Back in 2020, Oasis Exchange looked like a promising decentralized crypto exchange. It promised full control over your funds, no KYC, and seamless Ethereum integration. But today, if you try to visit oasisexchange.com, you’ll get a dead end. The site is gone. The app doesn’t work. Your money? If you left it there, it’s likely gone too.

What Was Oasis Exchange?

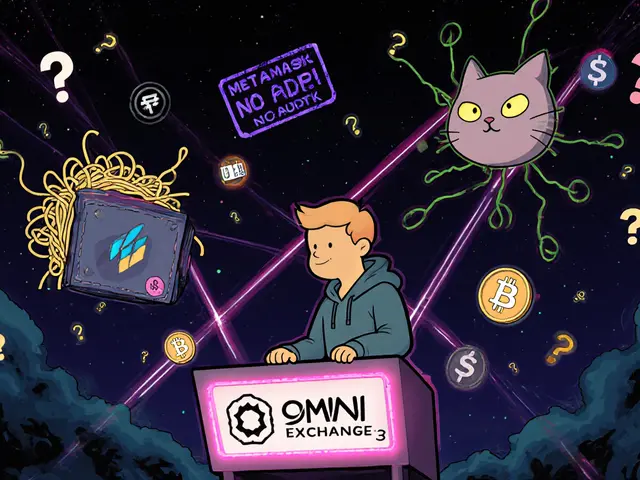

Oasis Exchange was a decentralized exchange (DEX) launched in 2019 by a South Korean company called Guardian Holdings. Unlike centralized exchanges like Binance or Coinbase, Oasis claimed to let users trade directly from their wallets-no deposits, no third-party custody. That’s the whole point of a DEX: you hold your keys, you control your crypto. It supported ERC-20 tokens and worked with MetaMask and other Ethereum wallets. No ID checks. No bank links. Just connect your wallet and trade. Sounds great, right? But here’s the catch: Oasis Exchange never solved the biggest problem all DEXs face-liquidity. Without enough traders and funds locked in, orders don’t fill. Prices jump wildly. And users start losing money.How It Crashed

In February 2021, Oasis Exchange reported a 24-hour trading volume of over $1.5 billion on CoinMarketCap. That made it look like a top-tier DEX. But that number was fake. By September 2021, CoinMarketCap flagged it as an “untracked listing.” That means the data stopped matching real blockchain activity. No trades were actually happening. The volume vanished overnight. What happened? Users started reporting the same problems over and over:- Trades showed up on the platform but never confirmed on Ethereum

- Withdrawals failed-money disappeared from the app but never reached wallets

- Customer support vanished. No replies on Telegram or Discord

- Liquidity pools looked empty even when the site claimed high trading volume

Why It Failed When Others Succeeded

Compare Oasis to Uniswap, PancakeSwap, or SushiSwap-all still going strong in 2025. These platforms didn’t just launch and hope for the best. They built ecosystems. Uniswap gave out $160 million in grants to developers and liquidity providers. PancakeSwap used its own token to reward traders. SushiSwap created a community-run treasury. Oasis had none of that. No incentive program. No marketing. No developer updates. No GitHub commits after 2021. No press releases. No announcements. Just silence. And then there’s the regulatory angle. Oasis never tried to comply with any jurisdiction. While other DEXs started blocking U.S. users after the SEC cracked down in 2022, Oasis didn’t even try. It just disappeared. A 2023 analysis by Galaxy Digital found that 92% of DEXs without clear tokenomics or regulatory strategy fail within 18 months. Oasis lasted 22 months. It didn’t beat the odds-it proved them.

Oasis Exchange vs. Oasis Network: Don’t Confuse Them

This is critical: Oasis Exchange is not the same as Oasis Network. Oasis Network is a real, active Layer 1 blockchain launched in 2020. It has its own native token, ROSE, and a market cap of over $187 million as of mid-2025. It’s focused on privacy and secure data handling, with partnerships from the World Economic Forum. Its DEX, YuzuSwap, launched in November 2021 and is still trading. It has $5.9 million in daily volume. Binance invested $200 million into its developer fund, and ROSE’s price jumped 14% overnight. Oasis Exchange? Dead. Oasis Network? Alive and growing. They’re completely separate projects with similar names. People mix them up all the time. Don’t be one of them.What Happens to Your Money If You Used Oasis Exchange?

If you ever deposited crypto into Oasis Exchange, you’re out of luck. The platform was non-custodial in theory-but in practice, it never properly connected to real smart contracts. The contracts were either abandoned or never deployed correctly. Etherscan shows zero transactions tied to Oasis Exchange since October 2021. No recovery tool exists. No legal recourse. No team to contact. The domain expired in January 2022. Social media accounts are gone. The company behind it, Guardian Holdings, has no public presence. This isn’t a hack. It’s a full shutdown. And in crypto, when an exchange vanishes without warning, your funds vanish with it.

What to Use Instead

If you want a decentralized exchange that’s safe, active, and reliable today, here are three solid options:- Uniswap (Ethereum): The most trusted DEX. High liquidity, active development, and over $1.2 billion in daily volume.

- PancakeSwap (BSC): Lower fees than Ethereum. Great for trading smaller tokens. $850 million daily volume.

- YuzuSwap (Oasis Network): If you like the Oasis name, use this. Real project. Real volume. $5.9 million daily trades.

Lessons Learned

Oasis Exchange is a textbook case of how not to build a crypto exchange. It looked good on paper. It had the right buzzwords: decentralized, no KYC, Ethereum-based. But it skipped the hard parts:- Building real liquidity

- Engaging the community

- Keeping code updated

- Being transparent

- Is trading volume confirmed on-chain?

- Are there recent GitHub commits?

- Does the team respond to issues?

- Is the platform listed on DeFi Llama or DappRadar?

Frequently Asked Questions

Is Oasis Exchange still operational?

No, Oasis Exchange has been completely inactive since late 2021. The website is offline, the domain expired in January 2022, and no blockchain transactions have been recorded since October 2021. Major crypto tracking platforms like CoinMarketCap and DeFi Llama no longer list it as active.

Can I recover my funds from Oasis Exchange?

No, recovering funds from Oasis Exchange is not possible. The platform never properly connected to functional smart contracts, and the team behind it vanished. There is no customer support, no recovery portal, and no legal avenue to reclaim your assets. Treat any crypto held on Oasis Exchange as permanently lost.

Is Oasis Network the same as Oasis Exchange?

No, they are completely different. Oasis Network is a live blockchain with its own token (ROSE), active development, and a working DEX called YuzuSwap. Oasis Exchange was a defunct trading platform that shut down in 2021. The similar names cause confusion, but they have no technical or organizational connection.

Why did Oasis Exchange fail when Uniswap succeeded?

Oasis Exchange failed because it had no liquidity incentives, no community engagement, and no ongoing development. Uniswap gave out millions in grants to liquidity providers, kept updating its code, and built trust through transparency. Oasis did none of that. It relied on fake volume and vanished when users realized they couldn’t trade or withdraw.

How do I avoid falling for a fake crypto exchange?

Check three things: First, verify trading volume on-chain using Etherscan or a blockchain explorer. Second, look for active GitHub commits and recent updates. Third, see if the platform is listed on DeFi Llama or DappRadar. If it’s only on CoinMarketCap with no on-chain data, it’s likely a ghost exchange. Never trust an exchange that doesn’t answer questions or update its website.

Michael Brooks

This is one of those posts that should be mandatory reading before you touch any new DEX. I lost my entire ETH stack on a similar ghost exchange back in 2020. No warnings, no refunds, just silence. Always check Etherscan first. If the contract hasn’t moved in months, run.

Also, never trust CoinMarketCap volume alone. I’ve seen fake volume on 12 different platforms. Real liquidity = real on-chain trades. Nothing else counts.

Thanks for the clear breakdown. This saved me from making the same mistake again.