Bitcoin Volatility: Why It Moves So Much and What It Means for You

When you buy Bitcoin, a decentralized digital currency that operates without a central bank or single administrator. Also known as BTC, it's the original cryptocurrency and still the most traded asset in the space. You’re not just buying a coin—you’re signing up for wild rides. Bitcoin volatility isn’t a bug; it’s a feature. Prices can jump 10% in a day, sometimes more. That’s not normal for stocks, gold, or real estate. It’s normal for Bitcoin. And if you don’t understand why, you’re setting yourself up to panic-sell at the worst time.

That volatility comes from a mix of factors: low liquidity compared to traditional markets, news-driven hype, whale movements, regulatory rumors, and even memes. Unlike a company’s stock, Bitcoin doesn’t have earnings reports or dividends. Its value is built on trust, adoption, and fear of missing out. When Elon Musk tweets about Dogecoin, Bitcoin feels it. When the SEC says something about crypto ETFs, Bitcoin reacts. And when a major exchange gets hacked—like what happened with Koinex or CreekEx—traders rush for the exits. These aren’t isolated events. They’re part of the system.

That’s why you’ll see posts here about crypto exchange restrictions, government policies that limit how people can buy, sell, or hold digital assets in Nigeria, Vietnam, or Bangladesh. When a country cracks down, Bitcoin’s price often dips. When a new exchange like COREDAX launches in Korea with proper licensing, it can spark a rally. And when a project like Flowmatic or Project Quantum collapses, it reminds everyone: not every crypto is built to last. Bitcoin stands out because it’s survived all of this—bans, scams, crashes, and hype cycles.

But here’s the thing: volatility isn’t just risky. It’s also where the opportunities hide. People who understand it don’t try to predict every swing. They prepare for them. They use tools like dollar-cost averaging. They avoid putting all their money in one meme coin like Pepes Dog (ZEUS) or TajCoin (TAJ), which have zero fundamentals and extreme volatility. They know Bitcoin’s swings are noisy, but they’re also predictable in pattern—boom, bust, consolidation, repeat. If you’re trading, investing, or just holding, you need to know this rhythm.

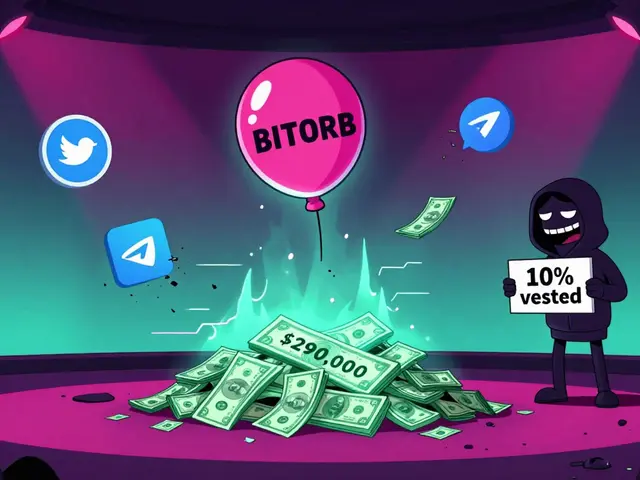

Below, you’ll find real stories from people who’ve been burned, saved, or learned the hard way. From airdrops that vanished overnight to exchanges that vanished with your funds, these posts aren’t theory. They’re lessons from the front lines of crypto. Whether you’re trying to reduce taxes abroad, understand DAO governance, or just figure out if you should hold through the next dip—this collection gives you the context you need to make smarter moves. No fluff. No hype. Just what actually happened.