Cryptocurrency Exchange: What They Are, How They Work, and Which Ones to Avoid

A cryptocurrency exchange, a platform where you buy, sell, or trade digital currencies like Bitcoin and Ethereum. Also known as crypto trading platform, it’s the gateway between your wallet and the wider blockchain economy. But not all exchanges are created equal. Some are secure, regulated, and built for real users. Others are scams waiting to drain your funds—like BTX Pro or Armoney, which don’t even exist as real platforms. The difference isn’t just in branding; it’s in transparency, liquidity, and whether they’ve been audited or tested by real traders.

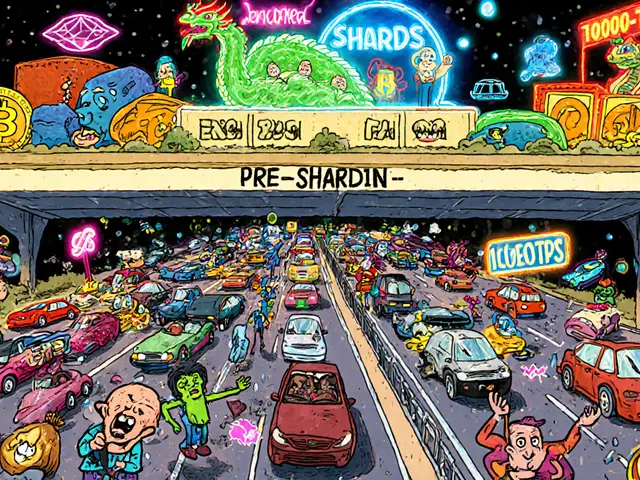

When you use a decentralized exchange, a peer-to-peer trading system that doesn’t hold your crypto, you keep control of your keys. That’s safer—but harder to use. Platforms like Ref Finance on NEAR or VVS Finance on Cronos let you swap tokens with fees under a penny, but they need you to understand gas, bridges, and slippage. Meanwhile, centralized exchanges like Coinbase or Kraken handle the complexity for you, but they hold your money. That’s convenient until they freeze withdrawals, as Nigerian users found out in 2025 when banks started blocking crypto-to-fiat transfers even through licensed exchanges.

Staking rewards, airdrops, and regional restrictions all tie back to the exchange you pick. Xcalibra targets users in 150+ countries with zero deposit fees but offers almost no customer support. COREDAX works great for Koreans with local bank accounts but won’t let anyone else in. And then there are the fake ones—COINZIX, with no public trading volume, or DYORSwap, whose bridge is broken and liquidity is tiny. These aren’t just risky; they’re often designed to look legitimate until you try to cash out. The same goes for airdrops that never happened, like XGT from Xion Finance, or tokens tied to meme figures like SBAE that have zero utility and a market cap smaller than your coffee budget.

What you need isn’t just a list of exchanges. You need to know how to spot the difference between a platform that’s trying to help you and one that’s trying to take your money. That’s why this collection includes real reviews of exchanges that actually operate, exposes scams hiding behind fancy names, and breaks down what’s legal—and what’s not—in places like Nigeria, the UK, and South Korea. You’ll find out why some exchanges ban ads, why others require local IDs, and how to avoid losing your crypto to platforms that vanish overnight. This isn’t theory. It’s what real traders learned the hard way in 2025—and you don’t have to repeat their mistakes.