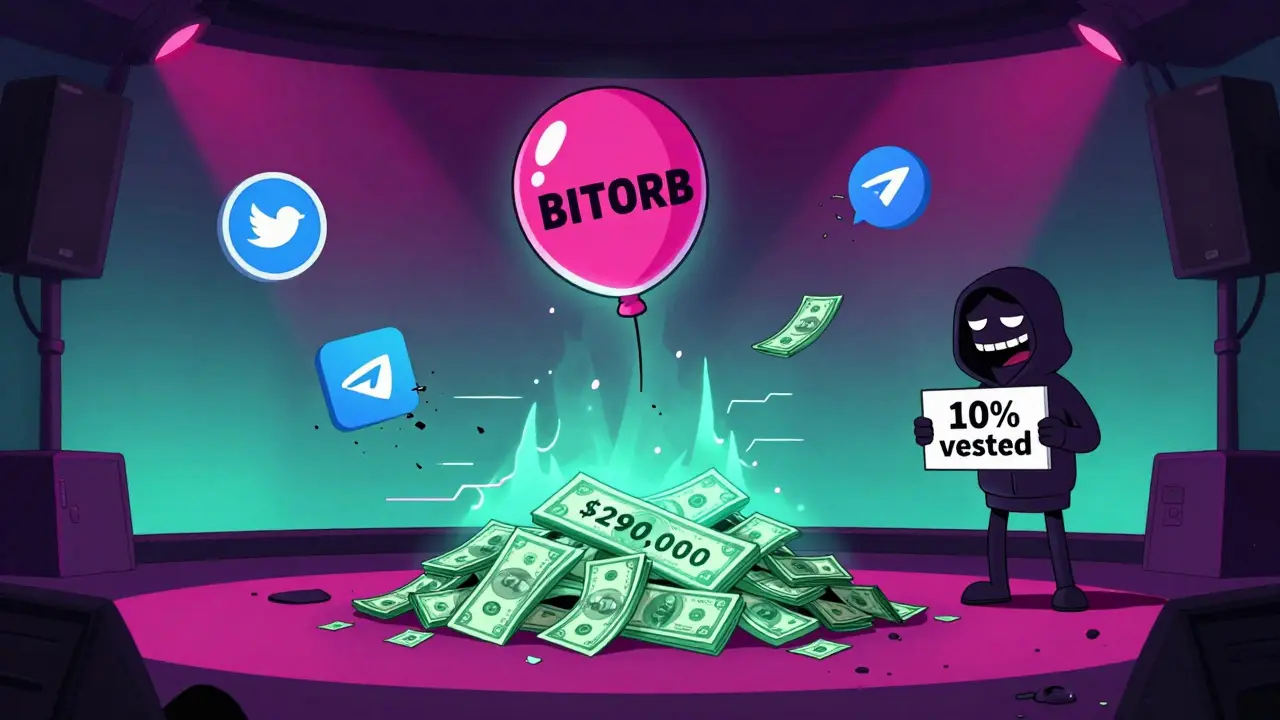

BitOrbit (BITORB) launched its IDO on November 4, 2021, through BSCPad - one of the bigger launchpads on Binance Smart Chain at the time. It raised $290,000 across six funding rounds, including an airdrop for early supporters. But here’s the thing: today, its market cap sits at just $2,830. That’s not a typo. You read that right. A project that raised nearly $300,000 is now worth less than the cost of a decent gaming laptop. What went wrong? And what can you learn from it if you’re thinking about joining the next airdrop?

How the BitOrbit Airdrop Actually Worked

The BitOrbit airdrop wasn’t a free giveaway like some projects promise. It was part of a multi-phase fundraising structure. To qualify, you had to complete specific tasks: join their Telegram, follow them on Twitter, submit your wallet address, and sometimes hold a minimum amount of BSCPad’s native token (BSP). These were standard requirements back in 2021 - nothing unusual. Once you qualified, you got a portion of the total BITORB token supply allocated to early community members. The project distributed 10% of tokens at launch, with the rest locked up. The remaining 90% followed a linear vesting schedule: a one-month cliff, then 22.5% released each month for the next four months. That’s actually a smart move. It was designed to stop whales from dumping all their tokens on day one. But here’s the catch - it didn’t matter how well the vesting was structured if no one cared about the project after launch.Why BitOrbit Chose BSCPad

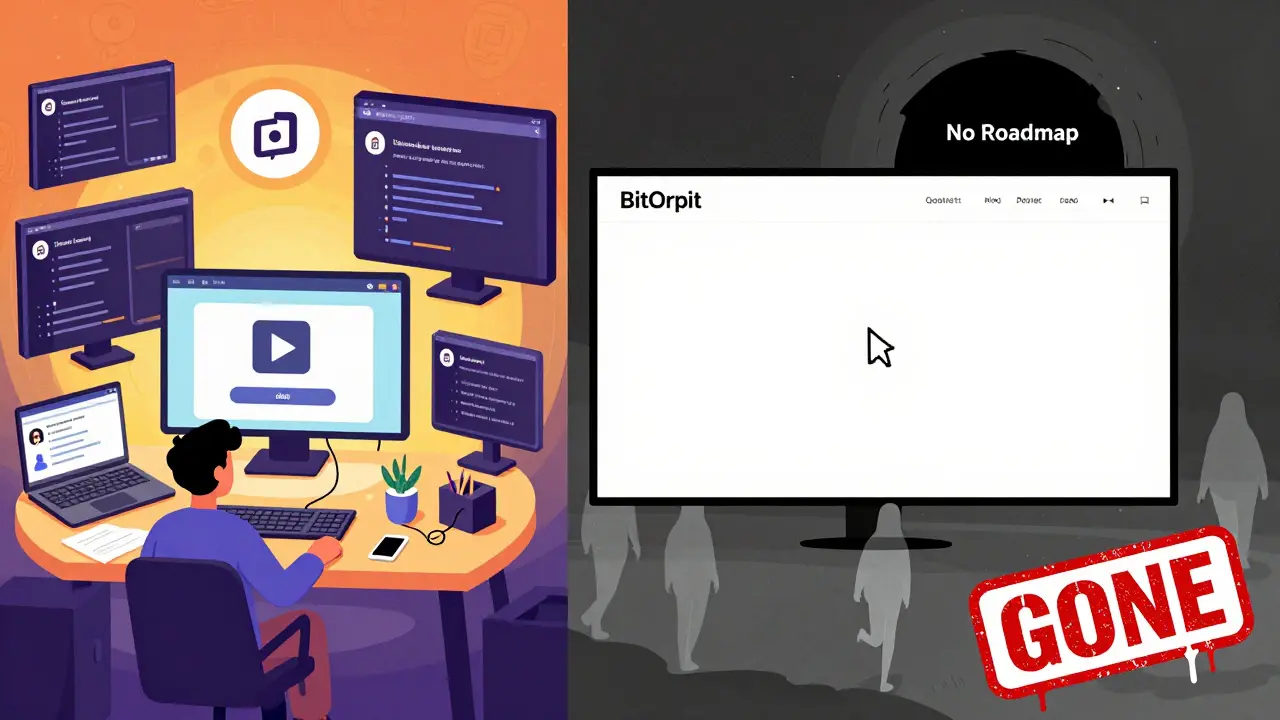

BSCPad was a top-10 IDO launchpad in 2021. It had a solid reputation, especially for projects on Binance Smart Chain. It offered a streamlined process: register, pass KYC, connect your wallet, fund your participation, and claim tokens. BitOrbit’s choice made sense - BSCPad had lower fees than Ethereum-based launchpads and faster transaction times. But BSCPad wasn’t just a gateway. It was a filter. Projects had to meet basic criteria to get listed. That doesn’t mean they were safe. It just meant they weren’t completely random. The problem? BSCPad didn’t guarantee success. It only guaranteed access. BitOrbit cleared the bar to launch - but that’s not the same as clearing the bar to survive.The Numbers Don’t Lie: $290K Raised, $2.8K Left

Let’s break this down. BitOrbit raised $290,000. That’s real money. That’s enough to hire developers, run marketing campaigns, build a website, and pay for audits. So why is the market cap now under $3,000? There are only two real answers: either the token price dropped 99%+ from its initial value, or almost no one is trading it. The truth is probably both. When the token launched, early buyers likely sold fast. Without a strong use case, no real product, and no clear roadmap, there was nothing to hold onto. People bought because they thought they’d get a quick flip. When the flip didn’t happen, they left. Compare that to top-performing IDOs from 2021. Some projects delivered 18x returns. BitOrbit didn’t even hit 1x after the initial hype faded. The market didn’t just ignore it - it moved on.

What BitOrbit Lacked (And What Successful Projects Had)

Successful IDOs in 2021 didn’t just rely on airdrops and launchpad listings. They had:- A working product - not just a whitepaper

- A team with verifiable experience

- Clear utility for the token - not just “for governance”

- Active community engagement beyond Telegram

- Post-launch development updates

The Bigger Picture: How IDOs Changed After 2021

2021 was the wild west of crypto fundraising. Anyone could launch a token, run an airdrop, and get listed on a launchpad. Today? It’s a different world. Modern launchpads like DAO Maker and GameFi now require:- Third-party smart contract audits

- Locked team tokens (often 2+ years)

- Proof of product traction (beta users, active dApps)

- Regulatory compliance checks

- Realistic tokenomics with clear vesting and burn mechanisms

What You Should Do Before Joining Any Airdrop

If you’re considering jumping into the next airdrop - whether it’s BitOrbit’s successor or something brand new - here’s what to check before you commit:- Is there a working product? Look for a live dApp, a demo video, or a GitHub repo with recent commits. No code? Red flag.

- Who’s behind it? Find the team. LinkedIn profiles? Past projects? Anonymous teams are a huge risk.

- What’s the token for? Does it actually do something? Or is it just “for governance” and “community rewards”? Real utility means staking, fees, access, or discounts - not just voting.

- What’s the vesting schedule? If the team gets 20% of tokens unlocked at launch? Run. If they’re locked for 2 years? That’s a good sign.

- Is there post-launch activity? Check their Twitter, Discord, and blog from the last 6 months. Are they still talking? Or did they go silent after the airdrop?

Final Reality Check

BitOrbit didn’t fail because of bad luck. It failed because it was built to be launched - not to last. The airdrop got attention. The IDO got funding. But without substance, there was no reason for anyone to stay. This isn’t just a story about one failed token. It’s a lesson for anyone thinking crypto airdrops are free money. They’re not. They’re entry tickets to a game where most players lose. The real winners are the ones who do the homework. If you want to make money in crypto, don’t chase the next airdrop. Chase the next real project. One with code, with people, and with a plan that outlasts the hype.Was BitOrbit (BITORB) a scam?

There’s no evidence BitOrbit was a rug pull or intentionally fraudulent. It raised funds, launched tokens, and followed the technical process. But it also had no product, no team visibility, and no post-launch development - which is the hallmark of a project that was never meant to succeed. It’s not a scam; it’s a ghost project.

Can I still claim BitOrbit tokens from the 2021 airdrop?

Technically, yes - if you still have the wallet address you used during the 2021 campaign and the tokens were sent to it. But there’s no active platform to claim them now. The BSCPad listing is gone, and the official website no longer supports token claiming. Even if you have the tokens, they’re worth less than $0.0001 each - essentially worthless.

What happened to BSCPad after BitOrbit’s launch?

BSCPad continued operating and even expanded to support other chains like Polygon and Avalanche. It’s still active today, but it’s no longer the dominant launchpad it was in 2021. Many users have moved to DAO Maker, Polkastarter, and GameFi, which now offer better vetting, higher success rates, and more reliable post-launch support.

How do modern airdrops differ from BitOrbit’s?

Modern airdrops are more selective. They often require staking tokens, holding NFTs, or completing multi-step engagement tasks. They’re also tied to projects with live products, active teams, and clear tokenomics. Unlike 2021, where you could join a Telegram group and get free tokens, today’s airdrops are rewards for real participation - not just signing up.

Should I avoid all IDOs after BitOrbit’s failure?

No - but you should be smarter. BitOrbit failed because it had no substance. Many successful IDOs since then have delivered real returns. The difference isn’t the launchpad - it’s the project. Focus on teams with track records, working products, and transparent development. Skip anything that sounds like “get rich quick.”

Jacob Lawrenson

This is why I only do IDOs with live dApps and team LinkedIn profiles now. No more guessing games. 🚀