Finance in Crypto: Understand Money, Exchanges, and Real-World Value

When you think about finance, the system that manages money, investments, and risk in digital assets. Also known as crypto economics, it's not just about buying coins—it's about knowing where your money goes, who controls it, and whether you’re truly safe. Most people jump into crypto thinking it’s a get-rich-quick scheme, but real finance in this space is about control, transparency, and long-term thinking. If you’re using a crypto exchange like AstralX crypto exchange, a platform offering high-leverage trading with thousands of assets, you need to ask: Is this just flashy numbers, or does it actually protect your funds?

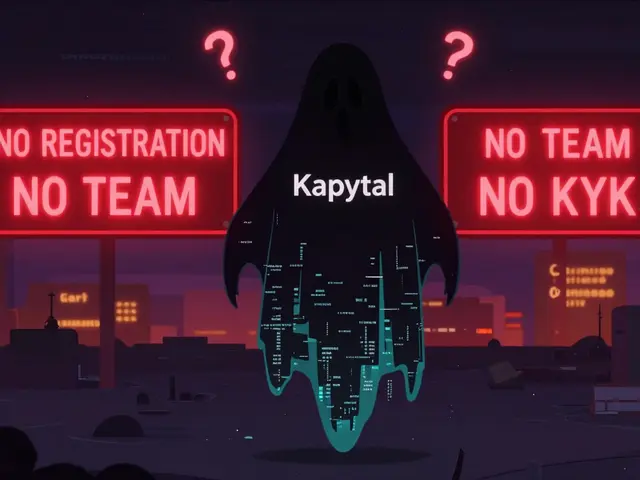

Finance in crypto isn’t the same as traditional banking. There’s no FDIC insurance, no central bank backing you up. Instead, you rely on things like regulated crypto exchange, a platform that follows government rules to prevent fraud and money laundering, and proof of reserves. But here’s the catch: many exchanges claim to be regulated, yet skip the most important step—public audits. That’s why AstralX’s lack of third-party verification is a red flag, no matter how many assets they offer or how high their leverage looks. Regulation without proof is just a label. Real finance means you can see where your money is, not just be told it’s safe.

What you’re really looking for in crypto finance is trust you can verify. That means checking if an exchange holds the coins it says it does, if it’s been hacked before, and if its team has a track record. It’s not about the number of trading pairs or the speed of withdrawals—it’s about who’s watching the vault. The posts below dig into exactly that: real reviews of platforms like AstralX, what regulators actually care about, and how to tell the difference between a legit exchange and a marketing stunt. You’ll find no fluff, no hype—just what works, what doesn’t, and why it matters for your money.