When a government bans cryptocurrency, it doesn’t make it disappear. It just pushes it underground - where prices don’t follow the charts you see on Coinbase or Binance. In places like China, Afghanistan, and Egypt, people still buy and sell Bitcoin and Ethereum. But they’re not paying the same price. They’re paying more. A lot more. And that gap? That’s the underground crypto premium.

What Exactly Is an Underground Crypto Premium?

An underground crypto premium is the extra amount people pay to buy Bitcoin or other digital assets when official exchanges are shut down, banned, or too risky to use. It’s the difference between the global market price and what you actually pay on a back-alley WhatsApp group, a hidden P2P app, or a cash-for-Bitcoin meetup in a parking garage.

Think of it like buying medicine in a country where it’s illegal. The drug hasn’t changed. The demand hasn’t dropped. But now you’re paying for secrecy, for risk, for someone willing to get caught. That’s the premium. In crypto, it’s often 10% to 40% higher than the global price - sometimes even more.

China: The Tightest Grip, the Biggest Risk

On May 30, 2025, China made history by banning personal ownership of all cryptocurrencies. Not just mining. Not just trading on exchanges. Holding Bitcoin in your wallet became a criminal offense. The government’s goal? Full control. The digital yuan is their answer - a state-monitored currency with no anonymity, no decentralization, no escape.

But people still want Bitcoin. So they find ways. Some use offshore wallets. Others trade cash for crypto through trusted contacts. A few use decentralized exchanges like Uniswap or PancakeSwap, routing transactions through VPNs and privacy tools.

There’s no official data on premiums in China - the government doesn’t release numbers on black markets. But insiders in Shenzhen and Guangzhou report that Bitcoin trades at 15-25% above global rates. Why? Because the risk is real. Police raids on crypto holders have increased. Phones are seized. Wallets are frozen. People face fines, detention, even prison.

That risk gets priced in. Every time someone pays extra for Bitcoin, they’re paying for safety. For silence. For a chance to keep their money away from the state.

Afghanistan: Religion, Fear, and Cash Deals

In Afghanistan, the Taliban banned crypto in 2022. Their reasoning? Crypto is haram - forbidden under Islamic law. They also fear losing control over the economy. With the country’s banking system in ruins, the Taliban wants to make sure every dollar flows through their system.

But cash is scarce. Remittances from abroad have dropped. Many Afghans rely on crypto to get money from family overseas. So they trade anyway. In Kabul’s backstreets, you’ll find men exchanging USD for Bitcoin in alleyways, using Telegram bots to confirm transfers before handing over cash.

Because of the extreme risk - arrests, confiscations, public shaming - premiums here are believed to be among the highest in the world. Estimates from underground traders suggest Bitcoin trades at 30-50% above global prices. Monero, a privacy coin, commands even higher premiums because it’s harder to trace.

It’s not just about money. It’s about survival. For many, crypto is the only way to send money to relatives or buy food without going through a government-controlled bank.

Other Banned Places: Egypt, Nigeria, and the Shadow Network

Egypt banned crypto trading in 2023. But by 2025, authorities had arrested 112 people for violating the ban. That’s not a sign the ban is working - it’s a sign people are still trading.

Nigeria’s EFCC seized $38 million in crypto in 2024. That sounds like a crackdown. But it’s also proof that crypto is flowing - and flowing in large amounts. People aren’t stopping. They’re just getting smarter.

Across these countries, the pattern is the same: strict laws, aggressive enforcement, and persistent demand. The result? A thriving underground market where premiums are the norm, not the exception.

Why Premiums Happen: The Three Rules of Black Market Crypto

There are three reasons underground crypto prices rise - and they’re all rooted in basic economics.

- Supply is limited. Legitimate exchanges are blocked. Banks won’t touch crypto. ATMs don’t exist. That means fewer sellers. Fewer sellers = higher prices.

- Risk costs money. If you’re caught trading, you could lose your wallet, your phone, your freedom. Sellers factor that in. They charge more to cover the chance they’ll get arrested or fined.

- Liquidity is low. On Binance, you can sell $10,000 of Bitcoin in seconds. In an underground market? You might wait days to find a buyer. That waiting time? It costs you. Buyers pay extra to get their crypto fast.

These aren’t theories. They’re how every black market works - from cigarettes in the 1920s to opioids today. Crypto is just the newest item on the list.

Technology Lets the Underground Survive

You can’t ban technology. That’s why underground crypto markets still exist.

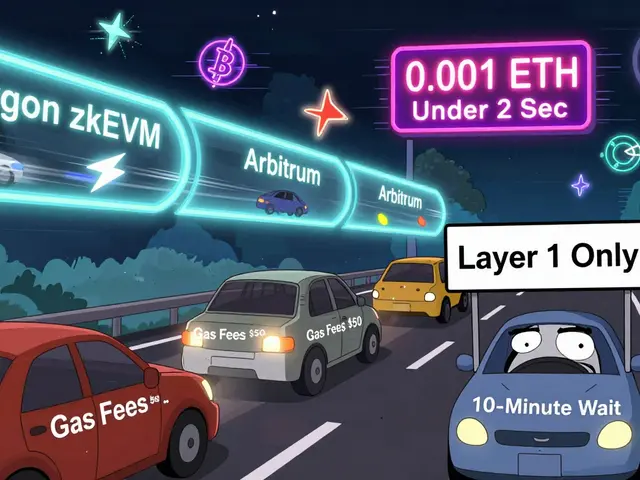

Decentralized exchanges like Uniswap and SushiSwap don’t need banks. They run on blockchain. You don’t need to sign up. You don’t need ID. You just need a wallet and a connection.

Peer-to-peer apps like LocalBitcoins and Paxful still work - even in banned countries - because they connect buyers and sellers directly. Some users use Tor browsers, mixers, or privacy coins like Monero to hide their trail.

And cross-border transfers? They’re the lifeline. Someone in the U.S. sends Bitcoin to a friend in Egypt. That friend sells it for cash locally. The sender loses 5% in fees. The receiver pays 20% extra. But they still come out ahead compared to the official banking system.

Enforcement Isn’t Perfect - And That’s the Problem

Not every country enforces its crypto ban the same way.

In South Africa, 12 crypto firms lost their licenses in 2025 for failing AML checks. In the Philippines, 20 exchanges were blacklisted. These are strong moves. But they don’t stop people. They just push them further underground.

In countries with weak enforcement - like parts of Africa or Central Asia - premiums are lower because the risk is lower. In places with high surveillance - like China or Egypt - premiums spike because the cost of getting caught is too high.

Corruption also plays a role. In some places, police turn a blind eye if you pay them. That lowers the real risk. And lower risk? Lower premium.

What About India and Brazil? They’re Not Fully Banned - But Still Pushing People Underground

India doesn’t ban crypto. But it makes it painful. In 2024, the Financial Intelligence Unit fined crypto firms $9.5 million for not following rules. That’s not a ban. It’s a squeeze.

Brazil fined 57 ICOs in 2024. Colombia saw an 40% jump in suspicious transaction reports in just six months.

These aren’t bans. But they’re close. When compliance costs soar - KYC forms, bank account freezes, tax audits - people start looking for easier paths. That’s where underground markets grow.

Even in legal countries, the system can feel so broken that people choose the shadows.

The Bigger Picture: Why This Matters

Underground crypto premiums aren’t just about price. They’re about freedom.

When a government bans crypto, it’s not just stopping transactions. It’s stopping people from controlling their own money. It’s telling them: you can’t hold wealth outside our system.

But money doesn’t care about borders or laws. It flows. And when it’s blocked, it finds a way - at a higher cost, yes. But still, it flows.

Every premium paid in China, Afghanistan, or Egypt is a vote. A quiet, risky, dangerous vote for financial autonomy.

And as long as people want control over their money - and governments keep trying to take it away - underground crypto markets will keep growing. And so will the premiums.

What’s Next?

The global regulatory landscape is changing fast. The Financial Action Task Force says 99 countries are updating their crypto laws in 2025. More bans. More rules. More fines.

But technology moves faster than governments. Decentralized finance, privacy coins, and P2P networks are getting better, cheaper, and harder to stop.

So while the bans may look strong on paper, they’re becoming more like speed bumps - not roadblocks.

The real question isn’t whether crypto will survive in banned countries.

It’s how high the premium will go before the system cracks.

Are underground crypto premiums legal?

No. Underground crypto trading is illegal in jurisdictions that ban cryptocurrency. Paying a premium doesn’t make it legal - it just makes it more dangerous. People who participate risk fines, asset seizure, or imprisonment.

How do people actually buy crypto in banned countries?

Most use peer-to-peer (P2P) platforms like LocalBitcoins or Telegram groups to connect with sellers. They pay in cash, mobile money, or bank transfers. Some use decentralized exchanges (DEXs) with VPNs to avoid detection. Privacy coins like Monero are popular because they’re harder to trace.

Is Bitcoin more expensive in China than elsewhere?

Yes, according to insider reports from traders in southern China. Bitcoin trades 15-25% above global prices due to the high risk of being caught. Since personal ownership became illegal in May 2025, the premium has grown as supply has shrunk and fear has increased.

Why do some countries ban crypto if people still use it?

Governments ban crypto to maintain control over money, prevent capital flight, and push their own digital currencies. China wants everyone to use the digital yuan. Afghanistan wants to enforce religious rules. But banning something doesn’t erase demand - it just drives it underground, where it becomes harder to regulate.

Do underground crypto markets ever collapse?

Not really. History shows that when a government bans something people want - alcohol in the U.S., drugs in many countries - the market doesn’t vanish. It adapts. Underground crypto markets are resilient because they rely on decentralized tech, global networks, and human need. As long as people want financial freedom, these markets will survive - even if they’re risky.

Gavin Francis

This is wild man. People paying 50% extra just to hold Bitcoin? That's not a market, that's a survival tactic. 🤯