Crypto Exchange India: What’s Legal, What’s Not, and Where to Trade in 2025

When you’re looking for a crypto exchange India, a platform where Indian residents can buy, sell, or trade digital assets like Bitcoin and Ethereum. Also known as Indian crypto trading platforms, it’s the bridge between your bank account and the global blockchain economy. It’s not just about finding the lowest fees—it’s about finding one that won’t get shut down tomorrow.

The story of crypto in India starts with the RBI crypto ban, a 2018 directive that forced banks to cut off services to crypto businesses. Also known as RBI banking restrictions, it crushed startups and scared away users for nearly two years. But in 2020, the Supreme Court crypto ruling, a landmark decision that overturned the RBI’s ban. Also known as Supreme Court crypto decision, it didn’t just restore access—it gave legitimacy to the entire industry. Since then, exchanges like WazirX, CoinDCX, and ZebPay have grown, but they’re still caught in a gray zone. The government hasn’t banned crypto, but it hasn’t fully embraced it either. Taxes are high, KYC is strict, and banks still treat crypto firms with suspicion.

What’s changed by 2025? A few things. The Indian crypto regulations, a patchwork of tax rules, reporting requirements, and licensing attempts. Also known as crypto law India, now require exchanges to verify every user and report large transactions to the tax department. You can’t use crypto to pay for groceries, but you can trade it legally. Some platforms now offer INR deposits via UPI, and others have partnered with fintechs to keep funds moving. But if you’re using a foreign exchange without KYC, you’re still at risk—both legally and financially.

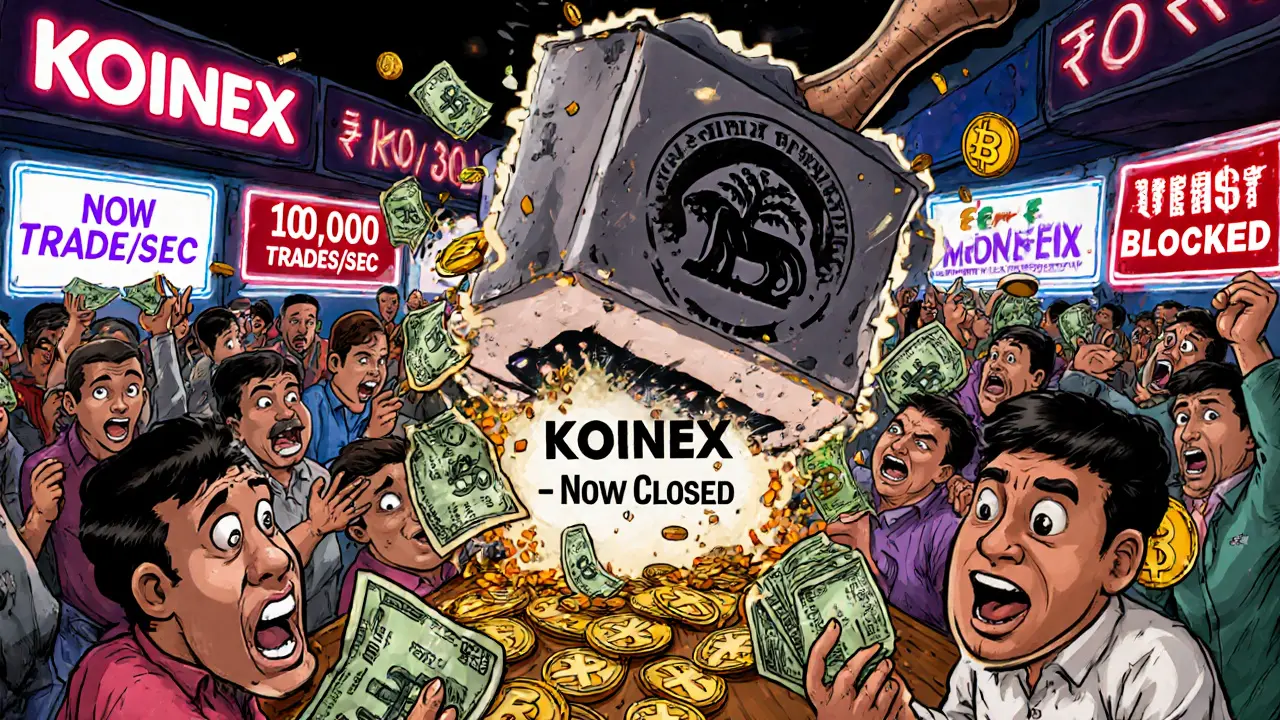

What you’ll find below isn’t a list of the "best" exchanges. It’s a collection of real stories from Indian traders—some who got locked out of their accounts, others who found loopholes, and a few who got scammed by fake platforms pretending to be local. You’ll see how people bypassed banking blocks, what happened after the RBI ban was lifted, and why some exchanges that looked safe turned out to be ghost towns overnight. This isn’t theory. It’s what actually happened on the ground in India’s messy, high-stakes crypto scene.