Web3 Explained: What It Really Means and How It’s Changing Crypto

When people talk about Web3, the decentralized version of the internet built on blockchain technology that gives users control over their data and assets. Also known as web three, it’s not about faster websites—it’s about who owns them. Unlike Web2, where companies like Google or Meta hold your data, Web3 puts that power back in your hands using crypto wallets, smart contracts, and open networks. You don’t just use apps—you help run them.

This shift changes everything. DeFi, short for decentralized finance, lets you lend, borrow, and trade crypto without banks—think Ref Finance on NEAR, where you swap tokens for less than a penny in fees. DAOs, decentralized autonomous organizations, let groups make decisions together using tokens instead of votes, like the ones behind Bunicorn or Archimedes Protocol. And crypto exchanges, platforms where you buy and sell digital assets, are no longer just middlemen—they’re becoming community-run platforms, regulated in Korea, banned in Bangladesh, or tightly controlled in Vietnam. Web3 isn’t one thing. It’s a whole new system.

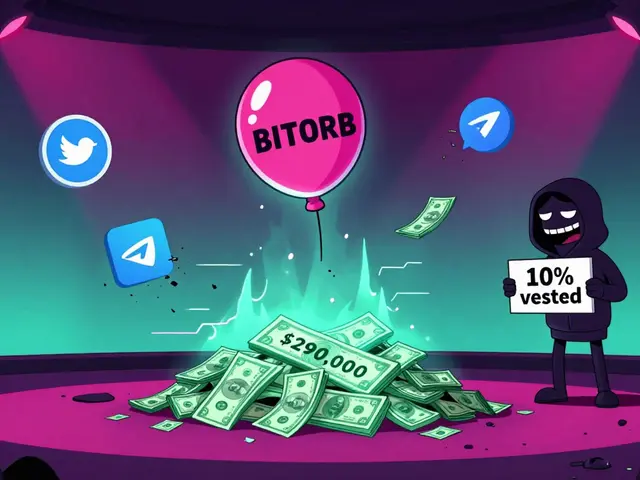

What you’ll find here isn’t theory. It’s real cases: exchanges that don’t exist (like CreekEx or Woof Finance), airdrops that vanished (ACMD, DSG), and tokens with no utility (Flowmatic, QBIT). Some projects pretend to be Web3 but are just hype. Others—like the ones built on NEAR or Arbitrum—are quietly changing how trading works. You’ll see how regulations in the UK, Indonesia, and Nigeria are forcing Web3 to grow up. You’ll learn why some airdrops are scams and others are your only shot at getting in early. This isn’t about future dreams. It’s about what’s happening right now, who’s getting left behind, and who’s actually building something real.