Whale Wallets: What They Are and How They Move the Crypto Market

When you hear about a crypto price crashing or surging out of nowhere, it’s often not random noise—it’s whale wallets, large cryptocurrency addresses that hold millions or even billions in digital assets. Also known as crypto whales, these wallets belong to individuals, funds, or institutions that own enough tokens to move markets with a single trade. Unlike regular traders who buy small amounts over time, whale wallets can dump 5% of a coin’s total supply in one click—and that’s enough to trigger panic selling or FOMO buying across the network.

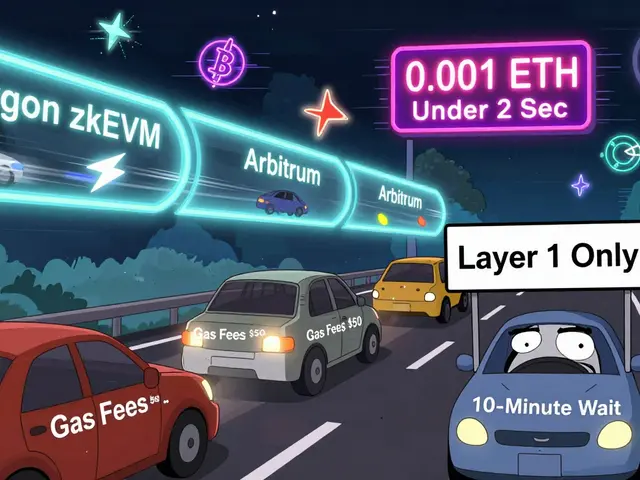

These wallets don’t just sit on their holdings. They’re constantly moving coins between exchanges, DeFi protocols, and multi-sig vaults. When a whale wallet starts transferring large sums to Binance or Kraken, it’s often a sign they’re preparing to sell. If they suddenly send tokens to a new wallet with no history, it could mean they’re locking up value or preparing for a long-term hold. Tools like Etherscan and Solana Explorer let anyone track these movements in real time, but most people don’t know what to look for. That’s why so many traders get caught off guard when a coin drops 20% overnight—because the whale already left the room.

Whale wallets also play a big role in market manipulation, the practice of artificially influencing crypto prices through coordinated buying or selling. Some use pump-and-dump schemes: they buy a low-cap coin, hype it on social media, then sell once retail traders jump in. Others use spoofing—placing huge buy orders that disappear before they’re filled, tricking others into thinking demand is rising. The more obscure the token, the easier this is to pull off. And yes, these tactics work—because most retail traders don’t check the on-chain data before buying.

It’s not all bad. Some whale wallets are long-term investors who help stabilize markets by holding through volatility. Others fund development, support liquidity pools, or back new projects. But the truth is, if you’re trading crypto without watching whale activity, you’re flying blind. You might think you’re making smart moves based on news or charts—but if a whale is quietly unloading, your strategy is already outdated.

In the posts below, you’ll find real examples of how whale wallets have impacted tokens like REF, ZEUS, and QBIT. You’ll see how a single transfer triggered a 40% crash, how a whale’s new wallet became a red flag for a fake airdrop, and why some so-called "meme coins" are just puppets controlled by a handful of addresses. These aren’t theories—they’re on-chain facts. And if you want to avoid getting squeezed, you need to know what to look for.