DeFi 2025: What’s Working, What’s Dead, and Where to Focus Now

When people talk about DeFi, decentralized finance is a system of financial services built on blockchains without banks or middlemen. Also known as decentralized finance, it’s no longer just about swapping tokens on Uniswap—it’s about who’s still building, who’s still paying users, and who vanished with the money. In 2025, DeFi isn’t a buzzword anymore. It’s a battlefield. Some protocols died quietly. Others adapted. And a few actually made trading cheaper, faster, and safer than anything traditional finance ever offered.

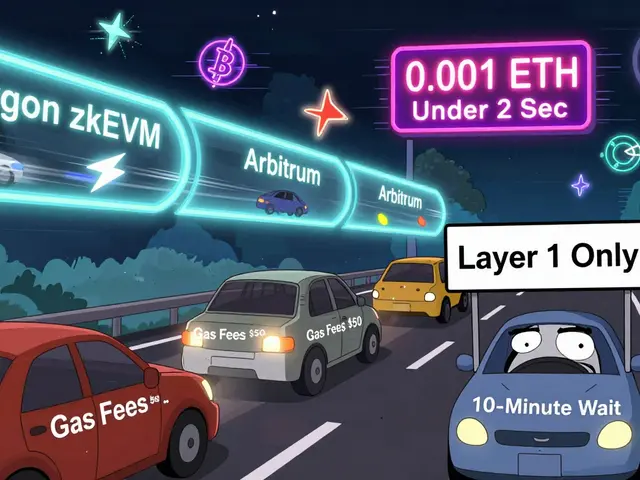

Look at the posts below. You’ll see Ref Finance, a fast, low-cost DeFi platform on NEAR Protocol that lets users swap crypto with fees under a penny still running strong. Then there’s OpenSwap, a deflationary DEX on Harmony that’s now dead with zero trading volume. Same space. Same year. One thrives. One’s a tombstone. Why? Because one solved a real problem—high fees on Ethereum—and the other just copied a trend. DeFi in 2025 rewards utility, not marketing. If a platform doesn’t save you money, attract users, or keep its code updated, it’s already gone.

You’ll also find DeFi airdrops, free token distributions tied to participation in DeFi protocols everywhere—but most are traps. The ACMD X CMC airdrop? The project went silent. The KCCSwap airdrop? Doesn’t exist. Even the AdEx Network’s old ADX airdrop is now just a footnote, replaced by AURA, a tool to help you find real ones. Real airdrops don’t promise riches. They reward early users who actually use the platform. If you’re chasing free tokens without checking if the protocol has users, liquidity, or a team, you’re just gambling.

And then there’s the dark side: tokens like Flowmatic ($FM) and MetaniaGames (METANIA) that promise DeFi tools but have zero liquidity, no team, and no roadmap. They look real. They have websites. They even have price charts. But if you can’t find a single real trade or a developer comment from the last six months, walk away. DeFi in 2025 doesn’t need more hype coins. It needs more honest platforms.

What’s left standing? Platforms that are cheap, simple, and focused. Ref Finance on NEAR. SushiSwap on Arbitrum Nova (even if traffic is low, the fees are still dirt cheap). And a handful of regulated exchanges like COREDAX in Korea that actually follow local rules. DeFi isn’t about wild speculation anymore. It’s about finding the quiet, reliable tools that let you swap, lend, or earn without getting scammed.

Below you’ll find real reviews, real failures, and real updates—no fluff, no guesses. These aren’t predictions. These are post-mortems and live updates from 2025. You’ll learn what DeFi platforms still work, which airdrops are worth your time, and which tokens are just digital ghosts. If you’re tired of losing money to fake projects, this is the list you need.