Scalability Blockchain: How Crypto Networks Handle Growth and Why It Matters

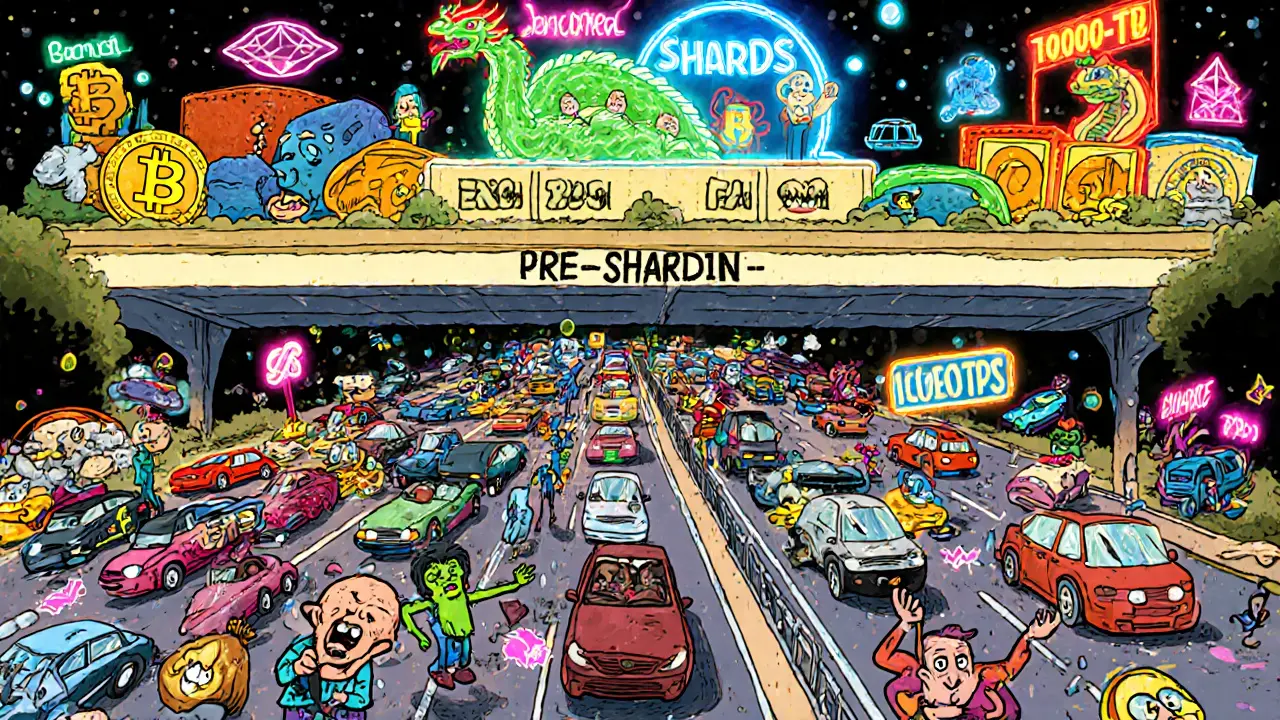

When we talk about scalability blockchain, the ability of a blockchain network to handle growing numbers of transactions without slowing down or becoming too expensive. Also known as blockchain throughput, it's what separates usable crypto from slow, costly experiments. Most blockchains were built to be secure and decentralized—but not fast. Bitcoin processes about 7 transactions per second. Ethereum used to do 15. That’s fine for digital gold, but useless if you want to pay for coffee or trade tokens in real time.

That’s where DeFi scalability, the ability of decentralized finance platforms to process trades, loans, and swaps quickly and cheaply comes in. Projects like NEAR Protocol and Arbitrum Nova aren’t just new chains—they’re fixes for the bottleneck. Ref Finance on NEAR lets users swap tokens for less than a penny because the underlying chain was built to scale from day one. Meanwhile, SushiSwap on Arbitrum Nova sits there with near-zero volume—not because people don’t want to use it, but because the network never attracted enough users to make it live.

Scalability isn’t just about speed. It’s about cost, reliability, and real adoption. Venezuela’s state-run mining pool? It’s slow because the government controls every node. Bangladeshis using VPNs to trade? They’re bypassing blocks, but the exchanges they reach still struggle with lag during spikes. Even airdrops like DSG or KCCSwap fail not because of scams, but because the underlying chains can’t support the load when people try to claim tokens.

Look at the winners: Harmony’s OpenSwap once had promise because it used sharding to split work across chains. COREDAX works for Korean traders because it’s built on a regulated, high-throughput backbone. Even the failed Flowmatic token collapsed not from bad code, but because its Solana-based infrastructure couldn’t handle demand without crashing.

Scalability blockchain isn’t a feature you add later. It’s the foundation. If a network can’t handle 10,000 transactions a second without fees spiking to $5, it’s not ready for mass use. The posts below show you exactly where this matters—whether it’s a DEX with no liquidity, a gaming token with no players, or an exchange that only works in one country because the global network is too slow. You’ll see which chains actually scaled, which ones pretended to, and why most airdrops and DeFi platforms end up as ghosts.