Tokenomics Health Checker

Tokenomics Evaluation Tool

Check for critical red flags using the 7 warning signs from the article. This tool evaluates key metrics to help you spot dangerous tokenomics before investing.

Most people jump into crypto because they see a price chart going up. They hear about a new token, check its last 24-hour gain, and throw money in without asking how the token actually works. That’s how you lose money. The real story isn’t in the chart - it’s in the tokenomics. And if the tokenomics is broken, no amount of hype can save it.

Tokenomics is the economic design behind a cryptocurrency. It answers: How many tokens exist? Who controls them? How are they distributed? What’s their purpose? And most importantly - will they hold value over time? Projects with terrible tokenomics don’t fail because they’re hacked. They fail because their economy collapses from the inside out.

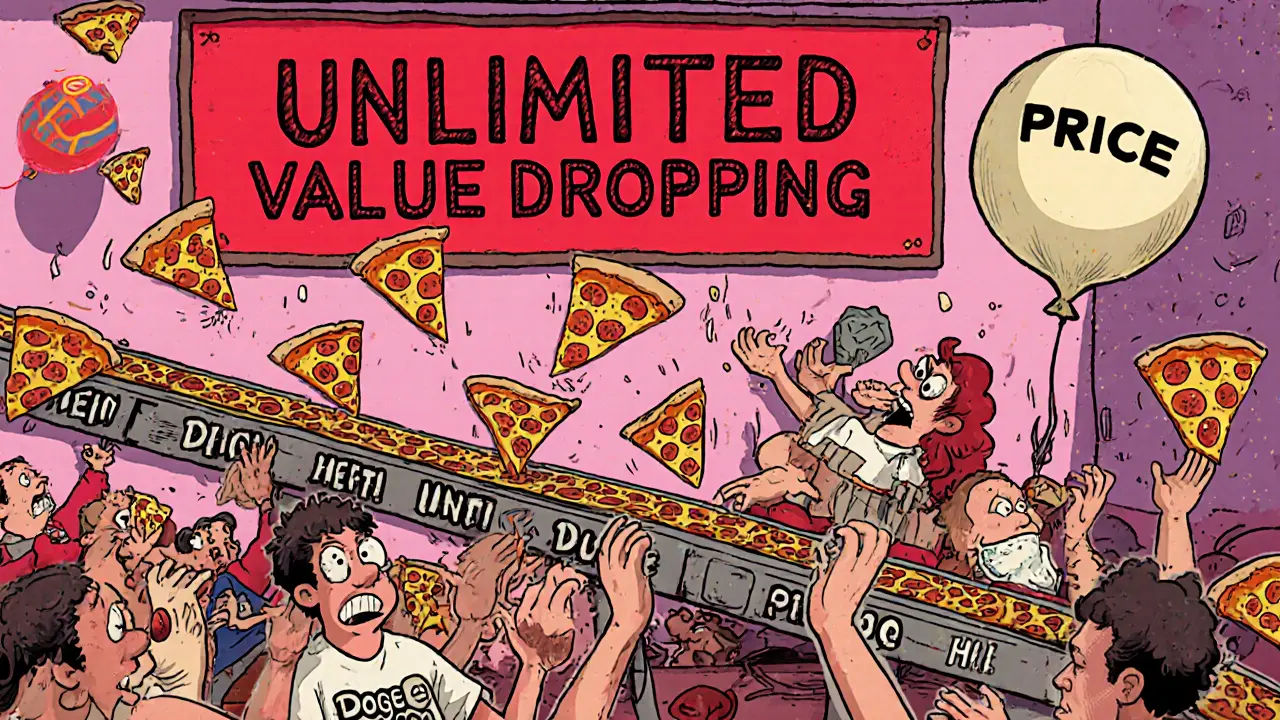

Unlimited Supply Without a Burn Mechanism

Imagine a pizza place that keeps making more pizzas every hour - but never stops. No matter how many you eat, there’s always more. Eventually, the value of each slice drops. That’s what happens with tokens that have unlimited supply.

Dogecoin is the classic example. It started as a joke, but its supply is infinite. Every year, new Dogecoins flood the market. Even with high demand, the constant inflation keeps the price low. Compare that to Ethereum, which introduced EIP-1559 in 2021. That update burns a portion of every transaction fee, effectively removing ETH from circulation. In some months, more ETH is burned than created - making it deflationary.

If a project doesn’t have a clear burn mechanism, or worse, doesn’t even list a max supply, treat it like a leaky bucket. No matter how much you pour in, it’ll never fill up. Check CoinMarketCap or CoinGecko. If the "Max Supply" field says "None" or "Unlimited," that’s a red flag. Not a dealbreaker - but a warning.

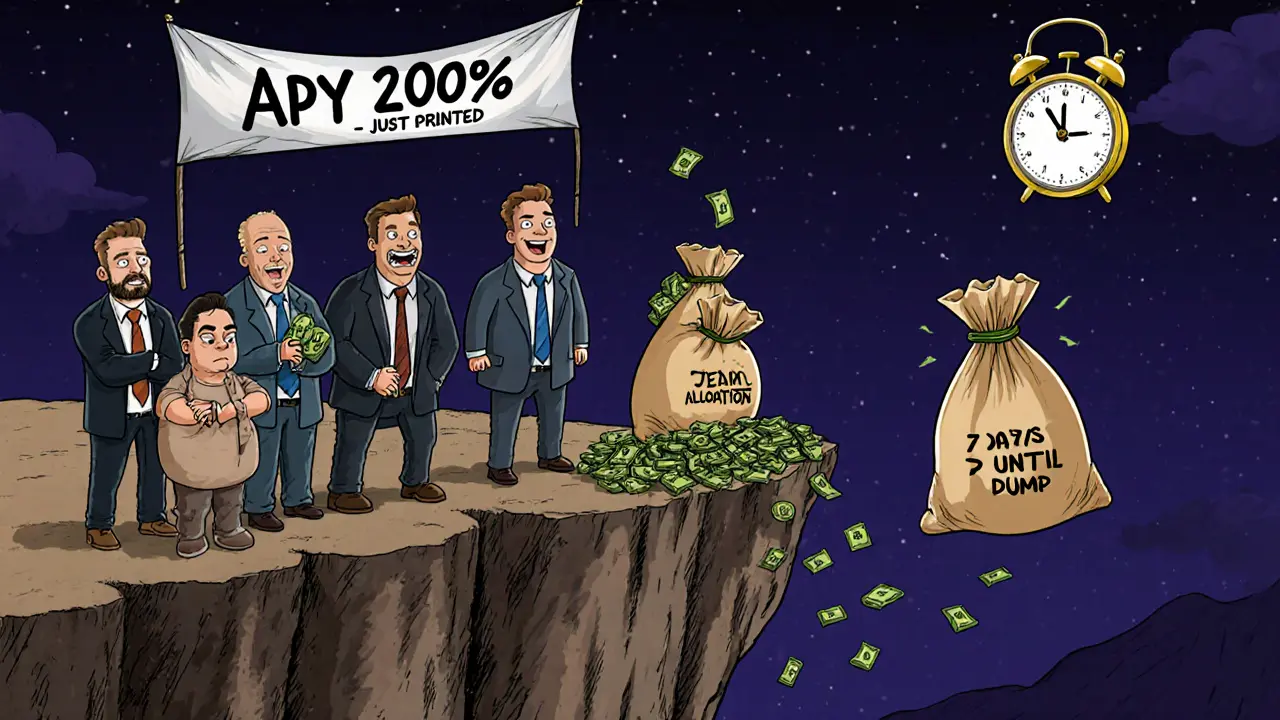

Insiders Get Too Much, Too Fast

Who owns the tokens before you do? If the team, private investors, or venture capitalists hold 30%, 40%, or even 60% of the total supply - and they can sell it all in 3 months - you’re not an investor. You’re the last person in line.

Healthy projects lock up insider tokens with vesting schedules. That means tokens are released gradually - say, 10% every 6 months over 3 years. This aligns incentives. The team has to build value over time to make their own tokens worth something.

Look for projects where the team’s allocation is under 15%, and vesting lasts at least 12 to 24 months. If you see a project where 20% of tokens unlock in the first week after launch? That’s a dump waiting to happen. The team already made their money. You’re just holding the bag.

No Real Use Case - Just Speculation

Why does this token exist? If the answer is "to make money," that’s not enough. Tokens need to do something. Pay for services. Access features. Earn rewards. Govern decisions.

Take Aave. Its token, AAVE, lets holders vote on protocol changes, earn fees from lending pools, and act as a safety buffer if loans go underwater. GMX uses its token to reward liquidity providers and share protocol revenue. These aren’t just tokens - they’re functional parts of a working system.

Now look at hundreds of new tokens that say they’re "the next big thing" but can’t explain what you actually do with them. They have a website with flashy animations and a Discord full of bots. But no utility. No revenue. No reason to hold beyond hoping someone else pays more tomorrow.

If you can’t explain the token’s role in 10 seconds, it probably doesn’t have one. And if it doesn’t have one, its price is purely driven by fear of missing out - which fades fast.

APYs Over 100% Are a Trap

"Earn 200% APY with our new token!" Sounds amazing. Until you realize that’s not a reward - it’s a Ponzi.

High yields are possible in crypto, but only if they’re backed by real revenue. For example, a decentralized exchange that charges 0.1% fees on every trade and distributes 50% of that to token holders? That’s sustainable. A project that pays out 150% APY by simply printing new tokens and giving them to early users? That’s unsustainable.

When the new money stops flowing - because no more people join - the yield collapses. Token prices crash. People panic-sell. The project dies. This has happened hundreds of times. In 2023, over 120 DeFi projects with APYs above 100% shut down within 6 months.

Ask: Where’s the revenue coming from? Is it from trading fees? Subscription payments? Licensing? Or just new investors buying in? If the answer is the latter, walk away.

Too Many Moving Parts - Over-Engineered Tokenomics

Some projects try to look smart by adding layers: minting, bonding, staking, farming, locking, boosting, compounding, tiered rewards, referral bonuses, NFT gates, and 10 different token types. It looks complex. It feels advanced. It’s a distraction.

Real innovation is simple. Think of Bitcoin: one token, fixed supply, mining rewards that halve. That’s it. Ethereum added staking and burning - two clean upgrades. That’s elegance.

Over-engineered tokenomics usually hides one thing: weakness. The team doesn’t believe their token has intrinsic value, so they build a Rube Goldberg machine to trick people into thinking it does. It’s like putting 17 filters on a blurry photo. The picture doesn’t get clearer - it just looks more complicated.

If the whitepaper reads like a user manual for a spaceship, be suspicious. The best token models are easy to explain. If you need a flowchart to understand it, it’s probably broken.

Weak or Nonexistent Governance

Who decides what happens next? If the team holds all the power - can change rules anytime, freeze wallets, redirect funds - then it’s not decentralized. It’s just a company with a token.

Strong tokenomics includes governance. Token holders vote on upgrades, fee structures, treasury spending, and emergency changes. The more tokens you hold, the more vote weight you have. That’s fair.

But if governance is controlled by a small group of addresses - or if the team can override votes - that’s a red flag. It means the token has no real ownership. You’re not a stakeholder. You’re a customer.

Check the project’s governance portal. Look at voting turnout. Are people actually participating? Or is every proposal passed with 99% approval from just three wallets? That’s not democracy. That’s control.

No Transparency - No Trust

Can you find the token contract on Etherscan? Is the supply publicly verifiable? Is the team’s wallet address listed? Are the vesting schedules published on-chain?

Projects that hide these details are hiding something. If you can’t verify the numbers yourself, you’re trusting strangers with your money. And in crypto, trust is the most expensive thing you can give.

Check the official whitepaper. Does it have a section titled "Tokenomics"? Does it include numbers? Charts? Timelines? Or does it just say "our token will be valuable"? If it’s vague, skip it.

Also look at the team. Are their names real? Do they have LinkedIn profiles? Have they worked on other blockchain projects? Anonymous teams are not a sign of privacy - they’re a sign of risk.

What to Do Instead

You don’t need to be an economist to spot bad tokenomics. Just ask five questions before investing:

- What’s the max supply? Is it capped or unlimited?

- How are tokens distributed? Are insiders locked up for over a year?

- What does the token actually do? Can I use it, or is it just for trading?

- Where does the APY come from? Is it sustainable, or just printing new tokens?

- Can I verify all this on-chain? Or am I relying on a website?

If even one answer makes you uncomfortable, walk away. The crypto market rewards patience. The biggest winners aren’t the ones who bought the hottest meme coin. They’re the ones who waited, studied, and invested only when the economics made sense.

Tokenomics isn’t sexy. It doesn’t trend on Twitter. But it’s the only thing that separates lasting projects from temporary noise. Learn it. Trust it. Let it guide you.

What is the most dangerous tokenomics red flag?

The most dangerous red flag is unlimited supply without a burn mechanism. It creates constant inflation, which steadily erodes the value of every token you hold. Even if demand rises, new tokens flood the market faster than value can grow. Projects like Dogecoin show this clearly - massive popularity, but persistent price stagnation because supply keeps growing. A capped supply with controlled emission is the bare minimum for any serious project.

Can a project recover from bad tokenomics?

Yes - but it’s rare. Ethereum is the only major example. It started with a simple, flawed model and later added EIP-1559 to burn transaction fees, turning it partially deflationary. That took years of community consensus and technical upgrades. Most projects can’t do this. Once trust is broken, users leave. Liquidity dries up. Even major changes often come too late. Don’t bet on a rescue. Avoid bad tokenomics from the start.

How do I check a token’s vesting schedule?

Look at the project’s official website or whitepaper for a token allocation breakdown. Then go to blockchain explorers like Etherscan or Solana Explorer. Search for the project’s treasury or team wallet addresses. Many projects lock tokens using smart contracts that show unlock dates. If the vesting isn’t on-chain, assume it’s not real. Tools like Token Terminal and Dune Analytics also track vesting schedules for major projects.

Is a low market cap always a red flag?

No. A low market cap just means the project is small. But combined with other red flags - unlimited supply, no utility, insider dumps - it becomes dangerous. Many low-cap tokens are pump-and-dump schemes. But some are undervalued early projects. Focus on the economic design, not the price. A $2 million project with controlled supply, real revenue, and locked team tokens is safer than a $50 million project with infinite supply and no transparency.

Should I avoid all new tokens?

No. The best opportunities often come from new projects. But don’t invest because of hype. Wait 30 to 60 days. See if the tokenomics holds up. Check if the team delivers on promises. Look at on-chain activity - are people actually using the protocol? Are tokens being burned? Is the APY sustainable? New doesn’t mean risky - but rushed investment does.

Michael Brooks

Unlimited supply without a burn is the quiet killer. People get hooked on the hype, but when the new coins keep flooding in, your holdings slowly turn into play money. Dogecoin’s still around because of meme power, not economics. Real projects need scarcity to create value. If you can’t find a max supply on CoinGecko, walk away. No exceptions.

Tokenomics isn’t sexy, but it’s the only thing that separates winners from the trash pile.