Polygon vs Ethereum Gas Fee Calculator

Save Up to 98.7% on Gas Fees

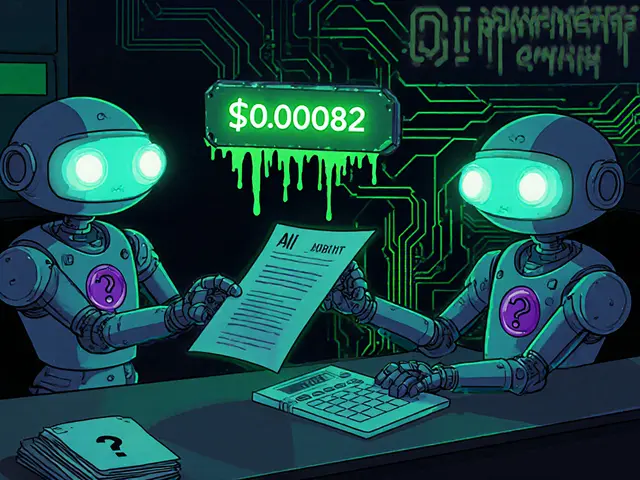

Compare trading costs between Polygon's QuickSwap and Ethereum's Uniswap. QuickSwap transactions cost just $0.00003 (0.0001 MATIC), while Ethereum can cost $10-$50 during peak times.

Your Savings

98.7%+There is no such thing as CookSwap - not in any credible database, not in any exchange listing, not in any blockchain audit report. If you're searching for CookSwap, you're either typing the wrong name or chasing a ghost. The platform you're probably looking for is QuickSwap, a well-established decentralized exchange built on Polygon that’s been quietly powering trades for over 5 years. This isn’t a fluke. QuickSwap has $487 million locked in its liquidity pools, processes $182 million in trades every day, and serves over a million users who want fast, cheap crypto swaps without a middleman.

What QuickSwap Actually Is

QuickSwap isn’t a traditional exchange like Coinbase or Kraken. You don’t deposit money, wait for verification, and click a button to buy Bitcoin. QuickSwap is a decentralized exchange (DEX) - meaning you trade directly from your wallet. No KYC. No account. No company holding your funds. You control your keys. You move your crypto. That’s the whole point. It runs on Polygon, which is a Layer 2 network built on top of Ethereum. Think of Polygon as a fast lane for Ethereum. While Ethereum’s main chain can cost $10-$50 in gas fees during peak times, QuickSwap lets you swap tokens for less than a penny. As of October 2025, the average transaction fee on QuickSwap is 0.0001 MATIC - roughly $0.00003. That’s 100 times cheaper than trading on Uniswap on Ethereum. QuickSwap launched in 2020 and is a fork of Uniswap V2. That means it uses the same automated market maker (AMM) model: instead of buy and sell orders, trades happen against pools of tokens locked by users. If you want to trade ETH for USDC, you’re not buying from someone else - you’re exchanging with a pool that already has both tokens in it. In return, people who add those tokens to the pool earn a cut of every trade.How QuickSwap Works - Step by Step

You don’t need to be a coder to use QuickSwap. But you do need a Web3 wallet. MetaMask is the most common. Here’s how it works:- Install MetaMask (or another wallet like Trust Wallet) and create a new wallet or import an existing one.

- Add the Polygon network to your wallet. Use chain ID 137, RPC URL https://polygon-rpc.com, and symbol MATIC.

- Get some MATIC for gas. You can buy it on Coinbase, Binance, or Kraken, then send it to your wallet. You need at least $0.10 worth to cover a few trades.

- Go to quickswap.exchange - yes, that’s the real site. Bookmark it. Scammers love fake domains.

- Click “Connect Wallet” and select MetaMask.

- Choose the tokens you want to swap. Type ETH, USDC, QUICK - it’ll auto-fill.

- Set your slippage tolerance. For stablecoins like USDC/USDT, use 0.5-0.8%. For volatile tokens like MEME coins, use 1.2-2%.

- Click “Swap” and confirm the transaction in your wallet.

That’s it. The whole process takes under a minute. Confirmations happen in about 2.4 seconds on average. You’ll see your tokens appear in your wallet almost instantly.

Why People Love QuickSwap

The biggest reason users stick with QuickSwap? Cost. One Reddit user, u/PolygonTrader, said they saved $387 in gas fees in a single month compared to using Uniswap on Ethereum. That’s not unusual. If you’re doing frequent trades - say, arbitrage, yield farming, or flipping new tokens - QuickSwap cuts your costs by 98.7% compared to Ethereum-based DEXes. It also has deep liquidity within the Polygon ecosystem. As of October 2025, QuickSwap supports 1,850 tokens - all on Polygon. The biggest pools are ETH/USDC (32.7% of total TVL), QUICK/ETH, and MATIC/USDC. If you’re trading Polygon-native tokens, this is the go-to place. The platform is also transparent. All code is open-source on GitHub. Smart contracts were audited by OpenZeppelin in August 2025 with no critical vulnerabilities found. The governance token, QUICK, gives holders voting rights on treasury spending, fee changes, and protocol upgrades. Over 1.35 million people hold QUICK tokens, making it one of the most widely held DeFi governance tokens.

Where QuickSwap Falls Short

But QuickSwap isn’t perfect. Here’s where it stumbles:- No fiat on-ramps - You can’t buy crypto with a credit card here. You need to get MATIC and tokens from a centralized exchange first.

- No stop-loss or limit orders - You can only do market swaps. If you want to buy ETH when it hits $3,200, you’re out of luck. You have to monitor the price yourself.

- No mobile app - The website works on mobile browsers, but there’s no dedicated app. That’s a problem for users who want to trade on the go.

- 72-hour bridge delays - If you’re moving assets from Ethereum to Polygon, you have to wait up to 72 hours for security checks. This isn’t QuickSwap’s fault - it’s Polygon’s design - but it’s frustrating if you need funds fast.

- Weak beginner support - 43% of Trustpilot reviews complain about lack of documentation. One user lost $120 because they set slippage too high and got front-run. There’s no live chat, no phone support, no email helpdesk. You’re on your own.

QuickSwap vs the Competition

Here’s how QuickSwap stacks up against its biggest rivals:| Feature | QuickSwap | Uniswap (Ethereum) | PancakeSwap | SushiSwap |

|---|---|---|---|---|

| Network | Polygon only | Ethereum | BNB Chain | Multi-chain |

| Avg. Fee | $0.00003 | $45 | $0.002 | $0.01 |

| TVL | $487M | $1.8B | $1.1B | $790M |

| 24H Volume | $182M | $1.2B | $420M | $155M |

| Tokens Listed | 1,850 | 4,200 | 2,100 | 3,900 |

| Fiat On-Ramp | No | No | No | No |

| Advanced Orders | No | No | No | Yes (via integrations) |

| Mobile App | No | No | Yes | Yes |

QuickSwap wins on cost and speed within Polygon. But if you need more tokens, deeper liquidity, or mobile access, Uniswap or PancakeSwap might be better. If you want advanced features like limit orders, SushiSwap’s integrations with DeFi platforms like Aave or Curve give it an edge.

Who Should Use QuickSwap?

QuickSwap is ideal if:- You trade mostly Polygon-based tokens (MATIC, QUICK, AAVE, etc.)

- You do frequent swaps and hate paying $20+ in gas fees

- You’re comfortable with self-custody and Web3 wallets

- You don’t need customer support or a mobile app

It’s not for you if:

- You’re new to crypto and want hand-holding

- You want to buy crypto with a credit card

- You need stop-losses or advanced trading tools

- You’re trading large amounts - QuickSwap’s average pool depth is $390,000, so big orders can slippage badly

What’s Next for QuickSwap?

QuickSwap isn’t standing still. In September 2025, they launched V3 - a major upgrade that lets liquidity providers concentrate their funds in tighter price ranges. This increased capital efficiency by 400%, meaning less money is tied up to get the same trading volume. They’ve also allocated $2.1 million from their treasury to boost USDT/USDC liquidity - a smart move as stablecoin trading dominates DeFi. The roadmap includes:- zk-Rollup integration by Q2 2026 - could slash fees another 90%

- Cross-chain swaps with Arbitrum and Optimism by Q4 2025

- Potential mobile app development (rumored, not confirmed)

Analysts are split. Coin Bureau gives QuickSwap an 85% chance of survival because of its tight focus. Delphi Digital says only 65% - warning that universal DEX aggregators like 1inch are eating into niche platforms.

Final Verdict

QuickSwap isn’t the biggest, flashiest, or most beginner-friendly DEX. But if you’re active on Polygon and care about saving money on gas, it’s one of the best tools you can use. It’s fast, cheap, secure, and backed by a strong community. Forget CookSwap. It doesn’t exist. QuickSwap does. And for thousands of users, it’s the only DEX they need.Is QuickSwap safe to use?

Yes, but only if you know what you’re doing. QuickSwap’s smart contracts were audited by OpenZeppelin and show no critical flaws. However, since it’s non-custodial, you’re responsible for your own security. If you send funds to the wrong address, lose your private key, or set slippage too high, there’s no one to help you. Always double-check addresses and use trusted wallets like MetaMask.

Can I use QuickSwap in the United States?

Yes, you can trade on QuickSwap from the U.S. - but you can’t participate in governance. In September 2025, the SEC classified the QUICK token as a security, which means U.S. users can’t vote on proposals or earn governance rewards. Trading, swapping, and providing liquidity are still allowed through non-custodial wallets.

How do I get MATIC for gas fees?

Buy MATIC on Coinbase, Kraken, or Binance, then send it to your MetaMask wallet. Make sure your wallet is set to the Polygon network before sending. You need at least $0.10 worth to cover a few swaps. Never send ETH or ERC-20 tokens to a Polygon address - you’ll lose them.

Why is my transaction failing on QuickSwap?

Most failures happen because of slippage settings. If the price moves between when you click “Swap” and when the transaction is confirmed, it will revert. For stablecoins, set slippage to 0.8%. For volatile tokens, use 1.2-2%. Also make sure you have enough MATIC for gas. If your wallet shows “insufficient funds,” you need more MATIC.

What’s the difference between QuickSwap and Uniswap?

QuickSwap runs on Polygon and costs pennies. Uniswap runs on Ethereum and costs dollars. QuickSwap supports about 1,850 tokens - all on Polygon. Uniswap supports over 4,200 tokens across 11 chains. If you’re trading Polygon tokens, QuickSwap is faster and cheaper. If you want access to more tokens or deeper liquidity, Uniswap is better - but you’ll pay more.

Does QuickSwap have a mobile app?

No, QuickSwap doesn’t have a dedicated mobile app. You can use it through your phone’s browser by visiting quickswap.exchange. The site is responsive and works fine on mobile, but it’s not as smooth as a native app. Some users report lag when switching between tokens or approving transactions.

How do I add liquidity to QuickSwap?

Go to the “Pool” tab on quickswap.exchange, click “Add Liquidity,” then select two tokens you want to pair (like ETH and USDC). You’ll need equal value in both tokens. After confirming, you’ll receive LP tokens representing your share of the pool. You’ll earn 0.25% of all trading fees from that pool. But be warned - if one token’s price changes drastically, you could lose value through impermanent loss.

![What is BitTorrent [New] (BTT) Crypto Coin? A Clear Breakdown of How It Works and Why It Matters](/uploads/2026/02/thumbnail-what-is-bittorrent-new-btt-crypto-coin-a-clear-breakdown-of-how-it-works-and-why-it-matters.webp)

Edward Phuakwatana

QuickSwap is the real MVP of Polygon 🚀 I’ve swapped over $15k worth of tokens on here and never paid more than 3 cents in gas. It’s like driving a Tesla through a toll-free highway while everyone else is stuck in a Model T paying $50 per exit. The devs are quietly building something beautiful - no hype, just utility. If you’re still using Uniswap on Ethereum, you’re literally throwing money into a black hole. 💸✨