Crypto Scam: How to Spot Fake Exchanges, Empty Airdrops, and Abandoned Tokens

When you hear about a new crypto scam, a deceptive scheme designed to steal your crypto funds or trick you into paying for worthless assets. Also known as crypto fraud, it’s not just phishing emails or fake websites—it’s entire platforms built to look real until your money vanishes. In 2025, crypto scams have gotten smarter. They copy real exchange names, use fake testimonials, and even create fake YouTube reviews. The goal? Get you to deposit funds, sign a wallet connection, or join a "limited-time" airdrop that never delivers.

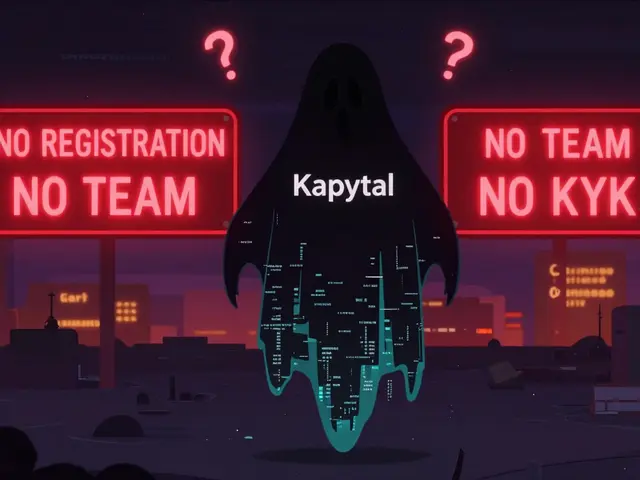

One common type is the fake crypto exchange, a platform that looks like Binance or Coinbase but doesn’t exist as a licensed business. Examples like CreekEx and Woof Finance were designed to look professional, with fake support teams and polished websites. But they had no real security, no withdrawal history, and no regulatory oversight. Once you deposit, your funds disappear. Another major red flag? Exchanges that only accept crypto deposits but won’t let you withdraw to your own wallet. Then there are the abandoned crypto token, coins with no team, no updates, and zero trading volume, often promoted with hype but built on empty promises. Flowmatic ($FM), Project Quantum (QBIT), and TajCoin (TAJ) all had websites, whitepapers, and social media—but no code updates, no community growth, and no real use. These aren’t investments. They’re digital ghosts. And don’t get fooled by crypto airdrop scam, free token offers that require you to connect your wallet, pay gas fees, or share private keys. The DSG token airdrop and KCCSwap "airdrop" had zero trading volume and no real ecosystem. Real airdrops don’t ask for money upfront. They don’t pressure you. They just drop tokens into your wallet if you met the criteria. These scams thrive on FOMO and confusion. People see a name that sounds like a real project—Armoney instead of Harmony, BNX instead of FORM—and assume it’s a typo. It’s not. It’s bait.

What ties all these scams together? Lack of transparency. No real team. No verifiable history. No licensed regulators. If you can’t find a clear company address, a real CEO, or a public audit report, walk away. The posts below show you exactly how these scams operate—from the fake exchange reviews to the dead tokens with no liquidity. You’ll see real cases from Nigeria, Korea, Bangladesh, and beyond. No fluff. No hype. Just what actually happened, who got burned, and how to avoid the same fate.