Xcalibra Exchange: What It Is, Why It’s Not Listed, and Where to Trade Instead

When you hear Xcalibra exchange, a name that appears in search results but has no official website, verified team, or trading volume. Also known as Xcalibra Crypto, it’s one of many fake exchange names designed to trick new traders into depositing funds that vanish overnight. This isn’t a glitch or a typo—it’s a red flag. Real exchanges like Kraken, Binance, or COREDAX publish clear company details, regulatory licenses, and customer support channels. Xcalibra has none of that. It’s a ghost name, built to look real long enough to steal money, then disappear.

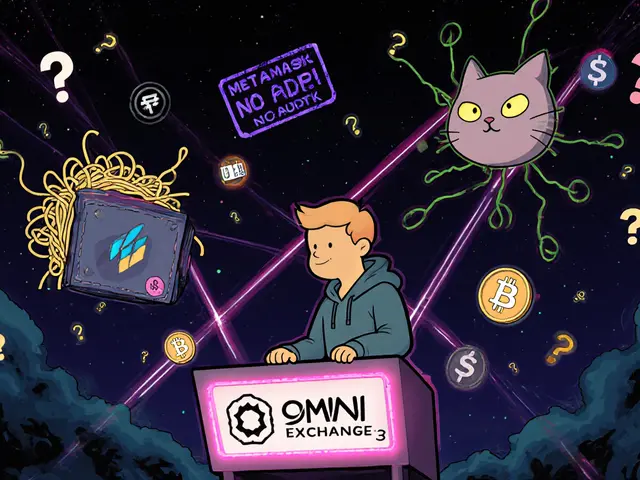

Scammers use names like Xcalibra because they sound technical and official. They copy fonts, colors, and layouts from real platforms. But if you dig deeper, you’ll find zero social media presence, no LinkedIn profiles for their "team," and no transaction history on blockchain explorers. It’s the same pattern you see with CreekEx, Woof Finance, and Armoney—all fake, all designed to drain wallets. These aren’t startups. They’re digital pickpockets. And they’re everywhere, especially targeting people who don’t know how to verify an exchange before signing up.

What makes this worse is that some sites link to Xcalibra as if it’s real. They might say "Xcalibra offers low fees" or "Xcalibra supports Bitcoin," but those claims are pulled from real exchanges and pasted onto fake pages. It’s identity theft for crypto platforms. You’re not just risking your money—you’re risking your private keys, your email, and your personal data. The only safe move is to avoid any exchange you can’t find on CoinGecko, CoinMarketCap, or a trusted review like the ones on MSB Labs. If it’s not listed on major trackers, it’s not trustworthy.

You don’t need to chase every new name that pops up. The best crypto exchanges don’t need flashy ads or mysterious branding. They earn trust through transparency, security audits, and real customer service. If you’re looking for a platform that works, check out what’s actually licensed in your country—like COREDAX for Korean traders or exchanges approved under HM Treasury rules in the UK. These platforms don’t hide. They publish their licenses, their compliance teams, and their audit reports. That’s the difference between a real business and a scam site pretending to be one.

Below, you’ll find real reviews of exchanges that actually exist—some regulated, some niche, some risky but honest about their flaws. You’ll also see how other fake names like Armoney and CreekEx were exposed, and what signs to watch for before you deposit a single dollar. No fluff. No hype. Just facts about what’s real and what’s rigged.