Tokenomics Red Flags: 7 Warning Signs You Can't Ignore in Crypto Projects

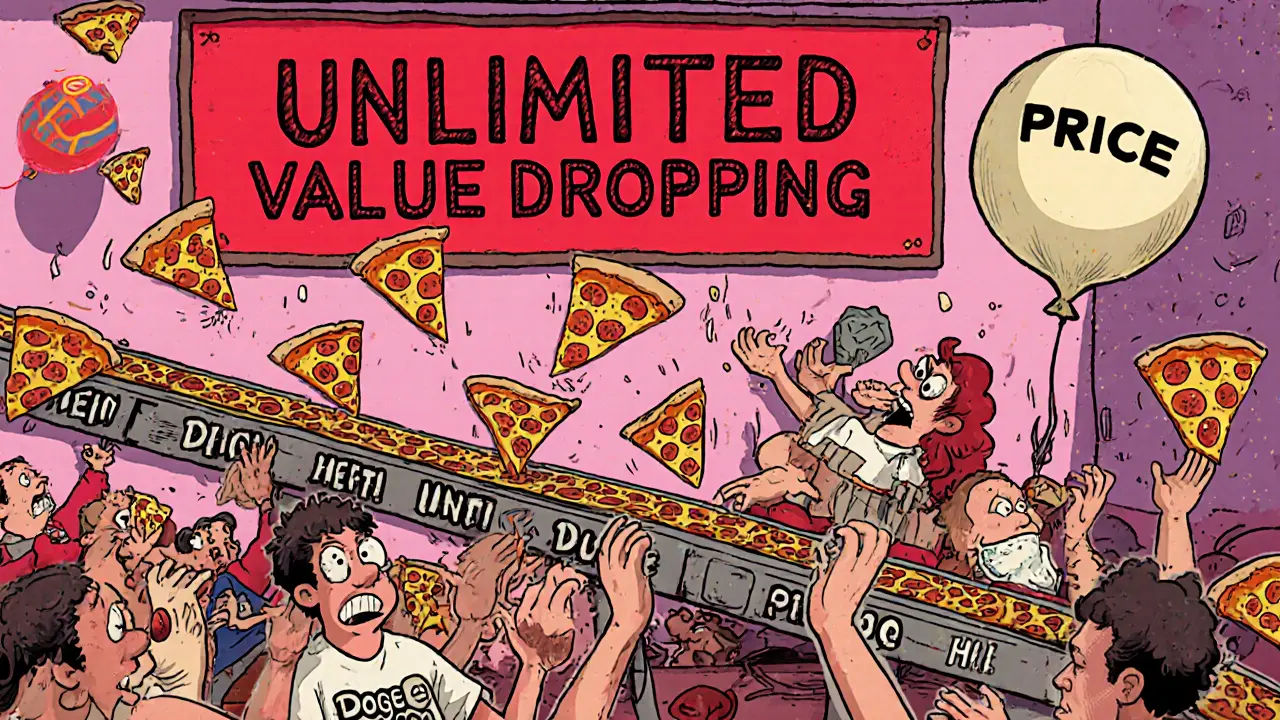

Learn the 7 critical tokenomics red flags that signal crypto project failure - from unlimited supply to fake utility - and how to avoid losing money on bad investments.

When people talk about crypto utility, the practical function a cryptocurrency serves beyond speculation. It's not about how much the price went up last week—it's about what the token actually does. Whether it's swapping coins on a decentralized exchange, earning rewards in a play-to-earn game, or voting in a community-run organization, utility is what separates real projects from empty hype. Most coins die because they have none. You can't eat meme coins, pay rent with abandoned tokens, or build on platforms that vanished overnight.

Look at Ref Finance, a fast, low-cost DeFi platform on NEAR Protocol. Its REF token isn't just traded—it's used to pay fees, earn rewards, and vote on upgrades. That's utility. Contrast that with Flowmatic ($FM), a Solana-based token with zero liquidity and no users. It had a website, a whitepaper, and a tweetstorm—but no real use case. It collapsed because no one needed it. Same goes for Project Quantum (QBIT), a gaming token tied to a game that doesn't exist. No playable product? No utility. Just a ticker symbol and a dream.

Utility shows up in how people use tokens. SoccerHub (SCH), a play-to-earn soccer management game gives you SCH tokens to buy players, upgrade teams, and compete. You earn them by playing, spend them in-game, and trade them if you want. That’s a loop. Compare that to the BinaryX (BNX) token swap, a forced upgrade to FORM that affected thousands of holders. That wasn’t an airdrop—it was a migration. The utility stayed, but the token changed. Many lost money because they didn’t understand the shift.

Some projects pretend utility exists. KCCSwap, a platform often confused with KuCoin’s ecosystem, has no official airdrop. Scammers use the name to steal wallets. Real utility doesn’t need hype—it needs users. And users don’t stick around for empty promises. They stick around for tools that work, games they enjoy, and systems they can trust.

What you’ll find below isn’t a list of coins that went up. It’s a collection of real stories—about platforms that delivered value, swaps that caught people off guard, airdrops that actually paid out, and scams that looked just like the real thing. If you want to know which crypto projects are built to last, and which are just digital ghosts, you’re in the right place.

26 June

Learn the 7 critical tokenomics red flags that signal crypto project failure - from unlimited supply to fake utility - and how to avoid losing money on bad investments.