Norway Crypto Mining Tax Calculator

How the Norway Mining Tax Works

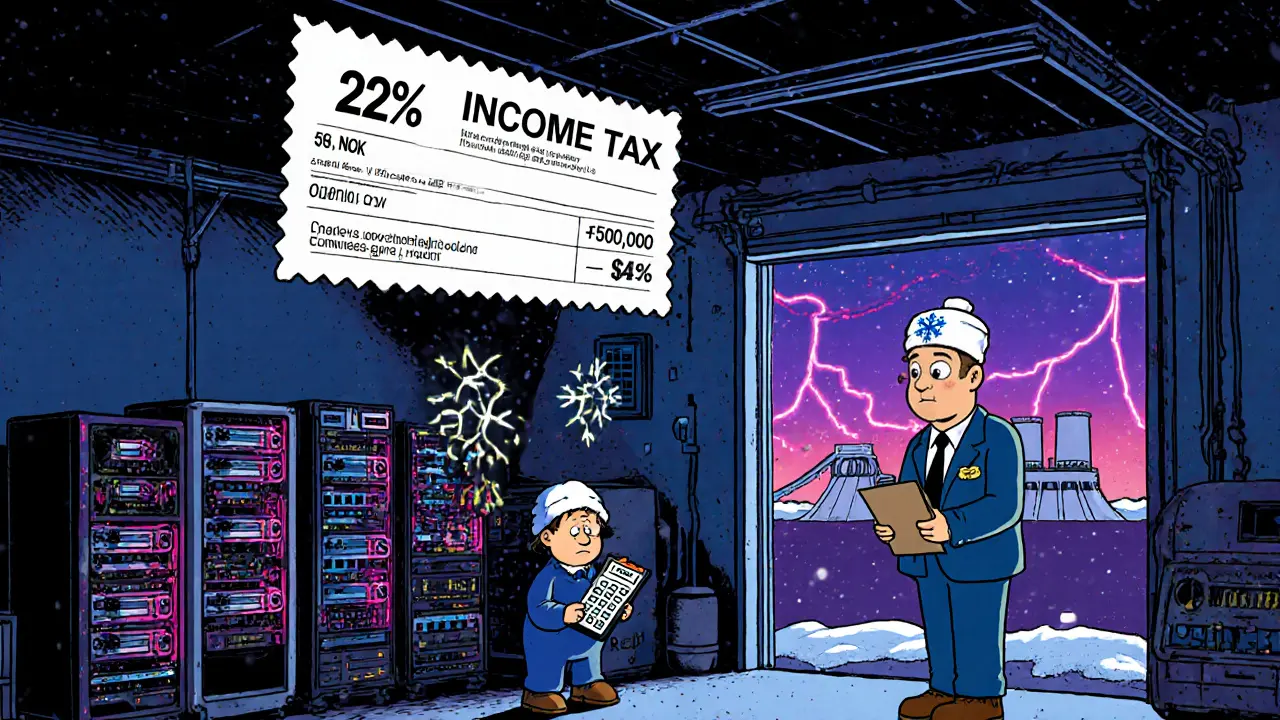

Norway taxes crypto mining income at a flat 22% rate on the value of rewards when received. You can deduct electricity costs and depreciate equipment at 30% annually.

When you hear about countries cracking down on crypto mining, you might think of China’s 2021 ban or Kazakhstan’s sudden electricity restrictions. But Norway? It’s not shutting down miners. It’s not removing tax breaks. And it never had them to begin with.

There’s a myth going around that Norway used to give crypto miners special tax incentives-and then pulled them. That’s not true. No such incentives ever existed. What you’re seeing now isn’t a rollback. It’s just the rules, plain and simple.

How Crypto Mining Is Taxed in Norway Today

If you’re mining Bitcoin, Ethereum, or any other cryptocurrency in Norway, you pay income tax on what you earn. Not capital gains. Not a special crypto rate. Just regular income tax-at a flat 22%.

Here’s how it works: every time your mining rig solves a block and you get rewarded in Bitcoin or another coin, that reward becomes taxable income the moment it hits your wallet. You don’t wait until you sell it. You don’t wait for the price to go up. You report the value in Norwegian kroner (NOK) based on the market price at the exact time you received it.

Let’s say you mine 0.1 BTC on March 15, 2025, and the price of Bitcoin is 580,000 NOK. You owe tax on 58,000 NOK of income. That’s 12,760 NOK in taxes-right there, upfront.

And it’s not just mining. Staking, airdrops, DeFi rewards-all treated the same way. If you get crypto for doing something, it’s income. Simple.

What You Can Deduct (And What You Can’t)

Here’s where Norway actually makes mining a bit easier: you can deduct your business costs.

You can write off:

- Miners (ASICs, GPUs)

- Electricity bills

- Internet and cooling systems

- Software and maintenance

For equipment, you don’t deduct the full cost in one year. Instead, you depreciate it at 30% per year. So if you buy a new Antminer S21 for 150,000 NOK, you can claim 45,000 NOK as a deduction this year, 31,500 NOK next year, and so on.

Electricity is fully deductible as a direct operating cost. That’s important-because Norway’s electricity isn’t cheap. Even with renewable energy, industrial rates for miners average around 0.15-0.20 NOK per kWh. A large mining operation can easily burn through 5-10 million NOK in power per year.

And if you’re part of a mining pool or cooperative? Each participant claims their share of deductions equally. No tricks. No loopholes.

Why People Think Tax Incentives Were Removed

So where did the idea come from that Norway removed tax incentives?

It’s confusion. People see Norway as a crypto-friendly country-low taxes on capital gains? Renewable energy? High-tech infrastructure?-and assume that must mean special treatment for miners. But Norway doesn’t give out tax breaks like coupons. It treats crypto mining like any other business: you earn income, you pay tax, you deduct costs.

Some international media outlets misreported Norway’s stable tax rules as a "policy shift" after the country tightened energy reporting requirements in 2024. That wasn’t a tax change. It was better tracking. The Tax Administration started asking mining companies to submit monthly energy usage reports to ensure electricity use was properly accounted for. This helped prevent fraud, not punish miners.

There was no incentive to remove. Just transparency added.

How Norway Compares to Other Countries

Let’s put this in context.

In the U.S., crypto mining is taxed as ordinary income, but you can deduct expenses and even use Section 179 to write off equipment in full the first year. Some states like Texas and Georgia offer cheap power and no state income tax-making them mining hotspots.

In Germany, mining income is tax-free if held for over a year. In El Salvador, it’s completely untaxed under Bitcoin law. In Russia, miners must register as legal entities and pay 13-25% tax, depending on structure.

Norway? 22% flat income tax. Deductible expenses. No special treatment. No exemptions. No hidden perks.

It’s not the cheapest place to mine. But it’s one of the most predictable. No sudden tax hikes. No surprise bans. No regulatory whiplash.

What Miners Need to Report

Every year, by April 30, Norwegian crypto holders must file their tax returns and list all cryptocurrency holdings as of December 31 of the previous year.

For miners, that means:

- Reporting all mining rewards received during the year (by date and value)

- Listing equipment purchases and depreciation schedule

- Submitting electricity cost records

- Declaring any crypto sold, traded, or spent during the year (subject to 22% capital gains)

The Norwegian Tax Administration (Skatteetaten) doesn’t just trust your word. They can request transaction logs from exchanges, blockchain analytics tools, and even energy provider data. If your mining operation suddenly shows up as consuming 2.5 GWh/year but you claimed only 500,000 NOK in electricity costs? That’s a red flag.

Keep detailed records. Use software like Koinly or CoinTracker. Export your wallet history. Save receipts. This isn’t optional-it’s mandatory.

Is Mining Still Worth It in Norway?

Yes-but only if you’re serious.

Norway’s electricity is 98% renewable, mostly hydro and wind. That’s a huge advantage for sustainability-focused miners. The grid is stable. The legal system is clear. The government doesn’t chase you down. But the tax rate isn’t low.

Here’s a realistic example:

- Monthly mining revenue: 250,000 NOK

- Electricity cost: 80,000 NOK

- Equipment depreciation: 20,000 NOK

- Other costs: 10,000 NOK

- Taxable income: 140,000 NOK

- Tax owed (22%): 30,800 NOK

- Net profit: 109,200 NOK

That’s a 44% net margin after tax. Not bad. But it’s not a get-rich-quick scheme. You need scale, efficiency, and discipline.

Small-scale miners-those running a few GPUs in their garage-are barely breaking even after electricity and hardware wear. Norway’s rules don’t crush them. But they don’t help them either.

What’s Next for Crypto Mining in Norway?

Don’t expect a tax cut. Don’t expect a ban. Norway’s approach is consistent: treat crypto like any other asset. Tax income. Tax gains. Allow deductions. Enforce reporting.

The country’s crypto mining sector contributes about 0.5% to GDP and uses roughly 1% of national electricity. That’s small enough to be ignored by politicians. But large enough to be regulated.

The next big change won’t be tax-related. It’ll be environmental. Norway is part of the EU’s Carbon Border Adjustment Mechanism (CBAM). While mining isn’t directly targeted, if the country’s energy grid faces pressure from industrial demand, miners could see higher electricity prices-or mandatory efficiency standards.

For now, the rules are clear. No incentives. No removals. Just taxes, deductions, and paperwork.

If you’re mining in Norway, you’re not getting a handout. You’re running a business. And that’s exactly how the government wants it.

What Miners Should Do Now

Don’t wait for a tax break that doesn’t exist. Don’t assume Norway will change its mind. Here’s what to do instead:

- Track every mining reward with exact date and NOK value

- Log all equipment purchases and calculate 30% annual depreciation

- Save monthly electricity bills under your business name

- Use crypto tax software to auto-generate reports

- File your return by April 30, 2026, for 2025 earnings

And if you’re thinking of starting? Don’t look for tax loopholes. Look for cheap power, reliable hardware, and a long-term plan. Norway won’t give you a subsidy. But it won’t get in your way either.

Did Norway remove tax incentives for crypto mining?

No, Norway never had tax incentives for crypto mining. The idea that incentives were removed is a misconception. Miners have always paid 22% income tax on mining rewards, with deductions allowed for equipment and electricity. There was no special tax break to take away.

Is crypto mining legal in Norway?

Yes, crypto mining is fully legal in Norway. It’s regulated by the Norwegian Tax Administration, which treats mining as a business activity. There are no bans, no restrictions on equipment, and no licensing requirements for individuals or companies.

How much tax do crypto miners pay in Norway?

Miners pay a flat 22% income tax on the Norwegian krone (NOK) value of mining rewards at the time they are received. This applies to Bitcoin, Ethereum, and all other cryptocurrencies. Capital gains from selling mined coins are also taxed at 22%.

Can I deduct electricity costs for mining in Norway?

Yes, electricity costs are fully deductible as a business expense. You can also depreciate mining equipment at 30% per year. Keep detailed records of your power usage and equipment purchases-these are required for tax filings.

Do I need to report my crypto holdings in Norway?

Yes. Every Norwegian resident must report all cryptocurrency holdings as of December 31 each year when filing their tax return by April 30. This includes mined coins, staking rewards, and any crypto held in wallets or exchanges.

Michael Heitzer

Let me tell you something real: Norway isn’t giving out handouts because they don’t believe in them. Mining is a business, not a welfare program. You show up with hardware, you pay for power, you report your income - that’s capitalism with a conscience. No subsidies, no gimmicks, just clean energy and clean books. That’s why I respect it. Other countries play games with tax loopholes and then panic when the crypto market shifts. Norway? They just keep the lights on and the ledgers balanced.