Tokenomics Red Flags: 7 Warning Signs You Can't Ignore in Crypto Projects

Learn the 7 critical tokenomics red flags that signal crypto project failure - from unlimited supply to fake utility - and how to avoid losing money on bad investments.

When you look at a new crypto token, you’re not just buying a coin—you’re betting on its tokenomics, the economic design behind how a cryptocurrency is created, distributed, and managed. Also known as token economy, it’s the hidden blueprint that decides if a project survives or collapses. Most people check the price chart. Smart investors check the tokenomics first.

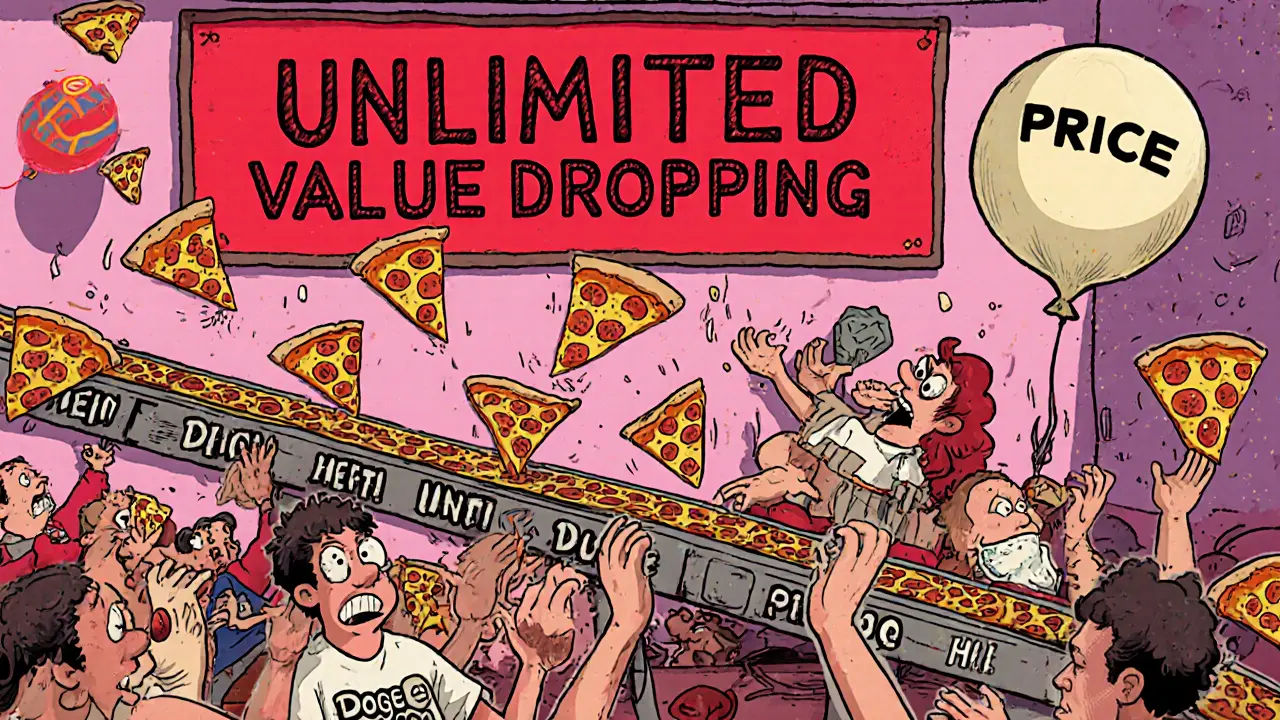

Bad tokenomics doesn’t just mean low value—it means the project was built to fail. Look for a token supply, the total number of coins ever created or available that’s absurdly high, like 420 trillion tokens. That’s not innovation, it’s a trick to make the price look cheap while hiding the fact that each token is worth almost nothing. Then there’s liquidity lock, a safety mechanism that prevents developers from pulling all the funds out of the trading pool. If the project doesn’t lock liquidity—or locks it for just 30 days—you’re one click away from a rug pull, when creators abandon the project and drain all the money. These aren’t rare mistakes. They’re the norm in 90% of the tokens that vanish within months.

Watch for teams that hide behind anonymous wallets, or tokens with zero trading volume but flashy marketing. Projects like Flowmatic ($FM), Project Quantum (QBIT), and TajCoin (TAJ) all looked promising on paper—until you dug into their tokenomics. No real users. No locked liquidity. No roadmap. Just a whitepaper and a tweet. Even airdrops like DSG and ACMD X CMC turned out to be ghosts after the initial hype. The ones that survive? They’re transparent. They lock liquidity for years. They cap supply. They have real usage, not just speculation. You don’t need to be a financial expert to spot these signs. You just need to ask: Who benefits if this token goes up? And who benefits if it crashes? If the answer is the same group of people, walk away.

Below, you’ll find real cases where tokenomics red flags turned into full-blown scams—Armoney, CreekEx, Woof Finance—and others where hidden truths killed the project before it even launched. These aren’t hypotheticals. They’re lessons from real losses. Learn them now, so you don’t become the next statistic.

26 June

Learn the 7 critical tokenomics red flags that signal crypto project failure - from unlimited supply to fake utility - and how to avoid losing money on bad investments.