Crypto Regulation India: What’s Legal, What’s Banned, and Where Traders Stand in 2025

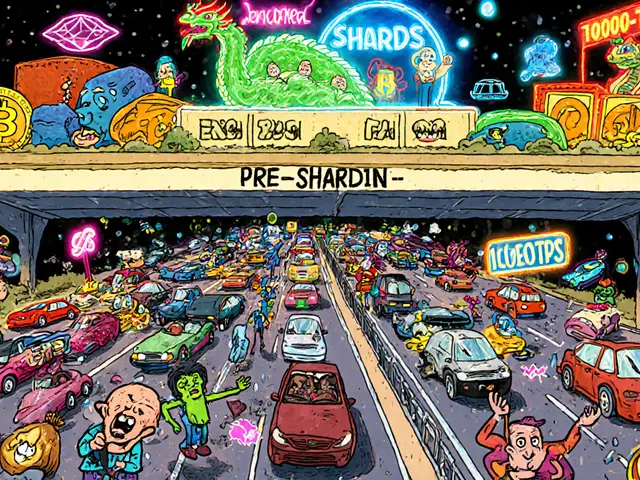

When it comes to crypto regulation India, the legal framework governing cryptocurrency use, trading, and taxation within India. Also known as Indian cryptocurrency laws, it’s no longer about whether crypto is allowed—it’s about how carefully you can use it without triggering scrutiny. After the 2018 RBI ban and years of legal back-and-forth, India didn’t outlaw crypto in 2025. Instead, it put it under the microscope. The government now treats digital assets as taxable property, not currency, and requires all exchanges to register with financial authorities.

That shift changed everything. RBI crypto ban, the 2018 central bank directive that forced banks to cut ties with crypto businesses. Also known as RBI circular on virtual currencies, it’s dead now—but its shadow still lingers. Many banks still treat crypto clients with suspicion, making it harder to deposit INR or withdraw profits without extra paperwork. Meanwhile, crypto exchanges India, licensed platforms like WazirX, CoinDCX, and ZebPay that comply with KYC and tax reporting rules. Also known as Indian crypto trading platforms, they now operate under strict AML guidelines and must report all transactions over ₹10,000 to the Income Tax Department. If you’re trading on an unregistered app or using a VPN to access Binance, you’re playing with fire—even if the platform itself isn’t illegal.

And then there’s the tax angle. cryptocurrency taxation India, the 30% flat tax on crypto gains, plus 1% TDS on every trade, introduced in 2022 and still in force in 2025. Also known as crypto income tax rules India, it’s one of the strictest in the world. Unlike in the U.S. or Europe, there’s no capital gains distinction—every trade, even swapping one coin for another, triggers a tax event. No deductions. No offsets. Just 30% of your profit, gone. That’s why so many Indian traders are now looking at peer-to-peer deals, using USDT to avoid INR exposure, or even moving funds offshore through legal residency changes.

The truth? Crypto isn’t banned in India—it’s just expensive, tracked, and tightly controlled. You can buy, sell, and hold. But if you’re not keeping records, paying taxes, and using a licensed exchange, you’re not just risking fines—you’re risking legal action. The government isn’t chasing small-time holders. But if you’re moving large sums, running a business, or using DeFi platforms without reporting, you’re on their radar. And with AI-powered transaction monitoring tools now used by tax authorities, hiding activity is harder than ever.

What you’ll find below are real stories from Indian traders who’ve navigated this maze. From the shutdown of Koinex after the RBI ban, to how people now use VPNs to access global platforms, to the rise of local exchanges that play by the rules. You’ll see what happened with the DSG token airdrop that vanished overnight, why Woof Finance turned out to be a scam targeting Indian users, and how some are legally reducing their crypto tax burden by relocating. This isn’t theory. It’s what’s happening right now, on the ground, in India’s crypto scene.