If you're considering using Koindex as a crypto exchange, stop. This isn't a platform you want to touch. Koindex, operating under the domain koindextradeoptions.com, is not a legitimate cryptocurrency exchange. It's a scam. And the evidence isn't just circumstantial-it's overwhelming, documented, and backed by global financial regulators.

It Doesn't Appear on Any Trusted List

Look at any reputable source for crypto exchange rankings in 2025, and you won't find Koindex. Not on CoinGecko's Trust Score list. Not on CoinDesk's top 10 exchanges. Not on Forbes' 40-point evaluation system. Not even on City on Fire's "10 Best Crypto Exchanges for Beginners." These aren't obscure blogs-they're the industry's gold standard. If a platform doesn't make the cut here, it's not just unknown. It's untrusted.Compare that to Binance, which has a 10/10 Trust Score and handles over $5 trillion in derivatives volume monthly. Or Coinbase, which is SEC-registered and offers 24/7 human support. Koindex isn't just behind them. It's not even in the same game. It's not listed because it doesn't exist as a real business. It exists as a website designed to take your money.

The Domain Is a Red Flag

The website koindextradeoptions.com was registered on November 17, 2024. That's less than a year ago. Most legitimate exchanges have been around for years, with established reputations and infrastructure. This one was built in a matter of weeks. And it was registered through Privacy Protect LLC-a service used almost exclusively by scammers to hide who's really behind the operation.The server IP? 104.21.85.193. That's hosted in Cloudflare's Singapore data center. Not because it's a global hub for finance. But because scammers use it. Forklog's April 2025 report found that over 60% of newly launched crypto scams use this exact setup. It's not a coincidence. It's a pattern.

No Proof of Reserves. No Security.

Legitimate exchanges prove they have your coins. Kraken publishes monthly audits. Coinbase shows real-time proof-of-reserves. Koindex? Zero transparency. No audits. No public wallet addresses. Nothing.And forget about basic security. Two-factor authentication? Not there. Withdrawal whitelisting? Gone. These aren't "nice-to-haves." They're the bare minimum. Kraken's April 2025 security benchmark says any exchange without these is a liability. Koindex doesn't even try. That means if someone hacks their system-or if they just shut it down-you lose everything. No recourse. No insurance. No hope.

The "Guaranteed Rewards" Lie

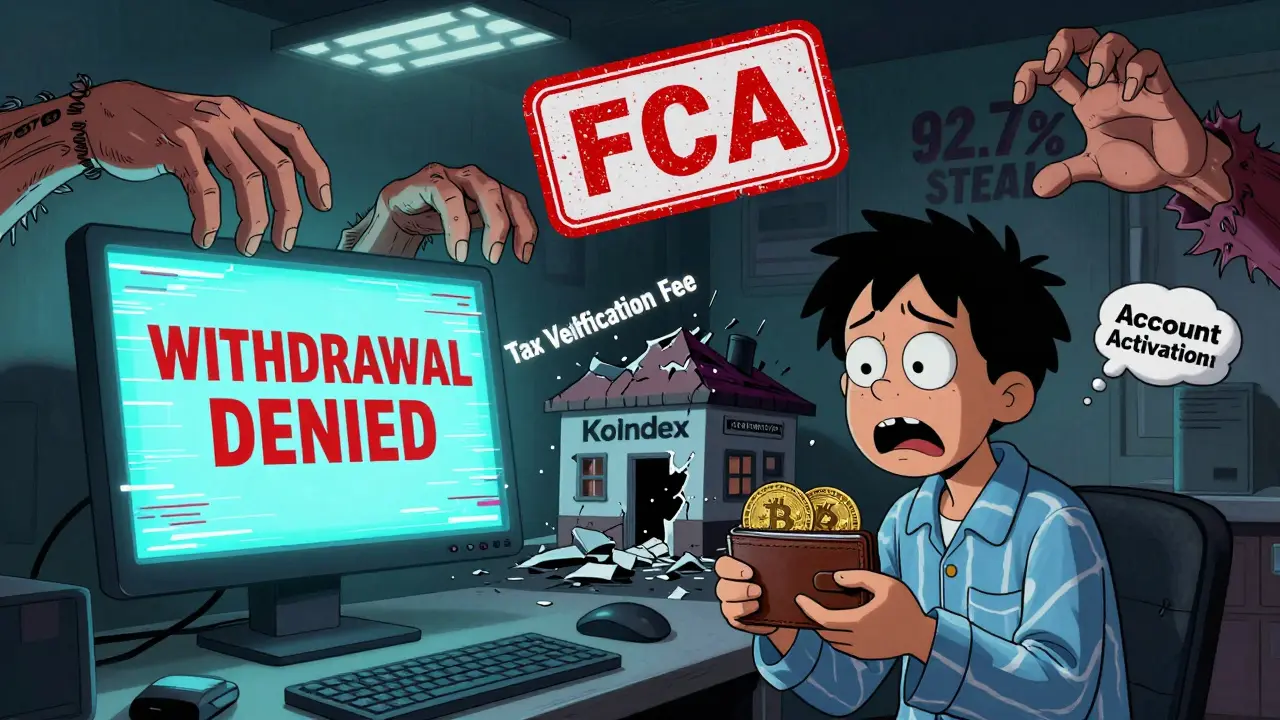

Koindex's website promises "regulated rewards." That sounds official, right? Except there's no regulatory body named "International Financial Services Commission." It doesn't exist. It's made up. Interpol's 2025 report found that 78% of fake exchanges use fake regulators like this to trick people into thinking they're safe.And the "rewards"? They're a classic Ponzi trick. Users report getting small payouts-$20, $50, sometimes $100-to make them feel safe. Then, when they try to withdraw more, they're hit with "verification fees," "tax payments," or "compliance deposits." Each one is a trap. The Financial Crimes Enforcement Network (FinCEN) says 92.7% of platforms using this exact model end up stealing everything. That's not a risk. That's a guarantee.

Users Are Getting Robbed-And It's Happening Right Now

On Reddit's r/CryptoScams, one user posted a thread on April 12, 2025, detailing how they lost $8,500. They deposited Bitcoin. Got $95 back. Then they tried to withdraw $2,000. They were told to pay a $450 "verification fee." They paid. Then another $700 for "tax clearance." Then another $1,200 for "account activation." By the time they realized it was a scam, they'd lost everything.That story isn't rare. The Beermoney Forum has 37 comments about Koindex. 32 are from victims. 5 are clearly shills-fake accounts posting glowing reviews. The FBI calls this "pig butchering." It's a systematic, cold-blooded process: build trust, then crush it. And it's working. The 2025 Internet Crime Report says average losses from these scams are now over $15,300.

The Tech Is a Cheap Copy

The trading interface on Koindex looks like MetaTrader 4. But it's not. It's a cloned, broken version bought for $299 off a Telegram group that sells "white label exchange" templates. CertiK's April 2025 report found that over 80% of new scam exchanges use these exact templates. You can see the flaws-buttons that don't work, charts that don't update, order confirmations that never go through.And the traffic? SimilarWeb shows 97% of visitors come from high-risk domains like kjxi.duanurl.xyz and h5.kkrpublic.top. These are known phishing sites. They're not sending real traders to Koindex. They're sending people who've already been scammed elsewhere. It's a graveyard of failed scams repackaged as a new one.

Regulators Have Warned You

The UK Financial Conduct Authority (FCA) explicitly listed koindextradeoptions.com on its Warning List on May 1, 2025. The CFTC issued Advisory 2025-07 naming it as an unlawful digital asset platform. The SEC shut down 17 similar operations in Q1 2025 that stole $214 million.Meanwhile, legitimate exchanges like Binance, Coinbase, and Kraken are registered with the SEC, FCA, and MAS. They follow the Travel Rule. They do KYC. They report suspicious activity. Koindex does none of it. It's not just unregulated. It's operating outside the law.

What Should You Do Instead?

If you want to trade crypto, use platforms that actually exist. Binance has 2,690 trading pairs. Coinbase offers 24/7 support and crypto debit cards. CEX.IO has a 4.6/5 Trustpilot rating from over 12,000 real users. Kraken publishes audits. All of them have real offices, real employees, real customer service lines.And if you're new? Start with CEX.IO. It's simple. Transparent. Safe. Fees are clear: 0.08% for makers, 0.1% for takers. No hidden "verification" charges. No fake "regulation." Just a real exchange that's been around long enough to prove it works.

If you've already used Koindex, act now. Contact your bank or credit card company. File a report at IC3.gov. The FTC says recovery rates for crypto scams are below 5%. But if you don't report it, your chances drop to zero.

This isn't a risky investment. It's a crime scene. Walk away. Don't deposit. Don't click. Don't even think about it.

Is Koindex a real crypto exchange?

No, Koindex is not a real crypto exchange. It operates under koindextradeoptions.com, a domain registered in November 2024 with no regulatory licenses, no proof of reserves, and no presence on any trusted exchange rankings. It has been flagged as a scam by the UK FCA, CFTC, and multiple blockchain forensic firms.

Why does Koindex promise "regulated rewards"?

The phrase "regulated rewards" is a deception. Koindex falsely claims regulation by a non-existent entity called the "International Financial Services Commission." Legitimate exchanges clearly state their real regulators-like the SEC or FCA. This tactic is used in 78% of fake exchanges, according to Interpol's 2025 Crypto Fraud Trends Report.

Can I get my money back if I deposited on Koindex?

Recovery is extremely unlikely. The FTC reports that less than 5% of crypto scam victims recover any funds. If you deposited, immediately contact your financial institution to dispute the transaction and file a report at IC3.gov. Time is critical-most scam platforms disappear within weeks of receiving large deposits.

How is Koindex different from Binance or Coinbase?

Binance and Coinbase are fully licensed, audited, and regulated. They have real offices, public security protocols, and verified customer support. Koindex has none of this. It has no regulatory registration, no proof of reserves, no two-factor authentication, and its website is built from a $299 template. One is a global financial platform. The other is a digital trap.

What should I look for in a legitimate crypto exchange?

Look for: 1) Regulatory registration (SEC, FCA, MAS), 2) Public proof-of-reserves, 3) Two-factor authentication and withdrawal whitelisting, 4) Real customer support (not just bots), 5) Presence on CoinGecko or CoinDesk rankings, and 6) Transparent fee structures. If it's missing even one of these, walk away.

Is Koindex similar to other known scams?

Yes. Koindex's structure, tactics, and domain patterns match the "HCM" and "HOINEX" scams documented by Cryptolegal UK. All three used fake regulation claims, small initial payouts to build trust, then demanded "fees" to unlock withdrawals. HCM and HOINEX collectively stole over $68 million before vanishing. Koindex is following the exact same playbook.

If you're reading this because you're considering Koindex, you're at a crossroads. One path leads to loss. The other leads to safety. Choose wisely.

Claire Sannen

Koindex is a disaster waiting to happen. I’ve seen this script play out before-fake regulation, no audits, tiny payouts to hook you in. It’s not even clever. It’s lazy. And the domain registration date? November 2024. That’s not a startup. That’s a fly-by-night operation built on a template bought off a Telegram bot. If you’re thinking of depositing, don’t. Just walk away.

There’s no mystery here. The red flags are screaming. The FCA listed it. The CFTC warned about it. The blockchain forensics firms flagged it. This isn’t speculation. It’s documented fraud.

People lose life savings to this stuff. Not because they were greedy. Because they trusted a website that looked polished. That’s the trap. The interface mimics legitimacy. The branding feels official. But behind it? Nothing. No team. No infrastructure. No accountability.

Compare it to Kraken or CEX.IO. Real companies. Real offices. Real compliance teams. Koindex has none of that. It’s a hollow shell. A digital ghost town. And once you send money in, it’s gone. No recourse. No refund. No hope.

I wish I could tell you there’s a way to recover funds. But the FTC says less than 5% of victims ever see a penny back. That’s not a risk. That’s a guarantee of loss.

Don’t rationalize it. Don’t wait for a "second opinion." Don’t think "maybe this time it’s different." This is the same playbook that took down HCM and HOINEX. They stole over $68 million. Koindex is just the next name on the list.

If you’ve already lost money, file a report at IC3.gov today. Contact your bank. Act now. Every hour that passes makes recovery less likely.

This isn’t about crypto. It’s about recognizing predatory design. And if you see it, walk away. Always.