Trading Slippage Calculator

How Liquidity Affects Your Trades

Shido DEX has a 24-hour trading volume of just $3,930, which is significantly lower than major exchanges. This low liquidity creates high slippage - the difference between the price you see and what you actually pay.

Warning: Trading on exchanges like Shido DEX can result in significant slippage and losses. The calculator below demonstrates potential slippage based on typical low-liquidity conditions.

When you hear the name Shido DEX, you might think it’s another promising decentralized exchange like Uniswap or PancakeSwap. But the reality is far different. Shido DEX isn’t just small-it’s nearly invisible in today’s crypto market. With a 24-hour trading volume of just under $4,000, it doesn’t even register on the radar of serious traders. If you’re looking for liquidity, reliability, or real trading power, Shido DEX won’t deliver. But if you’re curious about what happens when a project launches with big promises and zero traction, this review will show you exactly why most people walk away.

What Is Shido DEX, Really?

Shido DEX is part of the Shido Network, a self-described Layer 1 blockchain platform that claims to offer "freedom to trade on your terms." It’s built to let users trade crypto directly from their wallets without a middleman-standard for decentralized exchanges. But unlike Uniswap, which supports thousands of tokens and billions in daily volume, Shido DEX only lists three coins and four trading pairs. The most active pair is USDC against a token with a long, messy contract address: 0x8CB... That’s not a sign of innovation. That’s a sign of neglect. The platform uses two native tokens: SHIDO and SHDX. They appear to be the same project under two names, likely due to rebranding or confusion in listing. CoinMarketCap added SHIDO in October 2024, and CoinGecko lists SHDX. But even with that visibility, the numbers don’t lie. The 24-hour volume is $3,930.38. That’s less than what a single whale might trade on Uniswap in five minutes. There’s no way to get in or out of a position without massive slippage. If you buy $100 worth of SHDX, you might end up paying $110 by the time the trade settles.Why the Price Is So Volatile

The token price swings are wild. In October 2024, SHDX dropped 24.6% in just seven days, while the broader crypto market only fell 4.2%. That’s not market movement-it’s panic. Some sources, like MEXC, claimed SHIDO had an 88% price spike in a prior month. But that kind of spike usually happens when a small group of people pump the token, then dump it on new buyers. That’s exactly what’s happening here. Changelly’s long-term forecast says SHIDO could hit $1.25 by 2050. That’s 25 years away. And even then, they’re predicting an average price of just $0.77 in January 2050. That’s not a roadmap-it’s a fantasy. Meanwhile, BeInCrypto’s technical analysis says the price is in a neutral trend, with no clear direction. No bullish signal. No breakout pattern. Just a token stuck in a dead zone.Zero Liquidity, Zero Trust

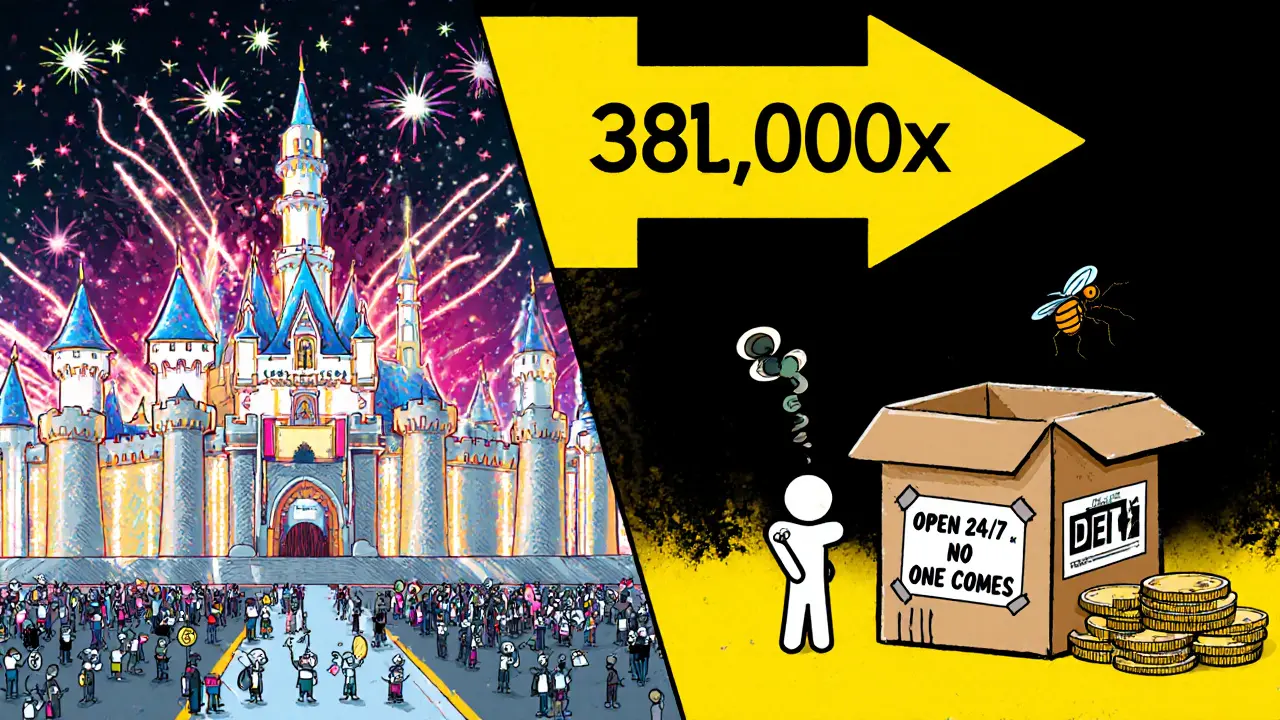

Liquidity is the lifeblood of any exchange. Without it, you can’t trade. Without deep order books, prices don’t reflect real value-they reflect whoever just clicked "buy". Shido DEX has $3,930 in daily volume. Uniswap does $1.5 billion. That’s a difference of 381,000 times. No trader with any experience would risk their capital here. Even small DEXs like SushiSwap or KyberSwap have daily volumes in the tens of millions. Shido DEX doesn’t even make the top 1,000 exchanges by volume. CoinGecko lists it, but there are no user reviews, no community ratings, no comments. Just a blank space where trust should be. The platform has 1,023 holders, according to CoinGecko. That’s fewer than a single Reddit thread about Dogecoin. Compare that to Uniswap, which has millions of unique wallets interacting with it every month.

Who’s Using It-and Why?

The only people using Shido DEX are speculators chasing hype. They’re drawn in by headlines like "Shido DEX integrates with CoinMarketCap!" That integration means nothing in practice. It just lets you see the price on CoinMarketCap. It doesn’t improve the exchange, add liquidity, or make trading easier. It’s a marketing tactic, not a technical upgrade. WEEX, a centralized exchange, says Shido DEX "may be listed in the future." That’s not a commitment. That’s a polite way of saying "we’re watching, but we’re not investing." There are no official guides, no tutorials, no Discord servers, no GitHub repos. If you get stuck trying to connect your wallet, you’re on your own. No customer support. No FAQs. No help center.Is There Any Real Value Here?

Let’s be blunt: no. Shido DEX offers nothing that existing DEXs don’t already do better. It doesn’t have lower fees. It doesn’t have faster transactions. It doesn’t have better security. It doesn’t even have a working community. The only "advantage" is that it’s a new token you can buy cheap-if you’re willing to risk losing it all. If you’re thinking of investing because of a 2050 price prediction, you’re not investing. You’re gambling. And you’re gambling on a project that doesn’t even have a functioning ecosystem. There’s no team profile. No whitepaper update. No roadmap beyond "we’re on CoinMarketCap now." That’s not innovation. That’s noise.

What Happens If You Try to Trade Here?

Let’s say you decide to give it a shot. Here’s what you’ll face:- You’ll need a Web3 wallet like MetaMask or Trust Wallet.

- You’ll have to find the Shido DEX contract address manually-there’s no official website link to trust.

- You’ll connect your wallet and swap USDC for SHDX.

- When you try to sell, you’ll notice the price jumps 15% just because you’re trying to move $50.

- You’ll wait minutes for your transaction to confirm, even though the network claims to be "fast."

- You’ll realize no one else is trading. Your order sits there, unfilled.

- By the next day, the price is down 10% again.

How It Compares to the Rest of the Market

| Exchange | 24H Volume | Trading Pairs | Active Holders | Community Presence |

|---|---|---|---|---|

| Shido DEX | $3,930 | 4 | 1,023 | None |

| Uniswap | $1.5B | 10,000+ | 10M+ | Large, active forums, GitHub, Discord |

| PancakeSwap | $800M | 5,000+ | 5M+ | Strong community, regular updates |

| Curve Finance | $400M | 2,000+ | 2M+ | Developer-focused, transparent |

Final Verdict: Avoid Unless You’re Speculating

Shido DEX isn’t a failure. It’s an afterthought. It’s a token with no utility, no liquidity, and no future. The CoinMarketCap integration didn’t save it. The price predictions won’t save it. The handful of holders won’t save it. If you’re looking for a decentralized exchange to trade on, go with Uniswap, PancakeSwap, or dYdX. They’re proven. They’re liquid. They have teams that respond to issues. They have communities that grow. If you’re just curious about Shido DEX, fine. Buy $10 worth of SHDX. See what it feels like to own a dead asset. But don’t call it an investment. Don’t call it a platform. Call it a warning.Is Shido DEX safe to use?

Technically, yes-if you understand the risks. Shido DEX runs on a blockchain, so transactions are immutable and don’t require a central authority. But safety isn’t just about technology. It’s about liquidity, community, and accountability. Shido DEX has none of those. If the project vanishes tomorrow, your tokens become worthless. There’s no team to contact, no support, no backup plan.

Can I buy SHIDO or SHDX on Binance or Coinbase?

No. Shido DEX tokens are not listed on any major centralized exchange like Binance, Coinbase, or Kraken. The only way to buy them is through the Shido DEX platform itself using a Web3 wallet. That means you need to already have crypto like USDC or ETH to swap. It’s a closed loop with no exit strategy.

Why does Shido DEX have two tokens, SHIDO and SHDX?

There’s no official explanation. It’s likely a rebranding mess or confusion between different listing platforms. CoinMarketCap lists SHIDO, while CoinGecko lists SHDX. They point to the same blockchain and same contract address. This inconsistency is a red flag. Legitimate projects don’t have two names for the same asset-it confuses users and erodes trust.

Is Shido DEX a scam?

It’s not a classic scam like a rug pull where the team disappears with funds. But it’s close. The project has no clear team, no roadmap, no updates, and no community. It’s a low-volume token with a flashy integration and zero substance. Most experts consider it a speculative dead end. If you’re buying it hoping for a return, you’re betting on luck, not logic.

What’s the best alternative to Shido DEX?

For spot trading, use Uniswap (Ethereum) or PancakeSwap (BSC). For futures, try dYdX or Hyperliquid. These platforms have deep liquidity, real user bases, active development teams, and transparent governance. You can trade thousands of tokens with minimal slippage. Shido DEX doesn’t even come close. Stick with platforms that have proven track records, not hype-driven tokens with no future.

Laura Hall

Bro just bought $50 of SHDX because the chart looked "cute" and now I’m watching it die slowly like a plant in a windowless room. No one’s trading, no one’s talking, and the website doesn’t even load right on mobile. I feel like I got scammed by a Discord bot.