SafeMoon SWaP was supposed to be the heart of a revolutionary crypto ecosystem. Back in 2021, it promised high rewards, a built-in exchange, an NFT marketplace, and even a hardware wallet-all tied to a token that claimed to pay you just for holding it. But as of early 2026, SafeMoon SWaP is barely alive. What was once a viral sensation with a loyal "SafeMoon Army" is now a ghost town of broken promises and fading wallets.

What SafeMoon SWaP Actually Did

SafeMoon SWaP was a decentralized exchange built on the Binance Smart Chain. It wasn’t just another DEX like Uniswap or PancakeSwap. It had one big gimmick: every time someone traded SafeMoon (SFMS), 2% of the transaction fee was split. Half went into a liquidity pool to stabilize the token. The other half was distributed automatically to everyone holding SFMS. That’s called a "reflection" system. If you held tokens, you got paid-just for sitting on them. That sounds great, right? Especially when early adopters claimed annual returns of up to 80%. But here’s the catch: those rewards only worked if people kept buying and selling. The more trading activity, the more money flowed into holders’ wallets. It wasn’t a business model. It was a cash flow loop. To make things worse, SafeMoon went through a major upgrade in December 2021 called V2. They consolidated tokens at a 1:1000 ratio-so if you had 1 million SFMS, you now had 1,000. The transaction fee dropped from 10% to 2%. On paper, that looked like progress. But in reality, it forced users to migrate manually if they held tokens in personal wallets. Many got locked out. Others lost money trying to move their assets.How It Compared to Real DEXs

Compare SafeMoon SWaP to PancakeSwap or Uniswap, and the differences are glaring. Most DEXs charge 0.25% to 0.3% per trade. SafeMoon charged 2%. That’s six to eight times higher. For traders who buy and sell often, that’s a killer. You’d lose hundreds of dollars in fees just to make a small profit. Uniswap doesn’t pay you to hold. It just lets you trade. PancakeSwap lets you stake, farm, and earn-but it doesn’t force you to pay extra just to move your tokens. SafeMoon’s model was designed for long-term holders, not active traders. But even then, the rewards were unstable. If trading volume dropped, so did your payouts. And it did-fast. By 2023, daily trading volume for SafeMoon on all exchanges combined was under $500,000. Compare that to Uniswap, which processes over $10 billion a day. SafeMoon wasn’t just behind. It was irrelevant.Features That Never Arrived

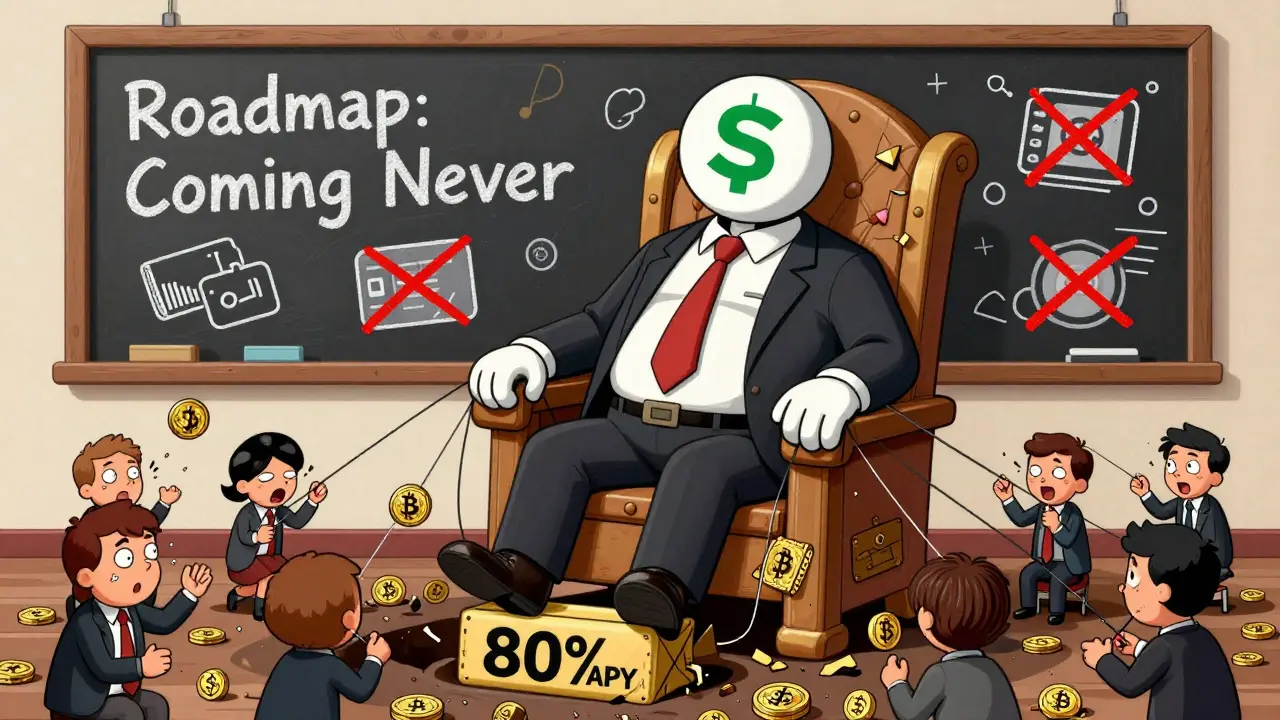

SafeMoon’s roadmap in 2021 was packed with promises:- A native crypto exchange (SafeMoon SWaP)

- A secure wallet (SafeMoon Wallet)

- An NFT marketplace

- A coin launchpad for new projects

- A blockchain of its own

- A hardware wallet

- IoT integration

Why Experts Warned Against It

Crypto analysts didn’t hold back. Koinly called it a "meme coin and potential Ponzi scheme." Margex said it was "not a good investment for price speculation." Mudrex listed SafeMoon among the "Top 5 Cryptocurrencies to Avoid" in late 2025, citing three big risks:- Regulatory exposure-SEC-style scrutiny was growing

- Unclear token utility-what was SFMS actually used for?

- Potential asset freezes-if regulators stepped in, your tokens could vanish

What Happened to Users?

Early adopters who bought in during the 2021 hype cycle saw big paper gains-at first. Some sold at peak prices and walked away with profits. But those who held? They got trapped. The token price crashed. Trading volume dried up. Rewards shrank to pennies per day. Then came the V2 migration. Many users didn’t understand how to move their tokens. Others tried and lost funds due to outdated guides. Support vanished. No chatbots. No help desk. No Discord moderators. Today, if you check SafeMoon on CoinMarketCap or CoinGecko, you’ll see a token with a market cap under $10 million and daily volume under $40,000. That’s not a crypto project. That’s a graveyard.

Is SafeMoon SWaP Still Working?

Technically, yes. The smart contract still runs. You can still buy SFMS on a few exchanges like DigiFinex and MEXC. You can still hold it. But the exchange itself? It’s dead. No new features. No upgrades. No team activity. No roadmap updates since 2022. If you’re thinking of buying SafeMoon now, ask yourself: why? What are you betting on? The reward system? It’s broken. The ecosystem? It’s gone. The team? They’re silent. The community? It’s scattered. There’s no future here. Not in 2026. Not in 2027. SafeMoon SWaP is a lesson, not an opportunity.What You Should Do Instead

If you want a decentralized exchange with real utility, try:- PancakeSwap - Low fees, active farming, strong community

- Uniswap - The largest DEX, trusted by institutions

- SushiSwap - Built on Ethereum, strong governance

Is SafeMoon SWaP still operational in 2026?

Technically, the SafeMoon SWaP smart contract still exists and tokens can be traded on a few exchanges like DigiFinex and MEXC. But the platform itself is no longer functional as a real exchange. There are no updates, no new features, no team activity, and no community support. It’s essentially a dead project with a lingering token.

Can I still earn rewards with SafeMoon SWaP?

Yes, but barely. The reflection system still pays out a small percentage of each trade to holders. However, with daily trading volume under $500,000, rewards are now negligible-often less than a few cents per day for large holders. The 80% APY claims from 2021 are long gone and were never sustainable.

Was SafeMoon a scam or just a failed project?

It’s hard to call it a scam in the legal sense, but it operated like one. The team marketed unrealistic returns, failed to deliver promised features, and disappeared after collecting millions in investor funds. Many analysts and users now classify it as a pump-and-dump scheme designed to enrich early insiders while leaving latecomers with worthless tokens.

Should I buy SafeMoon SFMS token now?

No. There is no functional exchange, no roadmap, no team, and no future development. Buying SafeMoon now is gambling on a dead asset. Even if the price rises slightly due to speculation, there’s no real utility or liquidity to support it. You’re likely to lose money over time.

What happened to the SafeMoon Wallet?

The SafeMoon Wallet was promoted as a secure storage solution for SFMS and other tokens. But it was never properly developed or audited. Most users who tried it reported crashes, slow performance, and lost funds during the V2 migration. The wallet app has been removed from app stores and is no longer supported.

Why did SafeMoon fail when other meme coins like Dogecoin survived?

Dogecoin had no fake promises. It was a joke that gained real cultural traction. SafeMoon, on the other hand, claimed to be a serious financial ecosystem with rewards, exchanges, and blockchains-but delivered none of it. Dogecoin didn’t charge 2% fees. It didn’t require migration. It didn’t vanish. SafeMoon’s downfall wasn’t because it was a meme-it was because it lied about its capabilities.

Are there any legal actions against SafeMoon?

As of early 2026, no formal legal action has been publicly filed against SafeMoon. However, regulators in the U.S. and Europe have increased scrutiny on projects with high fees, unrealistic yields, and no transparency. SafeMoon’s structure-relying on new investor money to pay old holders-matches the definition of a Ponzi scheme under financial law. Legal action could still come.

![What is BitTorrent [New] (BTT) Crypto Coin? A Clear Breakdown of How It Works and Why It Matters](/uploads/2026/02/thumbnail-what-is-bittorrent-new-btt-crypto-coin-a-clear-breakdown-of-how-it-works-and-why-it-matters.webp)