That’s a barrier.

- Stablecoin-pegged assets are the quiet winners. Tokenized real-world assets-like real estate or bonds on blockchain-had 22% lower volatility than pure crypto in 2025. They’re becoming the safe harbor.

Where Are We Headed?

Fidelity’s model suggests Bitcoin’s volatility could drop over time-if the percentage of addresses in profit stabilizes between 75-85%. Right now, it’s at 92%. That’s a sign of speculative frenzy. When that number cools, so might the swings. But here’s the catch: CoinDesk and others warn that the new volatility floor might be higher than before. Before 2023, Bitcoin’s implied volatility often sat between 20-35%. Now, models suggest 40-55% is the new normal. Why? Because of ADL, macro linkages, and derivatives. Gartner predicts crypto volatility will drop to 60-70% of equity market volatility by 2027. That sounds promising. But right now, it’s 140-180%. We’re halfway there-if we’re lucky. The biggest stabilizers? Stablecoins and tokenized assets. They’re growing fast. Their market cap jumped from $48 billion to $127 billion in just one year. They’re not flashy. But they’re quiet, and that’s what the market needs.Bottom Line: It’s Not One Trend. It’s Two.

Cryptocurrency volatility isn’t simply decreasing. It’s fragmenting.- On one side: Stablecoins, regulated tokens, and institutional-grade assets are becoming less volatile.

- On the other: Bitcoin and Ethereum are more exposed than ever to global shocks, leverage traps, and automated liquidations.

Is cryptocurrency volatility really decreasing in 2025?

It depends on the asset. Some coins like XRP and tokenized assets have seen 15-22% lower volatility due to institutional adoption and regulatory clarity. But Bitcoin and Ethereum experienced sharp spikes in volatility during 2025, especially after the October 10 crash. Overall, the market is fragmenting-some parts are calming, others are getting more volatile.

Why is Bitcoin still so volatile in 2025?

Bitcoin remains highly volatile because it’s now tied to global macro trends-interest rates, tariffs, and geopolitical risk. It’s also the most leveraged crypto asset, with $48.7 billion in futures open interest. When markets panic, Bitcoin leads the sell-off. Auto-deleveraging systems on exchanges amplify these moves, creating liquidity crunches that make price swings worse.

Are stablecoins less volatile than other cryptocurrencies?

Yes. Stablecoins pegged to real-world assets like real estate or bonds showed 22% lower volatility than pure cryptocurrencies in 2025. Their value is tied to underlying assets with stable cash flows, not speculation. As a result, they’re becoming the preferred entry point for institutions and risk-averse investors.

Should I use leverage in crypto trading in 2025?

Be extremely cautious. Fidelity’s analysis shows that during "high profit, high volatility" phases-like Ethereum’s August 2025 surge-leverage increases risk dramatically. Backtesting suggests reducing leverage by 25-40% during these periods. Auto-deleveraging events can wipe out positions instantly. Most retail traders lose money using leverage in today’s crypto market.

What’s the best way to protect against crypto volatility?

Diversify into low-volatility assets like stablecoins and tokenized real-world assets, which grew to $127 billion in market cap by September 2025. Avoid over-leveraging. Use stop-losses cautiously-many failed during the October 2025 crash due to slippage. And never allocate more than 5% of your portfolio to crypto unless the 30-day volatility is under 45%, as most institutions now require.

Will crypto volatility keep decreasing after 2025?

Long-term, yes-but not uniformly. Gartner predicts crypto volatility will fall to 60-70% of equity market levels by 2027, driven by institutional adoption and stablecoin growth. However, Bitcoin and Ethereum may remain more volatile than other assets due to their speculative nature and market influence. The new baseline for Bitcoin volatility is likely 40-55%, higher than the 20-35% seen in 2021-2022.

Brian Gillespie

Bitcoin’s still a rollercoaster. XRP’s calm. That’s it.