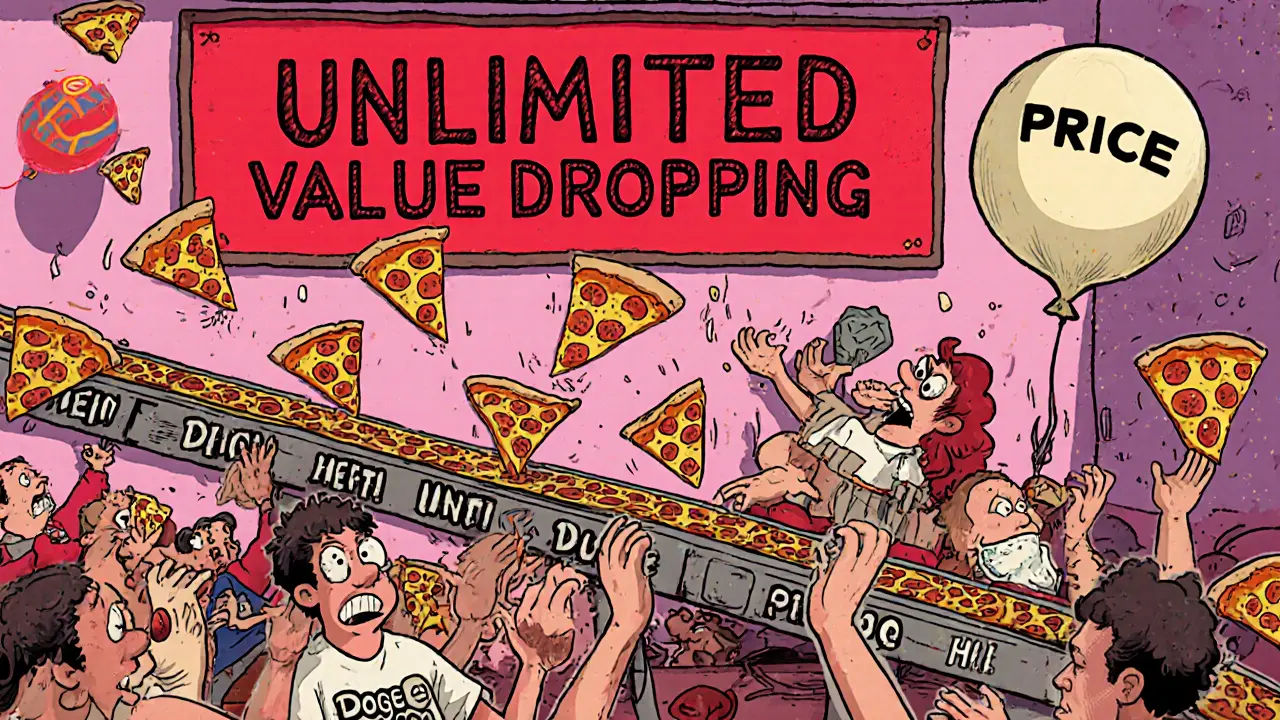

Tokenomics Red Flags: 7 Warning Signs You Can't Ignore in Crypto Projects

Learn the 7 critical tokenomics red flags that signal crypto project failure - from unlimited supply to fake utility - and how to avoid losing money on bad investments.

When you see a crypto project offering unsustainable APY, it’s usually a red flag wrapped in a shiny promise. An unsustainable APY, an artificially high annual percentage yield that can’t be maintained without burning through funds or attracting new investors isn’t a reward—it’s a countdown. These numbers don’t come from real revenue, smart code, or growing demand. They come from pumping new money in to pay old holders, a classic Ponzi structure dressed up as DeFi. You’ll see this in tokens with zero trading volume, no real users, and teams that vanish after the first big payout.

Projects like Flowmatic ($FM), a Solana-based DeFi token that collapsed due to zero liquidity and abandoned development, or Project Quantum (QBIT), a gaming token tied to an unlaunched game with no trading activity, are textbook examples. They lure people in with 500% APY, then disappear when the inflow slows. Even airdrops like DSG token, a token with zero circulating supply and no trading volume often come attached to these schemes. The same pattern shows up in fake exchanges like CreekEx and Woof Finance—high returns are used to mask the fact that there’s nothing behind them. If a platform can’t explain how it pays those returns without relying on new deposits, it’s not finance—it’s gambling with your principal.

Real yield comes from fees, usage, and sustainability. Ref Finance on NEAR pays under a penny per trade, but it’s alive because people actually use it. COREDAX in Korea works because it’s regulated and serves real traders. But when a token promises 1000% APY with no clear revenue model, it’s not innovation—it’s theft waiting to happen. The crypto space is full of these traps, especially around airdrops, new DEXs, and meme coins with no utility. You don’t need to chase the highest number. You need to ask: Who’s paying this, and why? Below, you’ll find real breakdowns of projects that promised too much and delivered nothing—plus the ones that actually worked. Learn how to tell the difference before your next investment turns into a loss.

26 June

Learn the 7 critical tokenomics red flags that signal crypto project failure - from unlimited supply to fake utility - and how to avoid losing money on bad investments.